Pizza Hut 2010 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

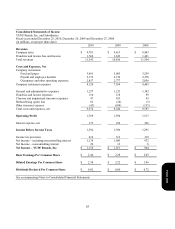

70

The internal costs we incur to provide support services to our franchisees and licensees are charged to General and

Administrative (“G&A”) expenses as incurred. Certain direct costs of our franchise and license operations are charged to

franchise and license expenses. These costs include provisions for estimated uncollectible fees, rent or depreciation

expense associated with restaurants we sublease or lease to franchisees, franchise and license marketing funding,

amortization expense for franchise related intangible assets and certain other direct incremental franchise and license

support costs.

Revenue Recognition. Revenues from Company operated restaurants are recognized when payment is tendered at the

time of sale. The Company presents sales net of sales tax and other sales related taxes. Income from our franchisees and

licensees includes initial fees, continuing fees, renewal fees and rental income. We recognize initial fees received from a

franchisee or licensee as revenue when we have performed substantially all initial services required by the franchise or

license agreement, which is generally upon the opening of a store. We recognize continuing fees based upon a percentage

of franchisee and licensee sales and rental income as earned. We recognize renewal fees when a renewal agreement with

a franchisee or licensee becomes effective. We include initial fees collected upon the sale of a restaurant to a franchisee in

Refranchising (gain) loss.

Direct Marketing Costs. We charge direct marketing costs to expense ratably in relation to revenues over the year in

which incurred and, in the case of advertising production costs, in the year the advertisement is first shown. Deferred

direct marketing costs, which are classified as prepaid expenses, consist of media and related advertising production costs

which will generally be used for the first time in the next fiscal year and have historically not been significant. To the

extent we participate in advertising cooperatives, we expense our contributions as incurred. Our advertising expenses

were $557 million, $548 million and $584 million in 2010, 2009 and 2008, respectively. We report substantially all of

our direct marketing costs in Occupancy and other operating expenses.

Research and Development Expenses. Research and development expenses, which we expense as incurred, are reported

in G&A expenses. Research and development expenses were $33 million, $31 million and $34 million in 2010, 2009 and

2008, respectively.

Share-Based Employee Compensation. We recognize all share-based payments to employees, including grants of

employee stock options and stock appreciation rights (“SARs”), in the financial statements as compensation cost over the

service period based on their fair value on the date of grant. This compensation cost is recognized over the service period

on a straight-line basis for the fair value of awards that actually vest. We report this compensation cost consistent with the

other compensation costs for the employee recipient in either Payroll and employee benefits or G&A expenses.

Impairment or Disposal of Property, Plant and Equipment. Property, plant and equipment (“PP&E”) is tested for

impairment whenever events or changes in circumstances indicate that the carrying value of the assets may not be

recoverable. The assets are not recoverable if their carrying value is less than the undiscounted cash flows we expect to

generate from such assets. If the assets are not deemed to be recoverable, impairment is measured based on the excess of

their carrying value over their fair value.

Form 10-K