Pizza Hut 2010 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

Fair Value Measurements. Fair value is the price we would receive to sell an asset or pay to transfer a liability (exit

price) in an orderly transaction between market participants. For those assets and liabilities we record or disclose at fair

value, we determine fair value based upon the quoted market price, if available. If a quoted market price is not available

for identical assets, we determine fair value based upon the quoted market price of similar assets or the present value of

expected future cash flows considering the risks involved, including counterparty performance risk if appropriate, and

using discount rates appropriate for the duration. The fair values are assigned a level within the fair value hierarchy,

depending on the source of the inputs into the calculation.

Level 1 Inputs based upon quoted prices in active markets for identical assets.

Level 2 Inputs other than quoted prices included within Level 1 that are observable for the asset, either directly o

r

indirectly.

Level 3 Inputs that are unobservable for the asset.

Cash and Cash Equivalents. Cash equivalents represent funds we have temporarily invested (with original maturities

not exceeding three months), including short-term, highly liquid debt securities.

Receivables. The Company’s receivables are primarily generated as a result of ongoing business relationships with our

franchisees and licensees as a result of royalty and lease agreements. Trade receivables consisting of royalties from

franchisees and licensees are generally due within 30 days of the period in which the corresponding sales occur and are

classified as Accounts and notes receivable on our Consolidated Balance Sheets. Our provision for uncollectible franchise

and licensee receivable balances is based upon pre-defined aging criteria or upon the occurrence of other events that

indicate that we may not collect the balance due. Additionally, we monitor the financial condition of our franchisees and

licensees and record provisions for estimated losses on receivables when we believe it probable that our franchisees or

licensees will be unable to make their required payments. While we use the best information available in making our

determination, the ultimate recovery of recorded receivables is also dependent upon future economic events and other

conditions that may be beyond our control. Net provisions for uncollectible franchise and license trade receivables of $3

million, $11 million and $8 million were included in Franchise and license expenses in 2010, 2009 and 2008, respectively.

Trade receivables that are ultimately deemed to be uncollectible, and for which collection efforts have been exhausted, are

written off against the allowance for doubtful accounts.

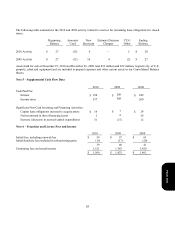

2010 2009

Accounts and notes receivable $ 289 $ 274

Allowance for doubtful accounts (33) (35)

Accounts and notes receivable, net $ 256 $ 239

Our financing receivables primarily consist of notes receivable and direct financing leases with franchisees which we

enter into from time to time. As these receivables primarily relate to our ongoing business agreements with franchisees

and licensees, we consider such receivables to have similar risk characteristics and evaluate them as one collective

portfolio segment and class for determining the allowance for doubtful accounts. We monitor the financial condition of

our franchisees and licensees and record provisions for estimated losses on receivables when we believe it probable that

our franchisees or licensees will be unable to make their required payments. Balances of notes receivable and direct

financing leases due within one year are included in Accounts and Notes Receivable while amounts due beyond one year

are included in Other assets. Amounts included in Other assets totaled $57 million (net of an allowance of $30 million)

and $66 million (net of an allowance of $33 million) at December 25, 2010 and December 26, 2009, respectively.

Financing receivables that are ultimately deemed to be uncollectible, and for which collection efforts have been

exhausted, are written off against the allowance for doubtful accounts. Interest income recorded on financing receivables

has traditionally been insignificant.

Form 10-K