Pizza Hut 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On The Ground Floor of

Global Growth

That Feeds the World

Table of contents

-

Page 1

On The Ground Floor of Global Growth Building The Defining Global Company That Feeds the World Yum! Brands 2010 Annual Customer Mania Report -

Page 2

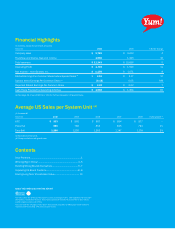

Financial Highlights (In millions, except for per share amounts) Year-end 2010 2009 % B/(W) change Company sales Franchise and license fees and income Total revenues Operating Profit Net Income - Yum! Brands, Inc. Diluted Earnings Per Common Share before Special Items Special Items Earnings Per ... -

Page 3

... Per Share (EPS) growth, excluding special items, representing the ninth straight year that we exceeded our annual target of at least 10%. In fact, 17% EPS growth is our best in the last decade and what makes this even more impressive is that it was driven by a 15% increase in operating profit prior... -

Page 4

...China and the emerging markets. With our leading global brands, 1.4 million system wide team members around the world already operating in over 110 countries and territories, powered by a powerful financial capability, we have everything it takes to make it happen. Our intent is to continue to drive... -

Page 5

... spirit by offering unbelievable value; KFC creates joyful eating experiences because it tastes better than good; Pizza Hut promotes social interaction by creating favorite moments for you and the people you love to be around. We have clear roadmaps to develop each of our brands. These "Plans to... -

Page 6

#1 Build Leading Brands Across CHINA In Every Significant Category. -

Page 7

... its assets with 24-hour operations, delivery service and continuing to build a solid breakfast business. We also have 520 casual dining Pizza Huts in 130 cities that had a breakout year, generating double digit same store sales growth in every quarter in 2010. Additionally, operating profit grew... -

Page 8

#2 Drive Aggressive INTERNATIONAL Expansion & Build Strong Brands Everywhere. Indonesia -

Page 9

...-fried products, and testing breakfast. We're also focused on improving our operating model at Pizza Hut to better separate casual dining from our carryout and delivery business in order to drive stronger returns. Finally, as we shift our resources to support high-growth, high-return businesses, we... -

Page 10

#3 Dramatically Improve US Brand Positions, Consistency and Returns. -

Page 11

... driving volume during those days and better leveraging our assets. We also continue to innovate with new products like the new Big Italy Pizza. As a result, we've gained share, dramatically turned around our sales (up 8% for the year) and our restructuring is virtually complete - over 90% of system... -

Page 12

...to high-growth emerging markets such as China, India and Russia, we expect total returns to remain strong. These returns will further improve as we continue to refranchise restaurants, as we have in the US, Mexico and Taiwan, which will increase our franchise fees with minimal capital investment. We... -

Page 13

... their hard work, dedication and commitment to help build Yum! as the defining Global company that Feeds the World. After reading this Annual Report, I hope you'll agree we're just on the ground floor of global growth! YUM! TO YOU! David C. Novak Chairman & Chief executive officer Yum! Brands, Inc... -

Page 14

-

Page 15

-

Page 16

-

Page 17

...Chairman of the Board and Chief Executive Officer Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to Be Held on May 19, 2011-this Notice and proxy statement is available at www.yum.com/investors/investor_materials.asp and the Annual Report on Form 10-K is... -

Page 18

... of record as of the close of business on March 21, 2011. You may also read the Company's Annual Report and this Notice and proxy statement on our Web site at www.yum.com/annualreport and www.yum.com/investors/ investor_materials.asp. Annual Report: A copy of our 2010 Annual Report on Form 10... -

Page 19

... to Permit Shareholders to Call Special Meetings ...STOCK OWNERSHIP INFORMATION ...EXECUTIVE COMPENSATION ...Compensation Discussion and Analysis ...Management Planning and Development Committee Report ...Summary Compensation Table ...All Other Compensation Table ...Proxy Statement 1 6 15 15 21 23... -

Page 20

...most highly paid executive officers. GENERAL INFORMATION ABOUT THE MEETING What is the purpose of the Annual Meeting? At our Annual Meeting, shareholders will vote on several important Company matters. In addition, our management will report on the Company's performance over the last fiscal year and... -

Page 21

... stock as of the close of business on the record date, March 21, 2011. Each share of YUM common stock is entitled to one vote. As of March 21, 2011, YUM had 466,853,722 shares of common stock outstanding. How does the Board of Directors recommend that I vote? Proxy Statement Our Board of Directors... -

Page 22

... voting Web site (www.proxyvote.com). Votes submitted through the Internet or by telephone through the Broadridge program must be received by 11:59 p.m., Eastern Daylight Saving Time, on May 18, 2011. Can I vote at the meeting? Shares registered directly in your name as the shareholder of record may... -

Page 23

... have the authority under the New York Stock Exchange rules to vote shares for which their customers do not provide voting instructions on certain ''routine'' matters. The proposal to ratify the selection of KPMG LLP as our independent auditors for fiscal year 2011 is considered a routine matter for... -

Page 24

... our management knows of no matters that will be presented for consideration at the meeting other than those matters discussed in this proxy statement. If any other matters properly come before the meeting and call for a vote of shareholders, validly executed proxies in the enclosed form returned to... -

Page 25

...at this Annual Meeting. As discussed in more detail later in this section, the Board has determined that 10 of our 12 continuing directors are independent under the rules of the New York Stock Exchange (''NYSE''). How often did the Board meet in fiscal 2010? The Board of Directors met 6 times during... -

Page 26

...information and procedures for employees to report ethical or accounting concerns, misconduct or violations of the Code in a confidential manner. The Code of Conduct applies to the Board of Directors and all employees of the Company, including the principal executive officer, the principal financial... -

Page 27

...from its Code (to the extent applicable to the Board of Directors or executive officers) on this Web site. What other Significant Board Practices does the Company have? • Private Executive Sessions. Our non-management directors meet in executive session at each regular Board meeting. The executive... -

Page 28

...designing pay programs at all levels that align team performance, individual performance, customer satisfaction and shareholder return, emphasize long-term incentives and require executives to personally invest in Company stock. In 2011, the Management Planning and Development Committee of the Board... -

Page 29

...Corporate Governance Principles, adopted by the Board, require that we meet the listing standards of the NYSE. The full text of the Principles can be found on the Company's Web site (www.yum.com/governance/principles.asp). Pursuant to the Principles, the Board undertook its annual review of director... -

Page 30

...appropriate members of management and/or the Board of Directors with respect to all concerns it receives. The full text of our Policy on Reporting of Concerns Regarding Accounting and Other Matters is available on our Web site at www.yum.com/governance/complaint.asp. 9MAR201101 Proxy Statement 11 -

Page 31

...the adequacy of the Company's internal systems of accounting and financial control • Reviews the annual audited financial statements and results of the audit with management and the independent auditors • Reviews the Company's accounting and financial reporting principles and practices including... -

Page 32

... of corporate goals set by the Committee • Reviews and approves the compensation of the chief executive officer and other senior executive officers • Reviews management succession planning 5 The Board has determined that all of the members of the Management Planning and Development Committee... -

Page 33

... is not an executive officer of the other company. During fiscal 2010, affiliates of Harman Management Corporation (''Harman''), as KFC, Taco Bell, Pizza Hut, Long John Silver's and A&W All American Food franchisees, paid royalties of approximately $13.4 million and contingent store opening fees of... -

Page 34

... ''Stock Ownership Information.'' See also ''Certain Relationships and Related Transactions.'' There are no family relationships among any of the directors and executive officers of the Company. Director ages are as of the Annual Meeting date. Director Bios David W. Dorman Age 57 Director since... -

