Pizza Hut 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

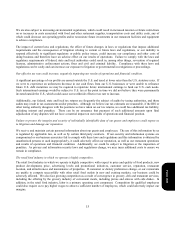

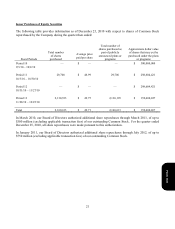

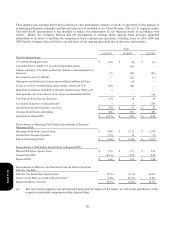

Fiscal years 2010, 2009, 2008, 2007 and 2006 all include 52 weeks.

The selected financial data should be read in conjunction with the Consolidated Financial Statements and the Notes

thereto.

(a) Fiscal year 2009 included non-cash charges of $26 million and $12 million to write-off goodwill related to our

LJS/A&W U.S. and Pizza Hut South Korea businesses, respectively. See Note 4 to the Consolidated Financial

Statements for a description of our store closures and store impairment expenses in 2010, 2009 and 2008.

Additionally, see Note 9 describing our goodwill impairment expense recognized in 2009.

(b) Fiscal year 2010 included U.S. refranchising losses of $18 million, a loss upon refranchising our Mexico market

of $52 million and a loss upon refranchising our Taiwan market of $7 million. Fiscal year 2009 included U.S.

refranchising gains of $34 million and a loss of $10 million as a result of our decision to offer to refranchise our

Taiwan market. These items are discussed further within our MD&A.

(c) Fiscal year 2010 included a loss of $18 million related to U.S. business transformation measures, including the

2010 U.S. refranchising losses, and the 2010 Mexico and Taiwan refranchising losses described in (b). Fiscal

year 2009 included a gain of $68 million related to the consolidation of a former unconsolidated affiliate in

China, a loss of $40 million related to U.S. business transformation measures, including the $26 million

goodwill charge described in (a) and the 2009 U.S. refranchising gains described in (b), and the 2009 Taiwan

refranchising loss described in (b). Fiscal year 2008 included a gain of $100 million related to the sale of our

interest in our unconsolidated affiliate in Japan and a loss of $61 million related to U.S. business transformation

measures. These items are discussed further within our MD&A.

(d) Adjusted for the two for one stock split on June 26, 2007.

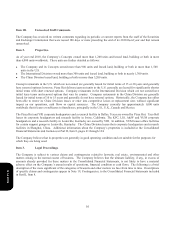

(e) In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”)

throughout this document, the Company has provided non-GAAP measurements which present operating results

on a basis before Special Items. The Company uses earnings before Special Items as a key performance measure

of results of operations for the purpose of evaluating performance internally. This non-GAAP measurement is

not intended to replace the presentation of our financial results in accordance with GAAP. Rather, the Company

believes that the presentation of earnings before Special Items provides additional information to investors to

facilitate the comparison of past and present operations, excluding items that the Company does not believe are

indicative of our ongoing operations due to their size and/or nature. The gains and charges described in (c),

above, are considered Special Items. The 2010, 2009 and 2008 Special Items are discussed in further detail

within the MD&A.

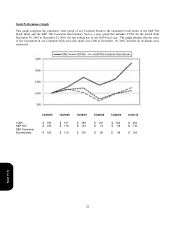

(f) System sales growth includes the results of all restaurants regardless of ownership, including Company owned,

franchise, unconsolidated affiliate and license restaurants. Sales of franchise, unconsolidated affiliate and

license restaurants generate franchise and license fees for the Company (typically at a rate of 4% to 6% of sales).

Franchise, unconsolidated affiliate and license restaurant sales are not included in Company sales on the

Consolidated Statements of Income; however, the franchise and license fees are included in the Company’s

revenues. We believe system sales growth is useful to investors as a significant indicator of the overall strength

of our business as it incorporates all our revenue drivers, Company and franchise same store sales as well as net

unit development. Same store sales growth includes the results of all restaurants that have been open one year or

more.

(g) Local currency represents the percentage change excluding the impact of foreign currency translation. These

amounts are derived by translating current year results at prior year average exchange rates. We believe the

elimination of the foreign currency translation impact provides better year-to-year comparability without the

distortion of foreign currency fluctuations.

Form 10-K