Pizza Hut 2010 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

(e)

2

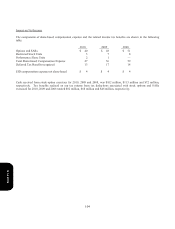

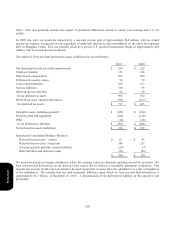

010, 2009 and 2008 include approximately $9 million, $16 million and $49 million, respectively, of charges

r

elating to U.S. general and administrative productivity initiatives and realignment of resources. Additionally,

2

008 includes $7 million of charges relating to investments in our U.S. Brands. See Note 4.

(f)

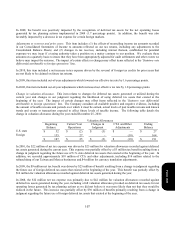

2

009 includes a $26 million charge to write-off goodwill associated with our LJS and A&W businesses in the

U

.S. See Note 9.

(g)

2

009 includes a $68 million gain related to the acquisition of additional interest in and consolidation of a former

u

nconsolidated affiliate in China and 2008 includes a $100 million gain recognized on the sale of our interest in

o

ur unconsolidated affiliate in Japan. See Note 4.

(h)

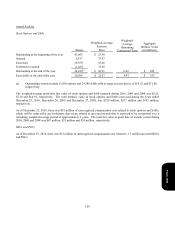

C

hina Division includes investments in 4 unconsolidated affiliates totaling $154 million, $144 million and $65

m

illion, for 2010, 2009 and 2008, respectively. The 2009 increase was driven by our acquisition of interest in

L

ittle Sheep, net of our acquisition of additional interest in and consolidation of our unconsolidated affiliate in

Shanghai, China. See Note 4.

(i) Primarily includes cash, deferred tax assets and property, plant and equipment, net, related to our office

facilities.

(j)

I

ncludes property, plant and equipment, net, goodwill, and intangible assets, net.

See Note 4 for additional operating segment disclosures related to impairment, store closure (income) costs and the

carrying amount of assets held for sale.

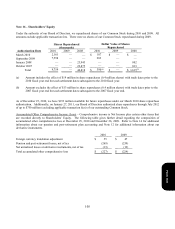

Note 19 – Contingencies

Lease Guarantees

As a result of (a) assigning our interest in obligations under real estate leases as a condition to the refranchising of certain

Company restaurants; (b) contributing certain Company restaurants to unconsolidated affiliates; and (c) guaranteeing

certain other leases, we are frequently contingently liable on lease agreements. These leases have varying terms, the latest

of which expires in 2026. As of December 25, 2010, the potential amount of undiscounted payments we could be

required to make in the event of non-payment by the primary lessee was approximately $525 million. The present value

of these potential payments discounted at our pre-tax cost of debt at December 25, 2010 was approximately $450 million.

Our franchisees are the primary lessees under the vast majority of these leases. We generally have cross-default

provisions with these franchisees that would put them in default of their franchise agreement in the event of non-payment

under the lease. We believe these cross-default provisions significantly reduce the risk that we will be required to make

payments under these leases. Accordingly, the liability recorded for our probable exposure under such leases at December

25, 2010 and December 26, 2009 was not material.

Form 10-K