Pizza Hut 2010 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

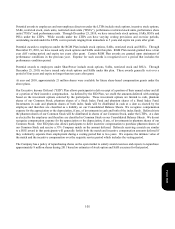

In addition, the Company is subject to various U.S. state income tax examinations, for which, in the aggregate, we had

significant unrecognized tax benefits at December 25, 2010, each of which is individually insignificant.

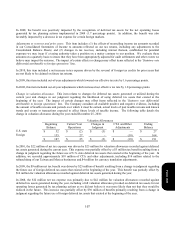

The accrued interest and penalties related to income taxes at December 25, 2010 and December 26, 2009 are set forth

below:

2010 2009

Accrued interest and

p

enalties

$

48 $ 41

During 2010 and 2009, $13 million and $6 million, respectively, of interest and penalties expense were recognized in our

Consolidated Statement of Income. The Company recognizes accrued interest and penalties related to unrecognized tax

benefits as components of its Income tax provision.

On June 23, 2010, the Company received a Revenue Agent Report (“RAR”) from the Internal Revenue Service (the

“IRS”) relating to its examination of our U.S. federal income tax returns for fiscal years 2004 through 2006. The IRS has

proposed an adjustment to increase the taxable value of rights to intangibles used outside the U.S. that Yum transferred to

certain of its foreign subsidiaries. The proposed adjustment would result in approximately $700 million of additional

taxes plus net interest to date of approximately $150 million. Furthermore, if the IRS prevails it is likely to make similar

claims for years subsequent to fiscal 2006. The potential additional taxes for these later years, through 2010, computed on

a similar basis to the 2004-2006 additional taxes, would be approximately $320 million plus net interest to date of

approximately $20 million.

We believe that the Company has properly reported taxable income and paid taxes in accordance with applicable laws and

that the proposed adjustment is inconsistent with applicable income tax laws, Treasury Regulations and relevant case law.

We intend to defend our position vigorously and have filed a protest with the IRS. As the final resolution of the proposed

adjustment remains uncertain, the Company will continue to provide for its position in this matter based on the tax benefit

that we believe is the largest amount that is more likely than not to be realized upon settlement of this issue. There can be

no assurance that payments due upon final resolution of this issue will not exceed our currently recorded reserve and such

payments could have a material adverse effect on our financial position. Additionally, if increases to our reserves are

deemed necessary due to future developments related to this issue, such increases could have a material, adverse effect on

our results of operations as they are recorded. The Company does not expect resolution of this matter within twelve

months and cannot predict with certainty the timing of such resolution.

Form 10-K