Pizza Hut 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

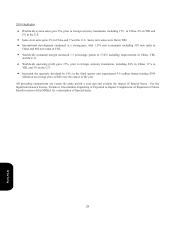

Segment Reporting Change

At the beginning of 2010 we began reporting information for our Thailand and KFC Taiwan businesses within our

International Division as a result of changes to our management reporting structure. These businesses now report to the

President of YRI, whereas previously they reported to the President of our China Division. While this reporting change

did not impact our consolidated results, segment information for previous periods has been restated to be consistent with

the current period presentation.

T

he following table summarizes the 2009 and 2008 increases to selected line items within the YRI segment as a result o

f

t

hese segment reporting changes (with equal and offsetting decreases impacting the China Division):

2009 2008

Company sales $ 270 $ 282

Company restaurant expenses 244 254

Operating Profit 6 9

Strategies

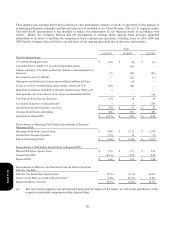

The Company continues to focus on four key strategies:

Build Leading Brands in China in Every Significant Category – The Company has developed the KFC and Pizza Hut

brands into the leading quick service and casual dining restaurants, respectively, in mainland China. Additionally, the

Company owns and operates the distribution system for its restaurants in mainland China which we believe provides a

significant competitive advantage. Given this strong competitive position, a growing economy and a population of 1.3

billion in mainland China, the Company is rapidly adding KFC and Pizza Hut Casual Dining restaurants and testing the

additional restaurant concepts of Pizza Hut Home Service (pizza delivery) and East Dawning (Chinese food). Our

ongoing earnings growth model in China includes double digit unit growth, same store sales growth of at least 4% and

leverage of our General and Administrative (“G&A”) infrastructure, which we expect to drive Operating Profit growth of

15%.

Drive Aggressive International Expansion and Build Strong Brands Everywhere – The Company and its franchisees

opened nearly 900 new restaurants in 2010 in the Company’s International Division, representing 11 straight years of

opening over 700 restaurants, and YRI is one of the leading international retail developers in terms of units opened. The

Company expects to continue to experience strong growth by building out existing markets and growing in new markets

including France, Russia and India. The International Division’s Operating Profit has experienced an 8 year compound

annual growth rate of 11%. Our ongoing earnings growth model for YRI includes Operating Profit growth of 10% driven

by 3-4% net unit growth, at least 2-3% same store sales growth, modest margin improvement and leverage of our G&A

infrastructure.

Dramatically Improve U.S. Brand Positions, Consistency and Returns – The Company continues to focus on improving its

U.S. position through differentiated products and marketing and an improved customer experience. The Company also

strives to provide industry leading new product innovation which adds sales layers and expands day parts. We continue to

evaluate our returns and ownership positions with an earn the right to own philosophy on Company owned restaurants.

Our ongoing earnings growth model calls for Operating Profit growth of 5% in the U.S. As we near completion of our

refranchising program in 2011, the Taco Bell operating segment will become an increasingly larger component of U.S.

ongoing earnings growth. The U.S. ongoing earnings growth model includes Taco Bell Operating Profit growth of 6%

driven by modest unit growth, same store sales growth of 3% and leverage of our G&A infrastructure.

Form 10-K