Pizza Hut 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

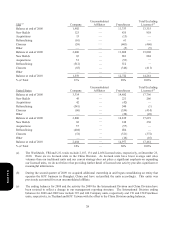

Refranchising of Equity Markets Outside the U.S.

In the fourth quarter of 2010 we recorded a $52 million loss on the refranchising of our Mexico equity market as we sold

all of our company operated restaurants, comprised of 222 KFCs and 123 Pizza Huts, to an existing Latin American

franchise partner. The buyer will also serve as the master franchisee for Mexico which had 102 KFCs and 53 Pizza Hut

franchise restaurants at the time of the transaction. The write off of goodwill included in this loss was minimal as our

Mexico reporting unit includes an insignificant amount of goodwill. This loss did not result in any related income tax

benefit and was not allocated to any segment for performance reporting purposes.

During the year ended December 26, 2009 we recognized a non-cash $10 million refranchising loss as a result of our

decision to offer to refranchise our KFC Taiwan equity market. During the year ended December 25, 2010 we

refranchised all of our remaining company restaurants in Taiwan, which consisted of 124 KFCs. We included in our

December 25, 2010 financial statements a non-cash write-off of $7 million of goodwill in determining the loss on

refranchising of Taiwan. Neither of these losses resulted in a related income tax benefit, and neither loss was allocated to

any segment for performance reporting purposes. The amount of goodwill write-off was based on the relative fair values

of the Taiwan business disposed of and the portion of the business that was retained. The fair value of the business

disposed of was determined by reference to the discounted value of the future cash flows expected to be generated by the

restaurants and retained by the franchisee, which include a deduction for the anticipated royalties the franchisee will pay

the Company associated with the franchise agreement entered into in connection with this refranchising transaction. The

fair value of the Taiwan business retained consists of expected, net cash flows to be derived from royalties from

franchisees, including the royalties associated with the franchise agreement entered into in connection with this

refranchising transaction. We believe the terms of the franchise agreement entered into in connection with the Taiwan

refranchising are substantially consistent with market. The remaining carrying value of goodwill related to our Taiwan

business of $30 million, after the aforementioned write-off, was determined not to be impaired as the fair value of the

Taiwan reporting unit exceeded its carrying amount.

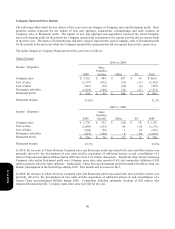

Consolidation of a Former Unconsolidated Affiliate in Shanghai, China

On May 4, 2009 we acquired an additional 7% ownership in the entity that operates more than 200 KFCs in Shanghai,

China for $12 million, increasing our ownership to 58%. Prior to our acquisition of this additional interest, this entity was

accounted for as an unconsolidated affiliate under the equity method of accounting. Concurrent with the acquisition we

received additional rights in the governance of the entity and thus we began consolidating the entity upon acquisition. As

required by GAAP, we remeasured our previously held 51% ownership in the entity, which had a recorded value of $17

million at the date of acquisition at fair value and recognized a gain of $68 million accordingly. This gain, which resulted

in no related income tax expense, was recorded in Other (income) expense in our Consolidated Statements of Income in

2009 and was not allocated to any segment for performance reporting purposes.

Form 10-K