Pizza Hut 2010 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

76

Common Stock Share Repurchases. From time to time, we repurchase shares of our Common Stock under share

repurchase programs authorized by our Board of Directors. Shares repurchased constitute authorized, but unissued shares

under the North Carolina laws under which we are incorporated. Additionally, our Common Stock has no par or stated

value. Accordingly, we record the full value of share repurchases, upon the trade date, against Common Stock on our

Consolidated Balance Sheet except when to do so would result in a negative balance in such Common Stock account. In

such instances, on a period basis, we record the cost of any further share repurchases as a reduction in retained earnings.

Due to the large number of share repurchases and the increase in the market value of our stock over the past several years,

our Common Stock balance is frequently zero at the end of any period. Our Common Stock balance was such that no

share repurchases impacted Retained Earnings in 2010, while $1,434 million in share repurchases were recorded as a

reduction in Retained Earnings in 2008. There were no shares of our Common Stock repurchased during 2009. See Note

16 for additional information.

Pension and Post-retirement Medical Benefits. We measure and recognize the overfunded or underfunded status of our

pension and post-retirement plans as an asset or liability in our Consolidated Balance Sheet as of our fiscal year end. The

funded status represents the difference between the projected benefit obligation and the fair value of plan assets. The

projected benefit obligation is the present value of benefits earned to date by plan participants, including the effect of

future salary increases, as applicable. The difference between the projected benefit obligation and the fair value of assets

that has not previously been recognized as expense is recorded as a component of Accumulated other comprehensive

income (loss).

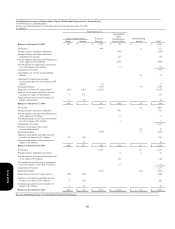

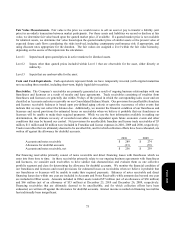

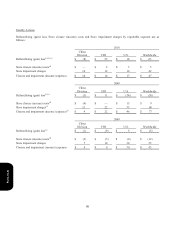

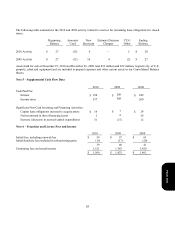

Note 3 – Earnings Per Common Share (“EPS”)

2010 2009 2008

N

et Income – YUM! Brands, Inc.

$

1,158 $ 1,071 $ 964

Weighted-average common shares outstanding (for basic

calculation) 474 471 475

Effect of dilutive share-based employee compensation 12 12 16

Weighted-average common and dilutive potential common shares

outstanding (for diluted calculation) 486 483 491

Basic EPS

$

2.44 $ 2.28 $ 2.03

Diluted EPS

$

2.38 $ 2.22 $ 1.96

Unexercised employee stock options and stock appreciation rights

(in millions) excluded from the diluted EPS computation(a) 2.2 13.3 5.9

(a) These unexercised employee stock options and stock appreciation rights were not included in the computation of

diluted EPS because to do so would have been antidilutive for the periods presented.

Form 10-K