Page 35

...: • Operating and management experience, including as chairman of an international sales and distribution business • Expertise in branding, marketing, sales and international business development • Public company directorship and committee experience • Independent of Company Proxy Statement... -

Page 36

... expertise: • Operating and management experience, including as a managing director of a consulting firm and chief executive officer of consumer, branded business • Expertise in finance, strategic planning, marketing, business development and corporate governance • Public company directorship... -

Page 37

... Group. Specific qualifications, experience, skills and expertise: • Operating and management experience, including as president and chief executive officer of a global travel-related services company • Expertise in finance, marketing and international business development • Public company... -

Page 38

... KFC and Pizza Hut. Specific qualifications, experience, skills and expertise: • Operating and management experience, including as president of the Company's China Division • Expertise in marketing and brand development • Expertise in strategic planning and international business development... -

Page 39

... and expertise: • Operating and management experience, including as chief executive officer, of a global healthcare and service provider business • Expertise in finance, business development, business integrations, financial reporting, compliance and controls • Public company directorship and... -

Page 40

... over financial reporting, statutory audits and services rendered in connection with the Company's securities offerings. (2) Audit-related fees for 2010 and 2009 included audits of financial statements of certain employee benefit plans, agreed upon procedures related to certain state tax credits and... -

Page 41

..., including actual services provided and associated fees, and must promptly report any non-compliance with the pre-approval policy to the Chairperson of the Audit Committee. Proxy Statement The complete policy is available on the Company's Web site at www.yum.com/governance/media/gov_auditpolicy... -

Page 42

... and Analysis section of this proxy statement, beginning on page 30, as well as the Summary Compensation Table and related compensation tables and narratives, which discuss in detail how our compensation policies and procedures operate and are designed to meet our compensation goals. Accordingly... -

Page 43

... of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. Proxy Statement What is the recommendation of the Board of Directors? THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE ONE YEAR ON THE FREQUENCY FOR CONDUCTING THE ADVISORY VOTE ON EXECUTIVE COMPENSATION... -

Page 44

... general descriptions of the Amendment herein are subject to the actual text of the Amendment in the form of Appendix A. Background Proxy Statement The ability of shareholders to call special shareholder meetings is increasingly considered an important aspect of good corporate governance. Last year... -

Page 45

...the Board of Directors to be held within 90 days after the special meeting request is received by the Secretary, (2) the business to be covered at the special meeting was previously included at an annual or special meeting held not more than 12 months before the special meeting request was delivered... -

Page 46

...each of the executive officers named in the Summary Compensation Table on page 52, and • all directors and executive officers as a group. Unless we note otherwise, each of the following persons and their family members has sole voting and investment power with respect to the shares of common stock... -

Page 47

... and executive officers as a group, 33,923 shares (2) The amounts shown include beneficial ownership of shares that may be acquired within 60 days pursuant to stock options and stock appreciation rights awarded under our employee or director incentive compensation plans. For stock options, we report... -

Page 48

...SEC. To our knowledge, based solely on a review of the copies of such reports furnished to YUM and representations that no other reports were required, all of our directors and executive officers complied with all Section 16(a) filing requirements during fiscal 2010. 9MAR201101 Proxy Statement 29 -

Page 49

... to report that for 2010 we: Proxy Statement • Achieved record year over year growth in Earnings Per Share (excluding special items) (''EPS'') growth of 17%-marking the ninth consecutive year that we exceeded our annual target of at least 10% • Increased worldwide system sales by 4% (prior... -

Page 50

...policy that gives the Board discretion to recover incentive compensation paid to senior management in the event of a restatement of our financial statements due to misconduct. • Future Severance Policy. We have a future severance policy that limits any future severance agreements with an executive... -

Page 51

... Category • Drive Aggressive International Expansion and Build Strong Brands Everywhere • Improve U.S. Brand Positions, Consistency and Returns • Provide Long-Term Shareholder and Franchisee Value Our compensation program is designed to support these strategies. For our annual bonus program... -

Page 52

... results on a year over year basis and the initial impact of expensing stock options in 2005. The special items excluded are the same as those excluded in the Company's annual earning releases. Annual Total Shareholder Return Through 12/31/10 84th percentile 43.3% 9MAR201101 Proxy Statement 94th... -

Page 53

...achieve pre-established 3-year EPS growth goals. In the remainder of the CD&A, we discuss in more detail our executive compensation program and how it worked in 2010. Among other topics, we address the following: Proxy Statement • The philosophy underlying our executive compensation program (page... -

Page 54

... International Division (''YRI'') • Scott Bergren, Chief Executive Officer-Pizza Hut U.S. and Yum! Innovation YUM's Compensation Philosophy YUM's compensation philosophy is reviewed annually by the Committee. Our philosophy is to: • reward performance • pay our restaurant general managers... -

Page 55

...of each year, the Committee reviews the performance and total compensation of our CEO and the other executive officers. The Committee reviews and establishes each executive's total compensation target for the current year which includes base salary, annual bonus opportunities and long-term incentive... -

Page 56

... the enterprise that franchising introduces, in particular, managing product introductions, marketing, driving new unit development, customer satisfaction and overall operations improvements across the entire franchise system. Accordingly, consistent with its practice from prior years which Meridian... -

Page 57

...We believe the current group of companies is reflective of the market in which we operate for executive talent. The group was chosen because of each of the company's relative leadership positions in their sector, relative size as measured by revenues, relative complexity of the business, and in some... -

Page 58

... responsibility, experience, individual performance and future potential. Specific salary increases take into account these factors and the current market for management talent. The Committee reviews each executive officer's salary and performance annually. Based on the economic environment in 2009... -

Page 59

... and targets are key factors that drive individual and team performance, which will result in increased shareholder value over the long term. These measures are designed to align employee goals with the Company's individual divisions' current year objectives to grow earnings and sales, develop new... -

Page 60

...% 10% 45 5 21 19 90 107 10 117 Proxy Statement Bergren Operating Profit Growth (Before Tax) System Same Store Sales Growth Restaurant Margin System Customer Satisfaction Total Weighted TP Factor-Pizza Hut U.S. 75% Division/25% Yum TP Factor 5% 3.5% 12.0% 61.5% 10.2% 7.7% 12.4% 56% 200 200 140... -

Page 61

... performance for 2010 was significantly above target based upon Pizza Hut U.S. significantly improving year over year sales and profit growth, as well as his leadership in reshaping the business through improved value, increasing weekday business and improvements in home delivery execution. Based on... -

Page 62

... investments. Under our LTI Plan, our executive officers are awarded long-term incentives in the form of non-qualified stock options or stock settled stock appreciation rights (''SARs''). The type of award granted is based upon the executives' local tax jurisdiction. Each year the Committee reviews... -

Page 63

... and five year periods) and operating income growth (top 50%). Based on this continued sustained strong performance, the Committee determined that Mr. Novak's target total compensation for 2010 should be at or slightly below the 75th percentile as compared to the compensation of chief executives in... -

Page 64

...employee) for employees with 20 years of service who retire after age 62. The annual change in pension value for each NEO is set forth on page 52, in the Summary Compensation Table, and the actual projected benefit at termination is set forth on page 59, in the Pension Benefits Table. For executives... -

Page 65

... based salaried employees. In 2010, our broad based employee disability plan was changed to limit the annual benefit coverage to $300,000. For employees whose coverage was reduced as a result of the change, the Company is purchasing individual disability coverage for three years (provided employment... -

