Pizza Hut 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

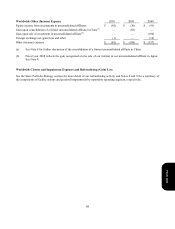

Internal Revenue Service Proposed Adjustment

On June 23, 2010, the Company received a Revenue Agent Report (“RAR”) from the Internal Revenue Service (the

“IRS”) relating to its examination of our U.S. federal income tax returns for fiscal years 2004 through 2006. The IRS has

proposed an adjustment to increase the taxable value of rights to intangibles used outside the U.S. that Yum transferred to

certain of its foreign subsidiaries. The proposed adjustment would result in approximately $700 million of additional

taxes plus net interest to date of approximately $150 million. Furthermore, if the IRS prevails it is likely to make similar

claims for years subsequent to fiscal 2006. The potential additional taxes for these later years, through 2010, computed on

a similar basis to the 2004-2006 additional taxes, would be approximately $320 million plus net interest to date of

approximately $20 million.

We believe that the Company has properly reported taxable income and paid taxes in accordance with applicable laws and

that the proposed adjustment is inconsistent with applicable income tax laws, Treasury Regulations and relevant case law.

We intend to defend our position vigorously and have filed a protest with the IRS. As the final resolution of the proposed

adjustment remains uncertain, the Company will continue to provide for its position in this matter based on the tax benefit

that we believe is the largest amount that is more likely than not to be realized upon settlement of this issue. There can be

no assurance that payments due upon final resolution of this issue will not exceed our currently recorded reserve and such

payments could have a material adverse effect on our financial position. Additionally, if increases to our reserves are

deemed necessary due to future developments related to this issue, such increases could have a material, adverse effect on

our results of operations as they are recorded. The Company does not expect resolution of this matter within twelve

months and cannot predict with certainty the timing of such resolution.

Taco Bell Beef Issue

In late January 2011 a lawsuit was filed alleging a violation of consumer protection statutes and deceptive business

practices by Taco Bell through its advertising that the beef served in its products is “seasoned beef”. Though the

Company denies all claims within the lawsuit and intends to vigorously defend its position, the resulting negative

publicity regarding its food quality has adversely impacted Taco Bell sales in both company and franchise stores. While

we do not anticipate a sustained negative impact on Taco Bell’s sales, it is difficult for us to predict if there will be any

significant impact on our 2011 Revenues and Operating Profit given the recent nature of the adverse publicity.

Sale of Long John Silver’s and A&W

Subsequent to the end of our fourth quarter, we decided to place our Long John Silver’s and A&W All-American Food

Restaurants brands for sale and began the process to identify a buyer. In the first quarter of 2011, we anticipate that we

will recognize a non-cash pre-tax impairment loss in Special Items as a result of our decision to sell. The amount of the

expected pre-tax loss as well as the related tax impact will be dependent upon indications we receive as to potential sales

prices and structures. We do not expect the eventual sale to have a material impact to our ongoing earnings or cash

flows.

Form 10-K