Pizza Hut 2010 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

98

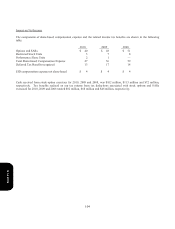

Plan Assets

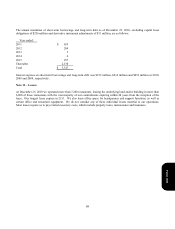

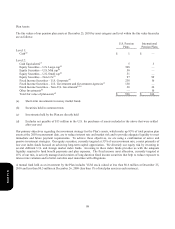

The fair values of our pension plan assets at December 25, 2010 by asset category and level within the fair value hierarchy

are as follows:

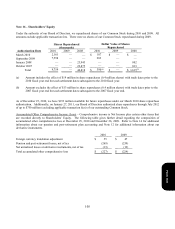

U.S. Pension

Plans

International

Pension Plans

Level 1:

Cash(a) $ 1 $

—

Level 2:

Cash Equivalents(a) 5 3

Equity Securities – U.S. Large cap(b) 308

—

Equity Securities – U.S. Mid cap(

b

) 50

—

Equity Securities – U.S. Small cap(

b

) 51

—

Equity Securities – Non-U.S.(

b

) 97 99

Fixed Income Securities – U.S. Corporate(

b

) 238 16

Fixed Income Securities – U.S. Government and Government Agencies(c) 150

—

Fixed Income Securities – Non-U.S. Government(

b

)(c) 20 36

Other Investments(b)

—

10

Total fair value of plan assets(d) $ 920 $ 164

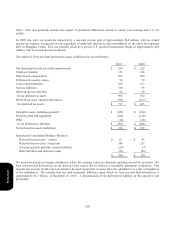

(a) Shor

t

-term investments in money market funds

(b) Securities held in common trusts

(c)

I

nvestments held by the Plan are directly held

(d)

E

xcludes net payable of $13 million in the U.S. for purchases of assets included in the above that were settled

a

fter year end

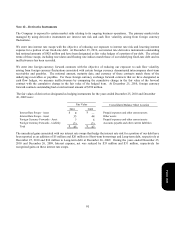

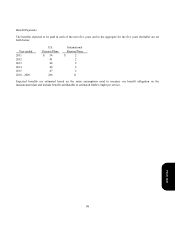

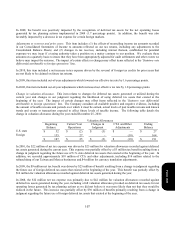

Our primary objectives regarding the investment strategy for the Plan’s assets, which make up 85% of total pension plan

assets at the 2010 measurement date, are to reduce interest rate and market risk and to provide adequate liquidity to meet

immediate and future payment requirements. To achieve these objectives, we are using a combination of active and

passive investment strategies. Our equity securities, currently targeted at 55% of our investment mix, consist primarily of

low cost index funds focused on achieving long-term capital appreciation. We diversify our equity risk by investing in

several different U.S. and foreign market index funds. Investing in these index funds provides us with the adequate

liquidity required to fund benefit payments and plan expenses. The fixed income asset allocation, currently targeted at

45% of our mix, is actively managed and consists of long duration fixed income securities that help to reduce exposure to

interest rate variation and to better correlate asset maturities with obligations.

A mutual fund held as an investment by the Plan includes YUM stock valued at less than $0.6 million at December 25,

2010 and less than $0.5 million at December 26, 2009 (less than 1% of total plan assets in each instance).

Form 10-K