Page 66

... top 600 employees. Our Chief Executive Officer is required to own 336,000 shares of YUM stock or stock equivalents (approximately eleven times his base salary at the end of fiscal 2010). Executive officers (other than Mr. Novak) are expected to attain their ownership targets, equivalent in value to... -

Page 67

... grants per year outside of the January time frame, and these grants have been awarded to employees below the executive officer level. In 2010, we made 3 Chairman's Awards on Board of Director meeting dates other than the January meeting. Payments upon Termination of Employment The Company does not... -

Page 68

... and benefits for terminated employees • access to equity components of total compensation after a change in control Future Severance Agreement Policy As recommended by shareholders in 2007, the Committee approved a new policy in 2007 to limit future severance agreements with our executives. The... -

Page 69

... believes that the annual incentive awards, stock option, stock appreciation rights, RSU and PSU grants satisfy the requirements for exemption under Internal Revenue Code Section 162(m). Payments made under these plans qualify as performance-based compensation. For 2010, the annual salary paid to Mr... -

Page 70

... Development Committee of the Board of Directors reports that it has reviewed and discussed with management the section of this proxy statement headed ''Compensation Discussion and Analysis,'' and, on the basis of that review and discussion, recommended that section be included in our Annual Report... -

Page 71

... Executive Officer and President Richard T. Carucci Chief Financial Officer Jing-Shyh S. Su Vice Chairman, Yum! Brands, Inc. Chairman and Chief Executive Officer, YUM's China Division Graham D. Allan Chief Executive Officer, Yum! Restaurants International Year (b) Salary ($)(1) (c) Bonus Stock... -

Page 72

... reflect the aggregate increase in actuarial present value of age 62 accrued benefits under all actuarial pension plans during the 2010 fiscal year (using interest rate and mortality assumptions consistent with those used in the Company's financial statements). See the Pension Benefits Table at page... -

Page 73

... following table contains a breakdown of the compensation and benefits included under All Other Compensation in the Summary Compensation Table above for 2010. Name (a) Perquisites(1) (b) Tax Reimbursements(2) (c) Insurance premiums(3) (d) Other(4) (e) Total (f) Novak Carucci Su Allan Bergren 247... -

Page 74

...provides information on stock options, SARs, RSUs and PSUs granted for 2010 to each of the Company's NEOs. The amount of these awards that were expensed is shown in the Summary Compensation Table at page 52. Name (a) Grant Date (b) Estimated Possible Payouts Under Non-Equity Incentive Plan Awards... -

Page 75

... using the Black-Scholes value on the grant date of $8.06. For additional information regarding valuation assumptions of SARs/stock options, see the discussion of stock awards and option awards contained in Part II, Item 8, ''Financial Statements and Supplementary Data'' of the 2010 Annual Report... -

Page 76

... (c) Option/ SAR Exercise Price ($) (d) Option/ SAR Expiration Date (e) Number of Shares or Units of Stock That Have Not Vested (#)(2) (f) Market Value of Shares or Units of Stock That Have Not Vested ($)(3) (g) Equity incentive plan awards: Number of unearned shares, units or other rights... -

Page 77

... and Mr. Su in which 173,137 RSUs represent a 2010 retention award (including accrued dividends) that vests after 5 years. (3) The market value of these awards are calculated by multiplying the number of shares covered by the award by $49.05, the closing price of YUM stock on the NYSE on December 31... -

Page 78

... Plan'') or the YUM! Brands International Retirement Plan determined using interest rate and mortality rate assumptions consistent with those used in the Company's financial statements. 2010 Fiscal Year Pension Benefits Table Number of Present Value of Years of Accumulated Credited Service Benefit... -

Page 79

... rate changes from year to year which are used to determine benefits under the plan. (1) YUM! Brands Retirement Plan The Retirement Plan and the Pension Equalization Plan (discussed below) provide an integrated program of retirement benefits for salaried employees who were hired by the Company... -

Page 80

... by Internal Revenue Code Section 417(e)(3) (currently this is the annual 30-year Treasury rate for the 2nd month preceding the date of distribution and the gender blended 1994 Group Annuity Reserving Table as set forth in Revenue Ruling 2001-62). (2) YUM! Brands Inc. Pension Equalization Plan The... -

Page 81

... to by the Company or one or more of the group of corporations that is controlled by the Company. 9MAR201101440694 Proxy Statement Benefits are payable under the same terms and conditions as the Retirement Plan without regard to Internal Revenue Service limitations on amounts of includible... -

Page 82

... that is, they provide market rate returns and do not provide for preferential earnings. The S&P 500 index fund, bond market index fund and stable value fund are designed to track the investment return of like-named funds offered under the Company's 401(k) Plan. The YUM! Stock Fund and YUM! Matching... -

Page 83

...-defer. Investments in the YUM! Stock Fund and YUM! Matching Stock Fund are only distributed in shares Under the LRP, participants receive a distribution of their vested account balance following the later to occur of their attainment of age 55 or retirement from the Company. Executive Contributions... -

Page 84

...are the year-end balances for each executive under the EID Program. As required under SEC rules, below is the portion of the year-end balance for each executive which has previously been reported as compensation to the executive in the Company's Summary Compensation Table for 2010 and prior years or... -

Page 85

... if the NEO's employment had terminated on December 31, 2010, given the NEO's compensation and service levels as of such date and, if applicable, based on the Company's closing stock price on that date. These benefits are in addition to benefits available generally to salaried employees, such as... -

Page 86

... performance. Pension Benefits. The Pension Benefits Table on page 59 describes the general terms of each pension plan in which the NEOs participate, the years of credited service and the present value of the annuity payable to each NEO assuming termination of employment as of December 31, 2010. The... -

Page 87

... each January 1 for another three-year term. An executive whose employment is not terminated within two years of a change in control will not be entitled to receive any severance payments under the change in control severance agreements. Generally, pursuant to the agreements, a change in control is... -

Page 88

... Statements and Supplementary Data'' of the 2010 Annual Report in Notes to Consolidated Financial Statements at Note 15, ''Share-based and Deferred Compensation Plans.'' (3) At December 31, 2010, the aggregate number of options and SARs awards outstanding for non-management directors was: Name... -

Page 89

... Non-employee directors also receive a one-time stock grant with a fair market value of $25,000 on the date of grant upon joining the Board, distribution of which is deferred until termination from the Board. Stock Ownership Requirements. Similar to executive officers, directors are subject to share... -

Page 90

... 31, 2010, the equity compensation plans under which we may issue shares of stock to our directors, officers and employees under the 1999 Long Term Incentive Plan (''1999 Plan''), the 1997 Long Term Incentive Plan (the ''1997 Plan''), SharePower Plan and Restaurant General Manager Stock Option Plan... -

Page 91

... RGMs. In addition, the Plan provides incentives to Area Coaches, Franchise Business Leaders and other supervisory field operation positions that support RGMs and have profit and loss responsibilities within a defined region or area. While all non-executive officer employees are eligible to receive... -

Page 92

... that arise throughout the year. Management is responsible for the Company's financial reporting process, including its system of internal control over financial reporting, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the... -

Page 93

... updates, and written summaries as required by the PCAOB rules (for tax services), on the amount of fees and scope of audit, audit-related and tax services provided. In addition, the Committee reviewed key initiatives and programs aimed at strengthening the effectiveness of the Company's internal... -

Page 94

...Louisville, KY 40213 or by calling Investor Relations at 1 (888) 439-4986 or by sending an e-mail to [email protected]. May I propose actions for consideration at next year's Annual Meeting of Shareholders or nominate individuals to serve as directors? Under the rules of the SEC, if a shareholder... -

