Pizza Hut 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

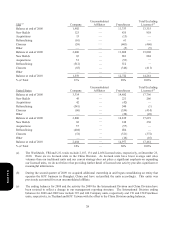

33

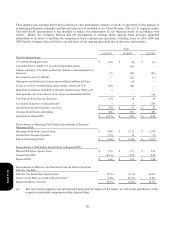

Under the equity method of accounting, we previously reported our 51% share of the net income of the unconsolidated

affiliate (after interest expense and income taxes) as Other (income) expense in the Consolidated Statements of Income.

We also recorded a franchise fee for the royalty received from the stores owned by the unconsolidated affiliate.

Subsequent to the date of the acquisition, we reported the results of operations for the entity in the appropriate line items

of our Consolidated Statements of Income. We no longer recorded franchise fee income for these restaurants nor did we

report Other (income) expense as we did under the equity method of accounting. Net income attributable to our partner’s

ownership percentage is recorded as Net Income-noncontrolling interest within our Consolidated Statements of Income.

For the year ended December 25, 2010 the consolidation of the existing restaurants upon acquisition increased Company

sales by $98 million, decreased Franchise and license fees and income by $6 million and positively impacted Operating

Profit by $3 million. For the year ended December 26, 2009 the consolidation of the existing restaurants upon acquisition

increased Company sales by $192 million; decreased Franchise and license fees and income by $12 million and positively

impacted Operating Profit by $4 million. The impact on Net Income – YUM! Brands, Inc. was not significant to the years

ended December 25, 2010 and December 26, 2009.

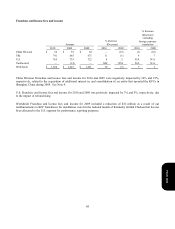

Sale of our Interest in our Unconsolidated Affiliate in Japan

During the year ended December 27, 2008 we recorded a pre-tax gain of approximately $100 million related to the sale of

our interest in our unconsolidated affiliate in Japan (See Note 4 for further discussion of this transaction). This gain was

recorded in Other (income) expense in our Consolidated Statement of Income and was not allocated to any segment for

performance reporting purposes.

Russia Acquisition

On July 1, 2010, we completed the exercise of our option with our Russian partner to purchase their interest in the co-

branded Rostik’s-KFC restaurants across Russia and the Commonwealth of Independent States. As a result, we acquired

company ownership of 50 restaurants and gained full rights and responsibilities as franchisor of 81 restaurants, which our

partner previously managed as master franchisee. Upon exercise of our option, we paid cash of $56 million, net of

settlement of a long-term note receivable of $11 million, and assumed long-term debt of $10 million. The remaining

balance of the purchase price, anticipated to be $11 million, will be paid in cash in July 2012. As a result of our

preliminary purchase price allocation for this acquisition, our Consolidated Balance Sheet includes $36 million of

goodwill and $36 million of identifiable intangibles at December 25, 2010. The impact of consolidating this business on

all line items within our Consolidated Statement of Income was insignificant for the year ended December 25, 2010.

Pizza Hut South Korea Goodwill Impairment

As a result of a decline in future profit expectations for our Pizza Hut South Korea market we recorded a goodwill

impairment charge of $12 million for this market during 2009. This charge was recorded in Closure and impairment

(income) expenses in our Consolidated Statement of Income and was allocated to our International Division for

performance reporting purposes.

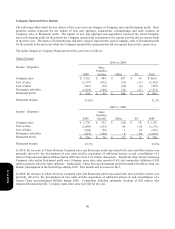

Store Portfolio Strategy

From time to time we sell Company restaurants to existing and new franchisees where geographic synergies can be

obtained or where franchisees’ expertise can generally be leveraged to improve our overall operating performance, while

retaining Company ownership of strategic U.S. and international markets in which we choose to continue investing

capital. In the U.S., we are targeting Company ownership of KFC, Pizza Hut and Taco Bell restaurants of about 12%,

down from its current level of 15%. This U.S. target ownership percentage no longer considers the impact of LJS and

A&W restaurants, both of which are completely franchise operated, as we are pursuing a sale of these brands. Consistent

with this strategy, 404, 541 and 700 Company restaurants in the U.S. were sold to franchisees in the years ended

December 25, 2010, December 26, 2009 and December 27, 2008, respectively, and at December 25, 2010 we have offered

for refranchising approximately 550 KFCs in the U.S. During 2010, we also executed refranchising of all Company

owned KFCs and Pizza Huts in Mexico (345 restaurants) and KFCs in Taiwan (124 restaurants).

Form 10-K