Pizza Hut 2010 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

In 2008, the benefit was positively impacted by the recognition of deferred tax assets for the net operating losses

generated by tax planning actions implemented in 2008 (1.7 percentage points). In addition, the benefit was also

favorably impacted by a decrease in tax expense for certain foreign markets.

Adjustments to reserves and prior years. This item includes: (1) the effects of reconciling income tax amounts recorded

in our Consolidated Statements of Income to amounts reflected on our tax returns, including any adjustments to the

Consolidated Balance Sheets; and (2) changes in tax reserves, including interest thereon, established for potential

exposure we may incur if a taxing authority takes a position on a matter contrary to our position. We evaluate these

amounts on a quarterly basis to insure that they have been appropriately adjusted for audit settlements and other events we

believe may impact the outcome. The impact of certain effects or changes may offset items reflected in the ‘Statutory rate

differential attributable to foreign operations’ line.

In 2010, this item included a net increase in tax expense driven by the reversal of foreign tax credits for prior years that

are not likely to be claimed on future tax returns.

In 2009, this item included out-of-year adjustments which lowered our effective tax rate by 1.6 percentage points.

In 2008, this item included out-of-year adjustments which increased our effective tax rate by 1.8 percentage points.

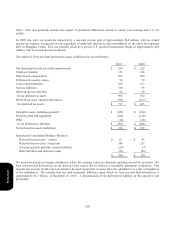

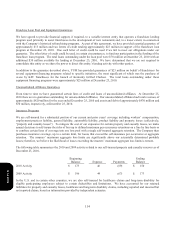

Change in valuation allowance. This item relates to changes for deferred tax assets generated or utilized during the

current year and changes in our judgment regarding the likelihood of using deferred tax assets that existed at the

beginning of the year. The impact of certain changes may offset items reflected in the ‘Statutory rate differential

attributable to foreign operations’ line. The Company considers all available positive and negative evidence, including

the amount of taxable income and periods over which it must be earned, actual levels of past taxable income and known

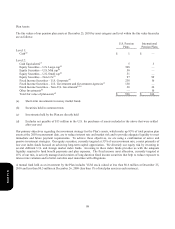

trends and events or transactions expected to affect future levels of taxable income. The following table details the

change in valuation allowance during the year ended December 25, 2010:

Valuation Allowances

Beginning

Balance

Current Year

Operations

Changes in

Judgment

CTA and Other

Adjustments

Ending

Balance

U.S. state $ 32 $ (2) $ (3) $ — $ 27

Foreign

155 27 - (18) 164

$ 187 $ 25 $ (3) $ (18) $ 191

In 2010, the $22 million of net tax expense was driven by $25 million for valuation allowances recorded against deferred

tax assets generated during the current year. This expense was partially offset by a $3 million tax benefit resulting from a

change in judgment regarding the future use of U.S. state deferred tax assets that existed at the beginning of the year. In

addition, we recorded approximately $18 million of CTA and other adjustments, including $14 million related to the

refranchising of our Taiwan and Mexico businesses and $4 million for currency translation adjustments.

In 2009, the $9 million net tax benefit was driven by $25 million of benefit resulting from a change in judgment regarding

the future use of foreign deferred tax assets that existed at the beginning of the year. This benefit was partially offset by

$16 million for valuation allowances recorded against deferred tax assets generated during the year.

In 2008, the $12 million net tax expense was primarily due to $42 million for valuation allowances recorded against

deferred tax assets generated during the year, including a full valuation allowance provided on deferred tax assets for net

operating losses generated by tax planning actions as we did not believe it was more likely than not that they would be

realized in the future. This increase was partially offset by $30 million of benefits primarily resulting from a change in

judgment regarding the future use of foreign deferred tax assets that existed at the beginning of the year.

Form 10-K