Page 95

... our proxy statement. These procedures provide that nominations for director nominees and/or an item of business to be introduced at an Annual Meeting of Shareholders must be submitted in writing to our Corporate Secretary at our principal executive offices and you must include information set forth... -

Page 96

... of Directors and all annual meetings of the Shareholders of the Corporation and Shareholders of the Corporation. A scheduled meeting of Shareholders may be postponed by the Board of Directors by public notice given at or prior to the time of the meeting. Proxy Statement ...(j) Special meetings of... -

Page 97

(This page has been left blank intentionally.) -

Page 98

... solely of shares of Common Stock) held by non-affiliates of the registrant as of June 12, 2010 computed by reference to the closing price of the registrant's Common Stock on the New York Stock Exchange Composite Tape on such date was $19,523,128,212. All executive officers and directors of the... -

Page 99

... Analysis of Financial Condition and Results of Operations included in Part II, Item 7 of this Form 10-K. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. In making these statements, we are not undertaking to address or update any risk factor... -

Page 100

... the world's largest quick service restaurant ("QSR") company based on number of system units, with more than 37,000 units in more than 110 countries and territories. Through the five concepts of KFC, Pizza Hut, Taco Bell, LJS and A&W (the "Concepts"), the Company develops, operates, franchises and... -

Page 101

..., the China Division recorded revenues of $4.1 billion and Operating Profit of $755 million. Restaurant Concepts Most restaurants in each Concept offer consumers the ability to dine in and/or carry out food. In addition, Taco Bell, KFC, LJS and A&W offer a drive-thru option in many stores. Pizza Hut... -

Page 102

..., the first franchise unit was opened. Today, Pizza Hut is the largest restaurant chain in the world specializing in the sale of ready-to-eat pizza products. As of year end 2010, Pizza Hut was the leader in the U.S. pizza QSR segment, with a 14 percent market share (Source: The NPD Group, Inc.; NPD... -

Page 103

... and sales volume of the restaurant. Most of the employees work on a part-time basis. Each Concept issues detailed manuals, which may then be customized to meet local regulations and customs, covering all aspects of restaurant operations, including food handling and product preparation procedures... -

Page 104

..., along with the representatives of the Company's KFC, Pizza Hut, Taco Bell, LJS and A&W franchisee groups, are members in the Unified FoodService Purchasing Co-op, LLC (the "Unified Co-op") which was created for the purpose of purchasing certain restaurant products and equipment in the U.S. The... -

Page 105

... in KFC, Pizza Hut, Taco Bell, LJS and A&W franchise and license agreements. Under current law and with proper use, the Company's rights in its marks can generally last indefinitely. The Company also has certain patents on restaurant equipment which, while valuable, are not material to its business... -

Page 106

...The Company's subsidiaries operate R&D facilities in Louisville, Kentucky (KFC); Dallas, Texas (Pizza Hut and YRI); and Irvine, California (Taco Bell) and in several locations outside the U.S., including Shanghai, China. The Company expensed $33 million, $31 million and $34 million in 2010, 2009 and... -

Page 107

... Financial Statements and footnotes in Part II, Item 8, pages 61 through 124. (e) Available Information The Company makes available through the Investor Relations section of its internet website at www.yum.com its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form... -

Page 108

... on our results of operations, financial condition or cash flows. We may not attain our target development goals and aggressive development could cannibalize existing sales. Our growth strategy depends in large part on our ability to increase our net restaurant count in markets outside the United... -

Page 109

... the financial or management resources that they need to open or continue operating the restaurants contemplated by their franchise agreements with us. In addition, franchisees may not be able to find suitable sites on which to develop new restaurants or negotiate acceptable lease or purchase terms... -

Page 110

...the percentage of Company ownership of KFCs, Pizza Huts, and Taco Bells in the U.S. from approximately 15% at the end of 2010 to approximately 12% by the end of 2011. Our ability to execute this plan will depend on, among other things, whether we receive fair offers for these restaurants, whether we... -

Page 111

... and consumer confidence. These and other macroeconomic factors could have an adverse effect on our sales mix, profitability or development plans, which could harm our financial condition and operating results. The impact of potentially limited credit availability on third party vendors such as our... -

Page 112

...industry in which we operate is highly competitive. The retail food industry in which we operate is highly competitive with respect to price and quality of food products, new product development, price, advertising levels and promotional initiatives, customer service, reputation, restaurant location... -

Page 113

...YUM leases office facilities for certain support groups in Louisville, Kentucky. The China Division leases their corporate headquarters and research facilities in Shanghai, China. Additional information about the Company's properties is included in the Consolidated Financial Statements and footnotes... -

Page 114

..., including, without limitation, marketing, operational standards, quality, service, and cleanliness issues, grants, transfers or terminations of franchise rights, territorial disputes and delinquent payments. Suppliers The Company purchases food, paper, equipment and other restaurant supplies from... -

Page 115

...Executive Officer Pizza Hut U.S. and YUM Innovation. He has served in this position since February 2011. Prior to this position, Mr. Bergren served as President and Chief Concept Officer of Pizza Hut, a position he held beginning in November 2006. Mr. Bergren served as Chief Marketing Officer of KFC... -

Page 116

... Operating and Development Officer - Designate from January 2008 until April 2008. From 2000 until January 2008, he was Senior Vice President/Managing Director of YUM Restaurants International South Pacific. Jing-Shyh S. Su, 58, is Vice-Chairman of the Board of YUM and Chairman and Chief Executive... -

Page 117

... Purchases of Equity Securities. The Company's Common Stock trades under the symbol YUM and is listed on the New York Stock Exchange ("NYSE"). The following sets forth the high and low NYSE composite closing sale prices by quarter for the Company's Common Stock and dividends per common share. 2010... -

Page 118

... 25, 2010 with respect to shares of Common Stock repurchased by the Company during the quarter then ended: Fiscal Periods Period 10 9/5/10 - 10/2/10 Period 11 10/3/10 - 10/30/10 Period 12 10/31/10 - 11/27/10 Period 13 11/28/10 - 12/25/10 Total Total number of shares purchased - Average price paid... -

Page 119

...Stock to the cumulative total return of the S&P 500 Stock Index and the S&P 500 Consumer Discretionary Sector, a peer group that includes YUM, for the period from December 30, 2005 to December 23, 2010, the last trading day of our 2010 fiscal year. The graph assumes that the value... 124 Form 10-K 22 -

Page 120

... shares of Common Stock Dividends paid on Common Stock Balance Sheet Total assets Long-term debt Total debt Other Data Number of stores at year end Company Unconsolidated Affiliates Franchisees Licensees System China Division system sales growth(f) Reported Local currency(g) YRI system sales... -

Page 121

... overall strength of our business as it incorporates all our revenue drivers, Company and franchise same store sales as well as net unit development. Same store sales growth includes the results of all restaurants that have been open one year or more. Local currency represents the percentage change... -

Page 122

.... Description of Business YUM is the world's largest restaurant company in terms of system restaurants with over 37,000 restaurants in more than 110 countries and territories operating under the KFC, Pizza Hut, Taco Bell, Long John Silver's or A&W All-American Food Restaurants brands. Four of... -

Page 123

... retail developers in terms of units opened. The Company expects to continue to experience strong growth by building out existing markets and growing in new markets including France, Russia and India. The International Division's Operating Profit has experienced an 8 year compound annual growth rate... -

