Pizza Hut 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Both the Credit Facility and the ICF contain cross-default provisions whereby our failure to make any payment on any of

our indebtedness in a principal amount in excess of $100 million, or the acceleration of the maturity of any such

indebtedness, will constitute a default under such agreement. Our Senior Unsecured Notes provide that the acceleration of

the maturity of any of our indebtedness in a principal amount in excess of $50 million will constitute a default under the

Senior Unsecured Notes if such acceleration is not annulled, or such indebtedness is not discharged, within 30 days after

notice.

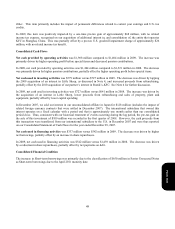

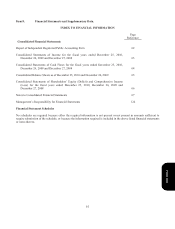

Contractual Obligations

In addition to any discretionary spending we may choose to make, our significant contractual obligations and payments as

of December 25, 2010 included:

Total

Less than 1

Year 1-3 Years 3-5 Years

More than 5

Years

L

ong-term debt obligations(a) $ 5,125 $ 804 $ 544 $ 533 $ 3,244

C

apital leases(b) 380 26 86 46 222

O

perating leases(b) 5,004 550 997 852 2,605

P

urchase obligations(c) 788 625 131 23 9

Other(d) 43 12 15 6 10

T

otal contractual obligations $ 11,340 $ 2,017 $ 1,773 $ 1,460 $ 6,090

(a) Debt amounts include principal maturities and expected interest payments. Rates utilized to determine interest

p

ayments for variable rate debt are based on the LIBOR forward yield curve. Excludes a fair value adjustment

of $31 million included in debt related to interest rate swaps that hedge the fair value of a portion of our debt.

See Note 10.

(b) These obligations, which are shown on a nominal basis, relate to more than 6,000 restaurants. See Note 11.

(c) Purchase obligations include agreements to purchase goods or services that are enforceable and legally binding

on us and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed,

minimum or variable price provisions; and the approximate timing of the transaction. We have excluded

agreements that are cancelable without penalty. Purchase obligations relate primarily to information technology,

marketing, commodity agreements, purchases of property, plant and equipment as well as consulting,

maintenance and other agreements.

(d) Other consists of 2011 pension plan funding obligations and projected payments for deferred compensation.

We have not included in the contractual obligations table approximately $322 million for long-term liabilities for

unrecognized tax benefits for various tax positions we have taken. These liabilities may increase or decrease over time as

a result of tax examinations, and given the status of the examinations, we cannot reliably estimate the period of any cash

settlement with the respective taxing authorities. These liabilities also include amounts that are temporary in nature and

for which we anticipate that over time there will be no net cash outflow.

Form 10-K