Pizza Hut 2010 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

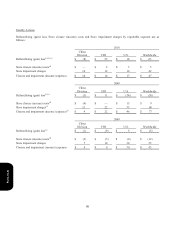

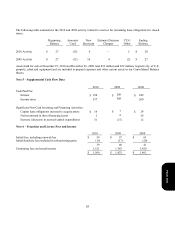

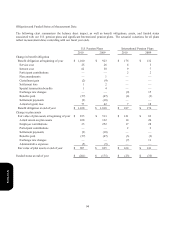

Note 10 – Short-term Borrowings and Long-term Debt

2010 2009

Short-term Borrowings

Current maturities of long-term debt $673 $56

Other — 3

$673 $ 59

Long-term Debt

Unsecured International Revolving Credit Facility, expires November 2012 $ — $ —

Unsecured Revolving Credit Facility, expires November 2012 — 5

Senior Unsecured Notes 3,257 2,906

Capital lease obligations (See Note 11) 236 249

Other, due through 2019 (11%) 64 67

3,557 3,227

Less current maturities of long-term debt (673 ) (56)

Long-term debt excluding hedge accounting adjustment 2,884 3,171

Derivative instrument hedge accounting adjustment (See Note 12) 31 36

Long-term debt including hedge accounting adjustment $ 2,915 $ 3,207

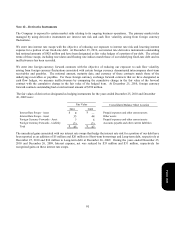

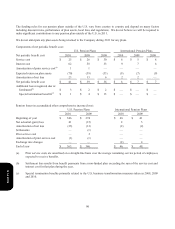

Our primary bank credit agreement comprises a $1.15 billion syndicated senior unsecured revolving credit facility (the

“Credit Facility”) which matures in November 2012 and includes 24 participating banks with commitments ranging from

$10 million to $113 million. Under the terms of the Credit Facility, we may borrow up to the maximum borrowing limit,

less outstanding letters of credit or banker’s acceptances, where applicable. At December 25, 2010, our unused Credit

Facility totaled $998 million net of outstanding letters of credit of $152 million. There were no borrowings outstanding

under the Credit Facility at December 25, 2010. The interest rate for borrowings under the Credit Facility ranges from

0.25% to 1.25% over the London Interbank Offered Rate (“LIBOR”) or is determined by an Alternate Base Rate, which is

the greater of the Prime Rate or the Federal Funds Rate plus 0.50%. The exact spread over LIBOR or the Alternate Base

Rate, as applicable, depends on our performance under specified financial criteria. Interest on any outstanding borrowings

under the Credit Facility is payable at least quarterly.

We also have a $350 million, syndicated revolving credit facility (the “International Credit Facility,” or “ICF”) which

matures in November 2012 and includes 6 banks with commitments ranging from $35 million to $90 million. There was

available credit of $350 million and no borrowings outstanding under the ICF at the end of 2010. The interest rate for

borrowings under the ICF ranges from 0.31% to 1.50% over LIBOR or is determined by a Canadian Alternate Base Rate,

which is the greater of the Citibank, N.A., Canadian Branch’s publicly announced reference rate or the “Canadian Dollar

Offered Rate” plus 0.50%. The exact spread over LIBOR or the Canadian Alternate Base Rate, as applicable, depends on

our performance under specified financial criteria. Interest on any outstanding borrowings under the ICF is payable at

least quarterly.

Form 10-K