Page 124

...QSR") industry. The Company's dividend and share repurchase programs have returned over $1.6 billion and $6 billion to shareholders, respectively, since 2004. The Company is targeting an annual dividend payout ratio of 35% to 40% of net income and has increased the quarterly dividend each year since... -

Page 125

... operating profit grew 15%, prior to foreign currency translation, including 26% in China, 11% in YRI, and 3% in the U.S. Increased the quarterly dividend by 19% in the third quarter and repurchased 9.8 million shares totaling $390 million at an average price of $40 over the course of the year... -

Page 126

... Amount 2010 Company sales Franchise and license fees and income Total revenues Company restaurant profit % of Company sales Operating Profit Interest expense, net Income tax provision Net Income - including noncontrolling interest Net Income - noncontrolling interest Net Income - YUM! Brands, Inc... -

Page 127

... in China Losses as a result of refranchising equity markets outside the U.S. Depreciation reduction from KFC restaurants impaired upon offer to sell Gain upon the sale of our interest in our Japan unconsolidated affiliate Total Special Items Income (Expense) Tax Benefit (Expense) on Special Items... -

Page 128

... income tax benefit, in the fourth quarter of 2009 to write-off goodwill associated with these businesses. Additionally, the Company recognized a reduction to Franchise and license fees and income of $32 million, pre-tax, in the year ended December 26, 2009, related to investments in our U.S. Brands... -

Page 129

... Outside the U.S. In the fourth quarter of 2010 we recorded a $52 million loss on the refranchising of our Mexico equity market as we sold all of our company operated restaurants, comprised of 222 KFCs and 123 Pizza Huts, to an existing Latin American franchise partner. The buyer will also serve as... -

Page 130

... Statements of Income. For the year ended December 25, 2010 the consolidation of the existing restaurants upon acquisition increased Company sales by $98 million, decreased Franchise and license fees and income by $6 million and positively impacted Operating Profit by $3 million. For the year... -

Page 131

...Total revenues and on Operating Profit from stores that were operated by us for all or some portion of the respective previous year and were no longer operated by us as of the last day of the respective current year. In these tables, Decreased Company sales and Decreased Restaurant profit represents... -

Page 132

...Decreased Company sales Increased Franchise and license fees and income Decrease in Total revenues $ $ $ $ Worldwide (722) $ 41 $ (681) The following table summarizes the impact of refranchising on Operating Profit as described above: 2010 China Division YRI U.S. (44) Decreased Restaurant profit... -

Page 133

... On June 23, 2010, the Company received a Revenue Agent Report ("RAR") from the Internal Revenue Service (the "IRS") relating to its examination of our U.S. federal income tax returns for fiscal years 2004 through 2006. The IRS has proposed an adjustment to increase the taxable value of rights to... -

Page 134

... Licensees(a) 3,013 509 - - (70) 1 3,453 507 - - China Division (c) Balance at end of 2008 New Builds Acquisitions Refranchising Closures Other (b) Balance at end of 2009 New Builds Acquisitions Refranchising Closures Other Balance at end of 2010 % of Total Company 2,272 427 - (11) (59) 237 2,866... -

Page 135

... a change in our management reporting structure. The International Division ending balances for 2008 and 2009 now include 393 and 444 Company units, respectively and 176 and 158 Franchisee units, respectively, in Thailand and KFC Taiwan with the offset to the China Division ending balances. Form 10... -

Page 136

... tables detail the key drivers of system sales growth for each reportable segment by year. Net unit growth represents the net impact of actual system sales growth due to new unit openings and historical system sales lost due to closures as well as any necessary rounding. 2010 vs. 2009 China Division... -

Page 137

... $16 million from our brands' participation in the World Expo during 2010. This benefit will not occur in 2011. Form 10-K In 2009, the increase in China Division Company sales and Restaurant profit associated with store portfolio actions was primarily driven by the development of new units and the... -

Page 138

.... Another significant factor impacting Restaurant profit during the year was labor inflation. Company same store sales were flat for the year. In 2009, the increase in YRI Company sales and Restaurant profit associated with store portfolio actions was driven by new unit development partially offset... -

Page 139

... portfolio actions was primarily driven by refranchising. Significant other factors impacting Company sales and/or Restaurant profit were Company same store sales decline of 4%, commodity deflation of $28 million (primarily cheese), and cost savings associated with productivity initiatives. Form 10... -

Page 140

... by 10% and 19%, respectively, related to the acquisition of additional interest in, and consolidation of, an entity that operated the KFCs in Shanghai, China during 2009. See Note 4. U.S. Franchise and license fees and income for 2010 and 2009 was positively impacted by 3% and 5%, respectively, due... -

Page 141

... 7% in 2010. The decrease was driven by lower provision for U.S. past due receivables (primarily at KFC and Pizza Hut) and lapping 2009 international franchise convention costs. Franchise and license expenses increased 19% in 2009. The increase was driven by quality control initiatives, increased... -

Page 142

... and Impairment Expenses and Refranchising (Gain) Loss See the Store Portfolio Strategy section for more detail of our refranchising activity and Notes 4 and 9 for a summary of the components of facility actions and goodwill impairments by reportable operating segment, respectively. Form 10-K 45 -

Page 143

... driven by the impact of same store sales growth and new unit development, partially offset by higher G&A costs. Operating profit benefited $16 million from our brands' participation in the World Expo during 2010. China Division Operating Profit increased 26% in 2009, including a 2%, or $10 million... -

Page 144

... of our Company operated KFC restaurants in the U.S. and a non-cash loss of $52 million related to the sale of our Mexico equity business, offset by U.S. gains for restaurants sold at Pizza Hut and Taco Bell. See Note 4 for further discussion. Interest Expense, Net 2010 195 (20) 175 2009 212 (18... -

Page 145

... dividends that were only partially offset by related foreign tax credits generated during the year. In 2008, the benefit was positively impacted by the recognition of deferred tax assets for the net operating losses generated by tax planning actions implemented in 2008 (1.7 percentage points). In... -

Page 146

... no related income tax benefit. Consolidated Cash Flows Net cash provided by operating activities was $1,968 million compared to $1,404 million in 2009. The increase was primarily driven by higher operating profit before special items and decreased pension contributions. In 2009, net cash provided... -

Page 147

... April 2011. Our China Division and YRI represented more than 65% of the Company's operating profit in 2010 (excluding Corporate and unallocated income and expenses) and both generate a significant amount of positive cash flows that we have historically used to fund our international development. To... -

Page 148

... 19, 2010 our Board of Directors approved cash dividends of $0.25 per share of Common Stock to be distributed on February 4, 2011 to shareholders of record at the close of business on January 14, 2011. The Company is targeting an ongoing annual dividend payout ratio of 35% - 40% of net income... -

Page 149

... are cancelable without penalty. Purchase obligations relate primarily to information technology, marketing, commodity agreements, purchases of property, plant and equipment as well as consulting, maintenance and other agreements. Other consists of 2011 pension plan funding obligations and projected... -

Page 150

...of our recorded liability for self-insured employee healthcare, long-term disability and property and casualty losses represents estimated reserves for incurred claims that have yet to be filed or settled. Off-Balance Sheet Arrangements We have agreed to provide financial support, if required, to an... -

Page 151

...in the fair value calculations is our estimate of the required rate of return that a franchisee would expect to receive when purchasing a similar restaurant or groups of restaurants and the related long-lived assets. The discount rate incorporates rates of returns for historical refranchising market... -

Page 152

... YRI business units (typically individual countries) and our China Division brands. Fair value is the price a willing buyer would pay for the reporting unit, and is generally estimated using discounted expected future after-tax cash flows from company operations and franchise royalties. Future cash... -

