Pizza Hut 2010 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

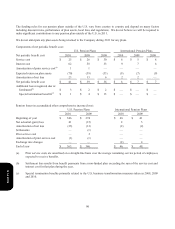

For our foreign currency forward contracts the following effective portions of gains and losses were recognized into Other

Comprehensive Income (“OCI”) and reclassified into income from OCI in the years ended December 25, 2010 and

December 26, 2009.

2010 2009

Gains (losses) recognized into OCI, net of tax

$

32

$

(9)

Gains (losses) reclassified from Accumulated OCI into income, net of tax

$

33

$

(14)

The gains/losses reclassified from Accumulated OCI into income were recognized as Other income (expense) in our

Consolidated Statement of Income, largely offsetting foreign currency transaction losses/gains recorded when the related

intercompany receivables and payables were adjusted for foreign currency fluctuations. Changes in fair values of the

foreign currency forwards recognized directly in our results of operations either from ineffectiveness or exclusion from

effectiveness testing were insignificant in the years ended December 25, 2010 and December 26, 2009.

Additionally, we had a net deferred loss of $13 million and $12 million, net of tax, as of December 25, 2010 and

December 26, 2009, respectively within Accumulated OCI due to treasury locks and forward starting interest rate swaps

that have been cash settled, as well as outstanding foreign currency forward contracts. The majority of this loss arose

from the settlement of forward starting interest rate swaps entered into prior to the issuance of our Senior Unsecured

Notes due in 2037, and is being reclassed into earnings through 2037 to interest expense. In 2010, 2009 and 2008 an

insignificant amount was reclassified from Accumulated OCI to Interest expense, net as a result of these previously settled

cash flow hedges.

As a result of the use of derivative instruments, the Company is exposed to risk that the counterparties will fail to meet

their contractual obligations. To mitigate the counterparty credit risk, we only enter into contracts with carefully selected

major financial institutions based upon their credit ratings and other factors, and continually assess the creditworthiness of

counterparties. At December 25, 2010 and December 26, 2009, all of the counterparties to our interest rate swaps and

foreign currency forwards had investment grade ratings according to the three major ratings agencies. To date, all

counterparties have performed in accordance with their contractual obligations.

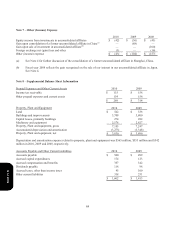

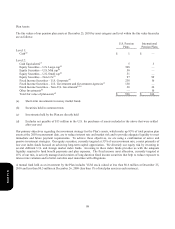

Note 13 – Fair Value Disclosures

The following table presents fair values for those assets and liabilities measured at fair value on a recurring basis and the

level within the fair value hierarchy in which the measurements fall. No transfers among the levels within the fair value

hierarchy occurred during the years ended December 25, 2010 or December 26, 2009.

Fair Value

Level 2010 2009

Foreign Currency Forwards, net 2 $ 4 $ 3

Interest Rate Swaps, net 2 41 44

Other Investments 1 14 13

Total $ 59 $ 60

The fair value of the Company’s foreign currency forwards and interest rate swaps were determined based on the present

value of expected future cash flows considering the risks involved, including nonperformance risk, and using discount

rates appropriate for the duration based upon observable inputs. The other investments include investments in mutual

funds, which are used to offset fluctuations in deferred compensation liabilities that employees have chosen to invest in

phantom shares of a Stock Index Fund or Bond Index Fund. The other investments are classified as trading securities and

their fair value is determined based on the closing market prices of the respective mutual funds as of December 25, 2010

and December 26, 2009.

Form 10-K