Pizza Hut 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9MAR201101381779

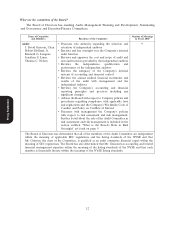

What access do the Board and Board committees have to Management and to Outside Advisors?

•Access to Management and Employees. Directors have full and unrestricted access to the management

and employees of the Company. Additionally, key members of management attend Board meetings

to present information about the results, plans and operations of the business within their areas of

responsibility.

•Access to Outside Advisors. The Board and its committees may retain counsel or consultants without

obtaining the approval of any officer of the Company in advance or otherwise. The Audit

Committee has the sole authority to retain and terminate the independent auditor. The Nominating

and Governance Committee has the sole authority to retain search firms to be used to identify

director candidates. The Management Planning and Development Committee has the sole

authority to retain compensation consultants for advice on executive compensation matters.

What is the Board’s role in risk oversight?

The Board maintains overall responsibility for overseeing the Company’s risk management. In

furtherance of its responsibility, the Board has delegated specific risk-related responsibilities to the Audit

Committee and to the Management Planning and Development Committee. The Audit Committee

engages in substantive discussions of risk management at its regular committee meetings held during the

year. At these meetings, it receives functional risk review reports covering significant areas of risk from

senior managers responsible for these functional areas, as well as receiving reports from the Company’s

Chief Auditor. Our Chief Auditor reports directly to the Chairman of the Audit Committee and our Chief

Financial Officer. The Audit Committee also receives reports at each meeting regarding legal and

regulatory risks from management. The Audit Committee provides a summary to the full Board at each

regular Board meeting of the risk area reviewed together with any other risk related subjects discussed at

the Audit Committee meeting. In addition, our Management Planning and Development Committee

considers the risks that may be implicated by our compensation programs through a risk assessment

conducted by management and reports its conclusions to the full Board.

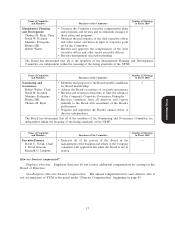

Has the Company conducted a risk assessment of its compensation policies and practices?

Proxy Statement

As stated in the Compensation Discussion and Analysis at page 35, the philosophy of our

compensation programs is to reward performance by designing pay programs at all levels that align team

performance, individual performance, customer satisfaction and shareholder return, emphasize long-term

incentives and require executives to personally invest in Company stock.

In 2011, the Management Planning and Development Committee of the Board of Directors oversaw

the performance of a risk assessment of our compensation programs for all employees to determine

whether they encourage unnecessary or excessive risk taking. In conducting this review, each of our

compensation practices and programs was reviewed against the key risks facing the Company in the

conduct of its business. Based on this review, the Committee concluded that our compensation policies and

practices do not encourage our employees to take unnecessary or excessive risks.

As part of this assessment, the Committee concluded that the following policies and practices of the

Company’s cash and equity incentive programs serve to reduce the likelihood of excessive risk taking:

• Our compensation system is balanced, rewarding both short term and long term performance.

• Long term Company performance is emphasized. The majority of incentive compensation for the

top level employees is associated with the long term performance of the Company.

• The annual incentive target setting process is closely linked to the annual financial planning process

and supports the Company’s overall strategic plan.

9