Page 153

...During 2010, the Company's reporting units with the most significant refranchising activity and recorded goodwill were our Taiwan business unit and our Pizza Hut-U.S. operating segment. Within our Taiwan business unit, 124 restaurants were refranchised (representing 100% of beginning of year company... -

Page 154

...long-term rates of return on plan assets also impacts our pension expense. Our estimated long-term rate of return on U.S. plan assets represents the weighted-average of historical returns for each asset category, adjusted for an assessment of current market conditions. Our expected long-term rate of... -

Page 155

The losses our U.S. plan assets have experienced, along with a decrease in discount rates over time, have largely contributed to an unrecognized pre-tax net loss of $363 million included in Accumulated other comprehensive income (loss) for the U.S. plans at December 25, 2010. For purposes of ... -

Page 156

... of future taxable income in these jurisdictions and our resulting ability to utilize net operating loss and tax credit carryforward benefits can significantly change based on future events, including our determinations as to the feasibility of certain tax planning strategies. Thus, recorded... -

Page 157

... and using discount rates appropriate for the duration. Foreign Currency Exchange Rate Risk The combined International Division and China Division Operating Profits constitute more than 65% of our Operating Profit in 2010, excluding unallocated income (expenses). In addition, the Company's net asset... -

Page 158

... Data. INDEX TO FINANCIAL INFORMATION Page Reference Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Consolidated Statements of Income for the fiscal years ended December 25, 2010, December 26, 2009 and December 27, 2008 Consolidated Statements of Cash... -

Page 159

... Registered Public Accounting Firm The Board of Directors and Shareholders YUM! Brands, Inc. We have audited the accompanying consolidated balance sheets of YUM! Brands, Inc. and Subsidiaries (YUM) as of December 25, 2010 and December 26, 2009, and the related consolidated statements of income, cash... -

Page 160

... per share data) 2010 2009 Revenues Company sales $ 9,783 $ 9,413 Franchise and license fees and income 1,560 1,423 Total revenues 11,343 10,836 Costs and Expenses, Net Company restaurants Food and paper Payroll and employee benefits Occupancy and other operating expenses Company restaurant expenses... -

Page 161

... months or less, net Repurchase shares of Common Stock Excess tax benefit from share-based compensation Employee stock option proceeds Dividends paid on Common Stock Other, net Net Cash Used in Financing Activities Effect of Exchange Rates on Cash and Cash Equivalents Net Increase (Decrease) in Cash... -

Page 162

... liabilities Income taxes payable Short-term borrowings Advertising cooperative liabilities Total Current Liabilities Long-term debt Other liabilities and deferred credits Total Liabilities Shareholders' Equity Common Stock, no par value, 750 shares authorized; 469 shares issued in 2010 and 2009... -

Page 163

... shares of Common Stock Employee stock option and SARs exercises (includes tax impact of $40 million) Compensation-related events (includes tax impact of $6 million) Balance at December 27, 2008 Net Income Foreign currency translation adjustment Pension and post-retirement benefit plans (net of tax... -

Page 164

... concept we have developed. YUM consists of six operating segments: KFC-U.S., Pizza Hut-U.S., Taco Bell-U.S., LJS/A&W-U.S., YUM Restaurants International ("YRI" or "International Division") and YUM Restaurants China ("China Division"). For financial reporting purposes, management considers the four... -

Page 165

... the KFCs in Beijing, China that was previously accounted for using the equity method. Additionally, in the second quarter of 2009 we began consolidating the entity that operates the KFCs in Shanghai, China, which was previously accounted for using the equity method. The increases in cash related to... -

Page 166

... Financial Statements and Notes thereto for prior periods to be comparable with the classification for the fiscal year ended December 25, 2010. These reclassifications had no effect on previously reported Net Income - YUM! Brands, Inc. Franchise and License Operations. We execute franchise... -

Page 167

... certain other direct incremental franchise and license support costs. Revenue Recognition. Revenues from Company operated restaurants are recognized when payment is tendered at the time of sale. The Company presents sales net of sales tax and other sales related taxes. Income from our franchisees... -

Page 168

... to its estimated fair value, which becomes its new cost basis. Fair value is an estimate of the price a franchisee would pay for the restaurant and its related assets and is determined by discounting the estimated future after-tax cash flows of the restaurant. The after-tax cash flows incorporate... -

Page 169

... sell assets, primarily land, associated with a closed store, any gain or loss upon that sale is also recorded in Closures and impairment (income) expenses. Considerable management judgment is necessary to estimate future cash flows, including cash flows from continuing use, terminal value, sublease... -

Page 170

...agreements. Trade receivables consisting of royalties from franchisees and licensees are generally due within 30 days of the period in which the corresponding sales occur and are classified as Accounts and notes receivable on our Consolidated Balance Sheets. Our provision for uncollectible franchise... -

Page 171

... value with its carrying value. Fair value is the price a willing buyer would pay for a reporting unit, and is generally estimated using discounted expected future after-tax cash flows from Company operations and franchise royalties. The discount rate is our estimate of the required rate of return... -

Page 172

... of the price a willing buyer would pay for the intangible asset based on discounted expected future after-tax cash flows. For purposes of our impairment analysis, we update the cash flows that were initially used to value the definite-lived intangible asset to reflect our current estimates and... -

Page 173

...future salary increases, as applicable. The difference between the projected benefit obligation and the fair value of assets that has not previously been recognized as expense is recorded as a component of Accumulated other comprehensive income (loss). Note 3 - Earnings Per Common Share ("EPS") 2010... -

Page 174

... 404 restaurants sold and non-cash impairment charges related to our offers to refranchise restaurants in the U.S., principally a substantial portion of our Company operated KFC restaurants. In connection with our G&A productivity initiatives and realignment of resources we recorded pre-tax charges... -

Page 175

... Sheep Group Limited ("Little Sheep") and obtain Board of Directors representation. We began reporting our investment in Little Sheep using the equity method of accounting and this investment is included in Investments in unconsolidated affiliates on our Consolidated Balance Sheets. Equity income... -

Page 176

... the equity method of accounting. Net income attributable to our partner's ownership percentage is recorded in Net Income - noncontrolling interest. For the years ended December 25, 2010 and December 26, 2009, the consolidation of the existing restaurants upon acquisition increased Company sales by... -

Page 177

... Actions Refranchising (gain) loss, Store closure (income) costs and Store impairment charges by reportable segment are as follows: 2010 China Division $ (8) $ $ - 16 16 YRI 53 2 12 14 U.S. 18 3 14 17 Worldwide 63 5 42 47 Refranchising (gain) loss(a) (b) (c) Store closure (income) costs(d) Store... -

Page 178

... on the sales price we would expect to receive from a franchisee for each restaurant group. This fair value determination considered current market conditions, real-estate values, trends in the KFC-U.S. business, prices for similar transactions in the restaurant industry and preliminary offers for... -

Page 179

(c) In the fourth quarter of 2010 we recorded a $52 million loss on the refranchising of our Mexico equity market as we sold all of our company owned restaurants, comprised of 222 KFCs and 123 Pizza Huts, to an existing Latin American franchise partner. The buyer will also serve as the master ... -

Page 180

... 2009 total $23 million and $32 million, respectively, of U.S. property, plant and equipment and are included in prepaid expenses and other current assets in our Consolidated Balance Sheets. Note 5 - Supplemental Cash Flow Data 2010 Cash Paid For: Interest Income taxes Significant Non-Cash Investing... -

