Pizza Hut 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

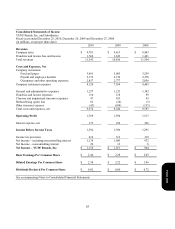

58

The losses our U.S. plan assets have experienced, along with a decrease in discount rates over time, have largely

contributed to an unrecognized pre-tax net loss of $363 million included in Accumulated other comprehensive income

(loss) for the U.S. plans at December 25, 2010. For purposes of determining 2010 expense, our funded status was such

that we recognized $23 million of net loss in net periodic benefit cost. We will recognize approximately $31 million of

such loss in 2011.

See Note 14 for further discussion of our pension plans.

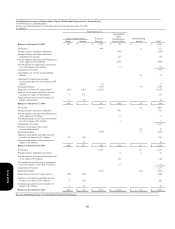

Stock Options and Stock Appreciation Rights Expense

Compensation expense for stock options and stock appreciation rights (“SARs”) is estimated on the grant date using a

Black-Scholes option pricing model. Our specific weighted-average assumptions for the risk-free interest rate, expected

term, expected volatility and expected dividend yield are documented in Note 15. Additionally, we estimate pre-vesting

forfeitures for purposes of determining compensation expense to be recognized. Future expense amounts for any

particular quarterly or annual period could be affected by changes in our assumptions or changes in market conditions.

We have determined that it is appropriate to group our stock option and SAR awards into two homogeneous groups when

estimating expected term and pre-vesting forfeitures. These groups consist of grants made primarily to restaurant-level

employees under our Restaurant General Manager Stock Option Plan (the “RGM Plan”) and grants made to executives

under our other stock award plans. Historically, approximately 10% - 15% of total options and SARs granted have been

made under the RGM Plan.

Stock option and SAR grants under the RGM Plan typically cliff vest after four years and grants made to executives under

our other stock award plans typically have a graded vesting schedule and vest 25% per year over four years. We use a

single weighted-average expected term for our awards that have a graded vesting schedule. We reevaluate our expected

term assumptions using historical exercise and post-vesting employment termination behavior on a regular basis. Based

on the results of this analysis, we have determined that five years and six years are appropriate expected terms for awards

to restaurant level employees and to executives, respectively.

Upon each stock award grant we reevaluate the expected volatility, including consideration of both historical volatility of

our stock as well as implied volatility associated with our traded options. We have estimated pre-vesting forfeitures based

on historical data. Based on such data, we believe that approximately 50% of all awards granted under the RGM Plan will

be forfeited and approximately 25% of all awards granted to above-store executives will be forfeited.

Form 10-K