Pizza Hut 2010 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

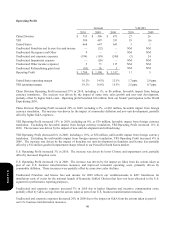

56

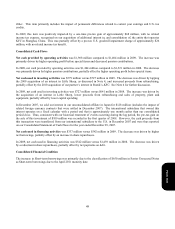

The discounted value of the future cash flows expected to be generated by the restaurant and retained by the franchisee is

reduced by future royalties the franchisee will pay the Company. The Company thus considers the fair value of future

royalties to be received under the franchise agreement as fair value retained in its determination of the goodwill to be

written off when refranchising. Others may consider the fair value of these future royalties as fair value disposed of and

thus would conclude that a larger percentage of a reporting unit’s fair value is disposed of in a refranchising transaction.

During 2010, the Company’s reporting units with the most significant refranchising activity and recorded goodwill were

our Taiwan business unit and our Pizza Hut-U.S. operating segment. Within our Taiwan business unit, 124 restaurants

were refranchised (representing 100% of beginning of year company units) and $7 million in goodwill was written off

(representing 19% of beginning of year goodwill). Within our Pizza Hut-U.S. operating segment, 278 restaurants were

refranchised (representing 43% of beginning of year company units) and $3 million in goodwill was written off

(representing 4% of beginning of year goodwill).

See Note 2 for a further discussion of our policies regarding goodwill.

Allowances for Franchise and License Receivables/Guarantees

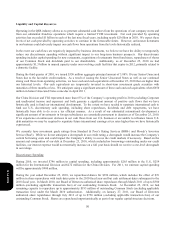

Franchise and license receivable balances include royalties, initial fees as well as other ancillary receivables such as rent

and fees for support services. Our reserve for franchisee or licensee receivable balances is based upon pre-defined aging

criteria or upon the occurrence of other events that indicate that we may not collect the balance due. This methodology

results in an immaterial amount of unreserved past due receivable balances at December 25, 2010. As such, we believe

our allowance for franchise and license receivables is adequate to cover potential exposure from uncollectible receivable

balances at December 25, 2010.

We have historically issued certain guarantees on behalf of franchisees primarily as a result of 1) assigning our interest in

obligations under operating leases, primarily as a condition to the refranchising of certain Company restaurants, 2)

facilitating franchisee development and 3) equipment financing arrangements to facilitate the launch of new sales layers

by franchisees. We recognize a liability for the fair value of such guarantees upon inception of the guarantee and upon

any subsequent modification, such as renewals, when we remain contingently liable. The fair value of a guarantee is the

estimated amount at which the liability could be settled in a current transaction between willing unrelated parties.

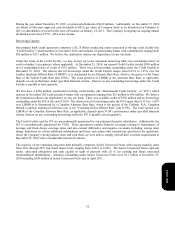

The potential total exposure for lease assignments is significant when aggregated, with approximately $450 million

representing the present value, discounted at our pre-tax cost of debt, of the minimum payments of the assigned leases at

December 25, 2010. Current franchisees are the primary lessees under the vast majority of these leases. Additionally, we

have guaranteed approximately $23 million of franchisee loans for various equipment programs. We generally have

cross-default provisions with these franchisees that would put them in default of their franchise agreement in the event of

non-payment under assigned leases and certain of the equipment loan programs. We believe these cross-default

provisions significantly reduce the risk that we will be required to make payments under these guarantees and,

historically, we have not been required to make significant payments for guarantees. If payment on these guarantees

becomes probable and estimable, we record a liability for our exposure under these guarantees. At December 25, 2010,

we have recorded an immaterial liability for our exposure under these guarantees which we consider to be probable and

estimable. If we begin to be required to perform under these guarantees to a greater extent, our results of operations could

be negatively impacted.

See Note 2 for a further discussion of our policies regarding franchise and license operations.

See Note 19 for a further discussion of our guarantees.

Form 10-K