Page 181

... Balance Sheet Information Prepaid Expenses and Other Current Assets Income tax receivable Other prepaid expenses and current assets 2010 115 154 269 2010 542 3,709 274 2,578 7,103 (3,273) 3,830 2009 158 156 314 2009 538 3,800 282 2,627 7,247 (3,348) 3,899 $ $ $ $ Property, Plant and Equipment... -

Page 182

... Pizza Hut South Korea reporting unit in the fourth quarter of 2009 as the carrying value of this reporting unit exceeded its fair value. The fair value of this reporting unit was based on the discounted expected after-tax cash flows from company operations and franchise royalties for the business... -

Page 183

... translation on existing balances and goodwill write-offs associated with refranchising. We recorded goodwill in our International segment related to the July 1, 2010 exercise of our option with our Russian partner to purchase their interest in the co-branded Rostik's-KFC restaurants across Russia... -

Page 184

...the Alternate Base Rate, as applicable, depends on our performance under specified financial criteria. Interest on any outstanding borrowings under the Credit Facility is payable at least quarterly. We also have a $350 million, syndicated revolving credit facility (the "International Credit Facility... -

Page 185

... the Company's balance sheet and cash flows we were able to comply with all debt covenant requirements at December 25, 2010 with a considerable amount of cushion. The majority of our remaining long-term debt primarily comprises Senior Unsecured Notes with varying maturity dates from 2011 through... -

Page 186

... for headquarters and support functions, as well as certain office and restaurant equipment. We do not consider any of these individual leases material to our operations. Most leases require us to pay related executory costs, which include property taxes, maintenance and insurance. Form 10-K 89 -

Page 187

... with direct financing lease receivables was $50 million and $61 million, respectively. The details of rental expense and income are set forth below: 2010 Rental expense Minimum Contingent Minimum rental income $ $ $ 565 158 723 44 $ $ $ 2009 541 123 664 38 $ $ $ 2008 531 113 644 28 Form 10... -

Page 188

... designated as hedging instruments for the years ended December 25, 2010 and December 26, 2009 were: Fair Value Interest Rate Swaps - Asset Interest Rate Swaps - Asset Foreign Currency Forwards - Asset Foreign Currency Forwards - Liability Total 2010 $ 8 2009 $ - Consolidated Balance Sheet Location... -

Page 189

... are used to offset fluctuations in deferred compensation liabilities that employees have chosen to invest in phantom shares of a Stock Index Fund or Bond Index Fund. The other investments are classified as trading securities and their fair value is determined based on the closing market prices of... -

Page 190

...for our Pizza Hut South Korea and LJS/A&W-U.S. reporting units, which are discussed in Note 9. These impairment charges were recorded in Closures and impairment (income) expenses in the Consolidated Statements of Income. At December 25, 2010 the carrying values of cash and cash equivalents, accounts... -

Page 191

... Plan amendments Curtailment gain Settlement loss Special termination benefits Exchange rate changes Benefits paid Settlement payments Actuarial (gain) loss Benefit obligation at end of year Change in plan assets Fair value of plan assets at beginning of year Actual return on plan assets Employer... -

Page 192

... net loss Prior service cost The accumulated benefit obligation for the U.S. and International pension plans was $1,212 million and $1,105 million at December 25, 2010 and December 26, 2009, respectively. Information for pension plans with an accumulated benefit obligation in excess of plan assets... -

Page 193

... period of employees expected to receive benefits. Settlement loss results from benefit payments from a non-funded plan exceeding the sum of the service cost and interest cost for that plan during the year. Special termination benefits primarily related to the U.S. business transformation measures... -

Page 194

...long-term rate of return on plan assets represents the weighted-average of expected future returns on the asset categories included in our target investment allocation based primarily on the historical returns for each asset category, adjusted for an assessment of current market conditions. Form 10... -

Page 195

... of total pension plan assets at the 2010 measurement date, are to reduce interest rate and market risk and to provide adequate liquidity to meet immediate and future payment requirements. To achieve these objectives, we are using a combination of active and passive investment strategies. Our equity... -

Page 196

... International Pension Plans $ 2 2 2 2 2 11 Year ended: 2011 2012 2013 2014 2015 2016 - 2020 Expected benefits are estimated based on the same assumptions used to measure our benefit obligation on the measurement date and include benefits attributable to estimated further employee service. Form... -

Page 197

... 2009 and 2008. Note 15 - Share-based and Deferred Compensation Plans Overview At year end 2010, we had four stock award plans in effect: the YUM! Brands, Inc. Long-Term Incentive Plan and the 1997 Long-Term Incentive Plan (collectively the "LTIPs"), the YUM! Brands, Inc. Restaurant General Manager... -

Page 198

... no longer than ten years after grant. At year end 2010, approximately 21 million shares were available for future share-based compensation grants under the above plans. Our Executive Income Deferral ("EID") Plan allows participants to defer receipt of a portion of their annual salary and all or... -

Page 199

... volatility of our stock as well as implied volatility associated with our traded options. The expected dividend yield is based on the annual dividend yield at the time of grant. The fair values of RSU and PSU awards are based on the closing price of our stock on the date of grant. Form 10-K 102 -

Page 200

... 2 years. The total fair value at grant date of awards vested during 2010, 2009 and 2008 was $47 million, $52 million and $54 million, respectively. RSUs and PSUs As of December 25, 2010, there was $12 million of unrecognized compensation cost related to 1.7 million unvested RSUs and PSUs. Form 10... -

Page 201

... share-based compensation expense and the related income tax benefits are shown in the following table: 2010 $ 40 5 2 47 13 $ 4 2009 $ 48 7 1 56 17 $ 4 2008 $ 51 8 - 59 18 $ 4 Options and SARs Restricted Stock Units Performance Share Units Total Share-based Compensation Expense Deferred Tax Benefit... -

Page 202

... are recorded directly to Shareholders' Equity. The following table gives further detail regarding the composition of accumulated other comprehensive loss at December 25, 2010 and December 26, 2009. Refer to Note 14 for additional information about our pension and post-retirement plan accounting and... -

Page 203

... local taxes, withholding taxes, and shareholder-level taxes, net of foreign tax credits. The favorable impact is primarily attributable to a majority of our income being earned outside of the U.S. where tax rates are generally lower than the U.S. rate. Form 10-K In 2010, the benefit was positively... -

Page 204

... recorded against deferred tax assets generated during the year, including a full valuation allowance provided on deferred tax assets for net operating losses generated by tax planning actions as we did not believe it was more likely than not that they would be realized in the future. This increase... -

Page 205

... below: 2010 220 158 102 50 166 130 82 908 (191) 717 (243) (104) (14) (361) 356 2009 222 148 106 59 157 99 59 850 (187) 663 (240) (118) (46) (404) 259 Net operating loss and tax credit carryforwards Employee benefits Share-based compensation Self-insured casualty claims Lease related liabilities... -

Page 206

... tax rate. The Company's income tax returns are subject to examination in the U.S. federal jurisdiction and numerous foreign jurisdictions. The following table summarizes our major jurisdictions and the tax years that are either currently under audit or remain open and subject to examination: Form... -

Page 207

... of its Income tax provision. On June 23, 2010, the Company received a Revenue Agent Report ("RAR") from the Internal Revenue Service (the "IRS") relating to its examination of our U.S. federal income tax returns for fiscal years 2004 through 2006. The IRS has proposed an adjustment to increase the... -

Page 208

..., 21, 4 and 9 countries and territories, respectively. Our five largest international markets based on operating profit in 2010 are China, Asia Franchise, Australia, United Kingdom, and Latin America Franchise. We identify our operating segments based on management responsibility. The China Division... -

