Pizza Hut 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

81

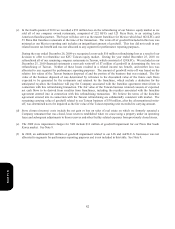

(a) Refranchising (gain) loss is not allocated to segments for performance reporting purposes.

(b) U.S. refranchising loss for the year ended December 25, 2010 is the net result of gains from 404 restaurants sold an

d

non-cash impairment charges related to our offers to refranchise KFCs in the U.S. While we did not yet believe

these KFCs met the criteria to be classified as held for sale, we did, consistent with our historical practice, review the

restaurants for impairment as a result of our offer to refranchise. We recorded impairment charges where we

determined that the carrying value of restaurant groups to be sold was not recoverable based upon our estimate o

f

expected refranchising proceeds and holding period cash flows anticipated while we continue to operate the

restaurants as company units. For those restaurant groups deemed impaired, we wrote such restaurant groups down

to our estimate of their fair values, which were

b

ased on the sales price we would expect to receive from a franchisee

for each restaurant group. This fair value determination considered current market conditions, real-estate values,

trends in the KFC-U.S. business, prices for similar transactions in the restaurant industry and preliminary offers fo

r

the restaurant group to date. We continued to depreciate the pre-impairment charges carrying value of these

restaurants for periods prior to impairment being recorded and continued to depreciate the post-impairment charges

carrying value thereafter. We will continue to depreciate the post-impairment charges carrying value going forward

until the date we believe the held for sale criteria for any restaurants are met. Additionally, we will continue to

review the restaurant groups for any further necessary impairment. The aforementioned non-cash write downs

totaling $85 million do not include any allocation of the KFC reporting unit goodwill in the restaurant group carrying

value. This additional non-cash write down would be recorded, consistent with our historical policy, if the restaurant

groups, or any subset of the restaurant groups, ultimately meet the criteria to be classified as held for sale. We will

also be required to record a charge for the fair value of our guarantee of future lease payments for leases we assign to

the franchisee upon any sale.

Form 10-K