Pizza Hut 2010 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

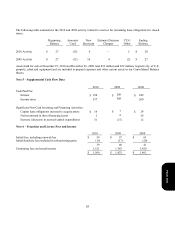

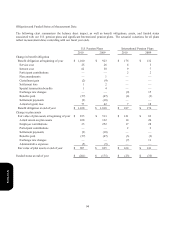

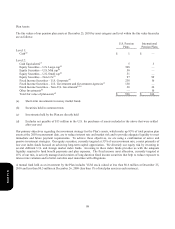

The following tables present the fair values for those assets and liabilities measured at fair value during 2010 or 2009 on a

non-recurring basis, and remaining on our Consolidated Balance Sheet as of December 25, 2010 or December 26, 2009.

Total losses include losses recognized from all non-recurring fair value measurements during the years ended December

25, 2010 and December 26, 2009:

Fair Value Measurements Using Total Losses

As of

December 25, 2010 Level 1 Level 2 Level 3

2010

Long-lived assets held for use $ 184

—

—

184 121

Fair Value Measurements Using Total Losses

As of

December 26, 2009 Level 1 Level 2 Level 3

2009

Long-lived assets held for use $ 30

—

—

30 56

Goodwill

—

—

—

—

38

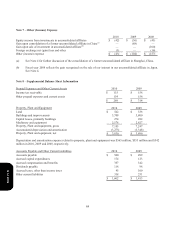

Long-lived assets held for use presented in the tables above include restaurants or groups of restaurants that were impaired

as a result of our semi-annual impairment review or restaurants not meeting held for sale criteria that have been offered

for sale at a price less than their carrying value during the year ended December 25, 2010 and December 26, 2009. Of the

$121 million in impairment charges shown in the table above for the year ended December 25, 2010, $91 million was

included in Refranchising (gain) loss and $30 million was included in Closures and impairment (income) expenses in the

Consolidated Statements of Income. Of the $56 million impairment charges shown in the table above for the year ended

December 26, 2009, $20 million was included in Refranchising (gain) loss and $36 million was included in Closures and

impairment (income) expenses in the Consolidated Statements of Income.

Goodwill losses in 2009 in the table above includes the goodwill impairment charges for our Pizza Hut South Korea and

LJS/A&W-U.S. reporting units, which are discussed in Note 9. These impairment charges were recorded in Closures and

impairment (income) expenses in the Consolidated Statements of Income.

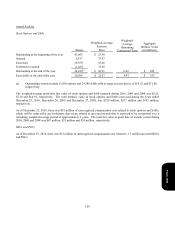

At December 25, 2010 the carrying values of cash and cash equivalents, accounts receivable and accounts payable

approximated their fair values because of the short-term nature of these instruments. The fair value of notes receivable

net of allowances and lease guarantees less subsequent amortization approximates their carrying value. The Company’s

debt obligations, excluding capital leases, were estimated to have a fair value of $3.6 billion, compared to their carrying

value of $3.3 billion. We estimated the fair value of debt using market quotes and calculations based on market rates.

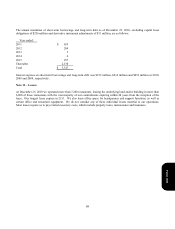

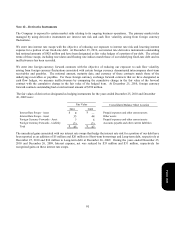

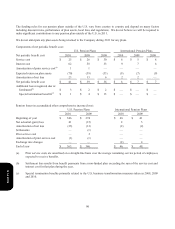

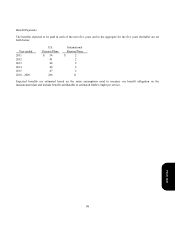

Note 14 – Pension, Retiree Medical and Retiree Savings Plans

Pension Benefits

We sponsor noncontributory defined benefit pension plans covering certain full-time salaried and hourly U.S. employees.

The most significant of these plans, the YUM Retirement Plan (the “Plan”), is funded while benefits from the other U.S.

plans are paid by the Company as incurred. During 2001, the plans covering our U.S. salaried employees were amended

such that any salaried employee hired or rehired by YUM after September 30, 2001 is not eligible to participate in those

plans. Benefits are based on years of service and earnings or stated amounts for each year of service. We also sponsor

various defined benefit pension plans covering certain of our non-U.S. employees, the most significant of which are in the

U.K. Our plans in the U.K. have previously been amended such that new employees are not eligible to participate in these

plans.

Form 10-K