Page 209

...purposes. Includes equity income from investments in unconsolidated affiliates of $42 million, $36 million and $40 million in 2010, 2009 and 2008, respectively, for the China Division. 2010 includes a $9 million depreciation reduction arising from the impairment of KFC restaurants we offered to sell... -

Page 210

...The 2009 increase was driven by our acquisition of interest in Little Sheep, net of our acquisition of additional interest in and consolidation of our unconsolidated affiliate in Shanghai, China. See Note 4. Primarily includes cash, deferred tax assets and property, plant and equipment, net, related... -

Page 211

Franchise Loan Pool and Equipment Guarantees We have agreed to provide financial support, if required, to a variable interest entity that operates a franchisee lending program used primarily to assist franchisees in the development of new restaurants and, to a lesser extent, in connection with the ... -

Page 212

... estimates, it is reasonably possible that we could experience changes in estimated losses which could be material to our growth in quarterly and annual Net income. We believe that we have recorded reserves for property and casualty losses at a level which has substantially mitigated the potential... -

Page 213

... restitution from LJS employees, including Restaurant General Managers ("RGMs") and Assistant Restaurant General Managers ("ARGMs"), when monetary or property losses occurred due to knowing and willful violations of LJS policies that resulted in losses of company funds or property, and that LJS... -

Page 214

...of all hourly employees who have worked at corporate-owned restaurants in California since September 2003 and alleges numerous violations of California labor laws including unpaid overtime, failure to pay wages on termination, denial of meal and rest breaks, improper wage statements, unpaid business... -

Page 215

...Taco Bell crew member, alleges that Taco Bell failed to timely pay her final wages upon termination, and seeks restitution and late payment penalties on behalf of herself and similarly situated employees. This case appears to be duplicative of the In Re Taco Bell Wage and Hour Actions case described... -

Page 216

...the applicable standard for employer provision of meal and rest breaks. Plaintiff filed an opposition to that motion on November 19, 2010. On January 14, 2011, the District Court granted KFC's motion and stayed the entire action pending a decision from the California Supreme Court. No trial date has... -

Page 217

... approximately 220 company-owned restaurants in California accessible to the class. Plaintiffs contend that queue rails and other architectural and structural elements of the Taco Bell restaurants relating to the path of travel and use of the facilities by persons with mobility-related disabilities... -

Page 218

... and did not receive compensation for all hours worked and did not receive overtime pay after 40 hours in a week. The plaintiff also purports to represent a separate class of Colorado assistant managers under Colorado state law, which provides for daily overtime after 12 hours in a day. Yum has been... -

Page 219

... Selected Quarterly Financial Data (Unaudited) 2010 Third Quarter $ 2,496 366 2,862 479 544 357 0.76 0.74 - First Quarter Revenues: Company sales Franchise and license fees and income Total revenues Restaurant profit Operating Profit(a) Net Income - YUM! Brands, Inc. Basic earnings per common share... -

Page 220

... Food Restaurants brands for sale and began the process to identify a buyer. In the first quarter of 2011, we anticipate that we will recognize a non-cash pre-tax impairment loss in Special Items as a result of our decision to sell. The amount of the expected pre-tax loss as well as the related tax... -

Page 221

... with accounting principles generally accepted in the United States of America and include certain amounts based upon our estimates and assumptions, as required. Other financial information presented in the annual report is derived from the financial statements. We maintain a system of internal... -

Page 222

... is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) under the Securities Exchange Act of 1934. Under the supervision and with the participation of our management, including our principal executive officer and... -

Page 223

... proxy statement which will be filed with the Securities and Exchange Commission no later than 120 days after December 25, 2010. Information regarding executive officers of the Company is included in Part I. Item 11. Executive Compensation. Information regarding executive and director compensation... -

Page 224

...(a) (1) Exhibits and Financial Statement Schedules. Financial Statements: Consolidated financial statements filed as part of this report are listed under Part II, Item 8 of this Form 10-K. Financial Statement Schedules: No schedules are required because either the required information is not present... -

Page 225

... duly caused this Form 10-K annual report to be signed on its behalf by the undersigned, thereunto duly authorized. Date: February 14, 2011 YUM! BRANDS, INC. By: /s/ David C. Novak Pursuant to the requirements of the Securities Exchange Act of 1934, this annual report has been signed below by the... -

Page 226

... S. Su Jing-Shyh S. Su /s/ Robert D. Walter Robert D. Walter Director February 14, 2011 Director February 14, 2011 Director February 14, 2011 Director February 14, 2011 Director February 14, 2011 Vice-Chairman of the Board February 14, 2011 Director February 14, 2011 Form 10-K 129 -

Page 227

... by reference from Exhibit 3.1 to YUM's Annual Report on Form 10-K for the fiscal year ended December 27, 2008. Amended and restated Bylaws of YUM, which are incorporated herein by reference from Exhibit 3.1 on Form 8-K filed on November 23, 2009. Indenture, dated as of May 1, 1998, between YUM... -

Page 228

...'s Annual Report on Form 10-K for the fiscal year ended December 31, 2005. YUM! Brands Executive Income Deferral Program, Plan Document for the 409A Program, as effective January 1, 2005, and as Amended through June 30, 2009, which is incorporated by reference from Exhibit 10.10.1 to YUM's Quarterly... -

Page 229

...op Agreement, dated as of August 26, 2002, between YUM and the Unified FoodService Purchasing Co-op, LLC, which is incorporated herein by reference from Exhibit 10.20 to YUM's Annual Report on Form 10-K for the fiscal year ended December 28, 2002. YUM Restaurant General Manager Stock Option Plan, as... -

Page 230

...! Brands Supplemental Long Term Disability Coverage Summary, as effective January 1, 2010, which is incorporated by reference from Exhibit 10.26 to YUM's Annual Report on Form 10-K for the fiscal year ended December 26, 2009. 1999 Long Term Incentive Plan Award (Restricted Stock Unit Agreement) by... -

Page 231

...Chief Financial Officer pursuant to Rule 13a-14(a) of Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Certification of the Chairman, Chief Executive Officer...the XBRL-related information in Exhibit 101 to this Annual Report on this Form 10-K shall... -

Page 232

... online at the Web site of American Stock Transfer & Trust (''AST''): www.amstock.com. • Access account balance and other general account information • Change an account's mailing address • View a detailed list of holdings represented by certificates and the identifying certificate numbers... -

Page 233

... requirements of the NYSE, the world's leading equities market. Franchise Inquiries DOMESTIC FRANCHISING INQUIRY PHONE LINE (866) 2YUMYUM (298-6986) INTERNATIONAL FRANCHISING INQUIRY PHONE LINE (972) 338-7780 ONLINE FRANCHISE INFORMATION http://www.yumfranchises.com/ Yum! Brands' Annual Report... -

Page 234

Yum! brands, Inc. 2010 annual customer manIa report -

Page 235

... 55 Chief Executive Officer, Yum! Restaurants International Scott O. Bergren 64 Chief Executive Officer, Pizza Hut U.S. and Yum! Innovation, Yum! Brands, Inc. Jonathan D. Blum 52 Senior Vice President, Chief Public Affairs Officer, Yum! Brands, Inc. Emil J. Brolick 63 Chief Operating Officer, Yum... -

Page 236

Alone we're delicious. Together we're Yum! ® www.yum.com/annualreport Yum! Brands, Inc., trades under the symbol YUM and is proud to meet the listing requirements of the NYSE, the world's leading equities market.