Pizza Hut 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

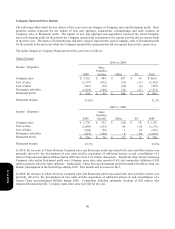

Other. This item primarily includes the impact of permanent differences related to current year earnings and U.S. tax

credits.

In 2009, this item was positively impacted by a one-time pre-tax gain of approximately $68 million, with no related

income tax expense, recognized on our acquisition of additional interest in, and consolidation of, the entity that operates

KFC in Shanghai, China. This was partially offset by a pre-tax U.S. goodwill impairment charge of approximately $26

million, with no related income tax benefit.

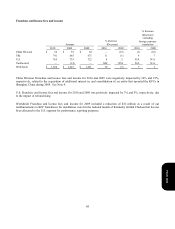

Consolidated Cash Flows

Net cash provided by operating activities was $1,968 million compared to $1,404 million in 2009. The increase was

primarily driven by higher operating profit before special items and decreased pension contributions.

In 2009, net cash provided by operating activities was $1,404 million compared to $1,521 million in 2008. The decrease

was primarily driven by higher pension contributions, partially offset by higher operating profit before special items.

Net cash used in investing activities was $579 million versus $727 million in 2009. The decrease was driven by lapping

the 2009 acquisition of an interest in Little Sheep, as discussed in Note 4, and increased proceeds from refranchising,

partially offset by the 2010 acquisition of our partner’s interest in Rostik’s-KFC. See Note 4 for further discussion.

In 2009, net cash used in investing activities was $727 million versus $641 million in 2008. The increase was driven by

the acquisition of an interest in Little Sheep, lower proceeds from refranchising and sales of property, plant and

equipment, partially offset by lower capital spending.

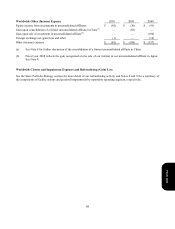

In December 2007, we sold our interest in our unconsolidated affiliate in Japan for $128 million (includes the impact of

related foreign currency contracts that were settled in December 2007). The international subsidiary that owned this

interest operates on a fiscal calendar with a period end that is approximately one month earlier than our consolidated

period close. Thus, consistent with our historical treatment of events occurring during the lag period, the pre-tax gain on

the sale of this investment of $100 million was recorded in the first quarter of 2008. However, the cash proceeds from

this transaction were transferred from our international subsidiary to the U.S. in December 2007 and were thus reported

on our Consolidated Statement of Cash Flows for the year ended December 29, 2007.

Net cash used in financing activities was $337 million versus $542 million in 2009. The decrease was driven by higher

net borrowings, partially offset by an increase in share repurchases.

In 2009, net cash used in financing activities was $542 million versus $1,459 million in 2008. The decrease was driven

by a reduction in share repurchases, partially offset by net payments on debt.

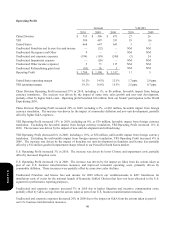

Consolidated Financial Condition

The increase in Short-term borrowings was primarily due to the classification of $650 million in Senior Unsecured Notes

as Short-term borrowings due to the April 2011 maturity date.

Form 10-K