OfficeMax 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

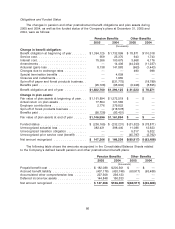

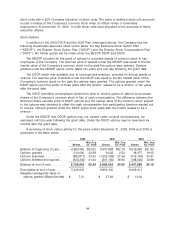

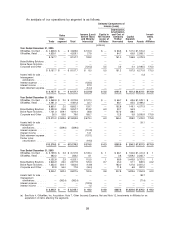

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss includes the following:

Minimum Foreign Accumulated

Pension Currency Cash Other

Liability Translation Flow Comprehensive

Adjustment Adjustment Hedges Loss

(thousands)

Balance at December 31, 2003, net of

taxes ......................... $(255,150) $61,491 $(159) $ (193,818)

Current-period changes, before taxes . . . 32,117 29,933 261 62,311

Income taxes .................... (13,090) — (102) (13,192)

Balance at December 31, 2004, net of

taxes ......................... (236,123) 91,424 $ — (144,699)

Current-period changes, before taxes . . . 14,099 (6,037) — 8,062

Income taxes .................... (5,484) — — (5,484)

Balance at December 31, 2005, net of

taxes ......................... $(227,508) $85,387 $ — $(142,121)

2003 Director Stock Compensation Plan and OfficeMax Incentive and Performance Plan

In February 2003, the Company’s Board of Directors adopted the 2003 Director Stock

Compensation Plan (the ‘‘2003 DSCP’’) and the 2003 OfficeMax Incentive and Performance Plan

(the ‘‘2003 Plan’’), formerly named the 2003 Boise Incentive and Performance Plan, which were

approved by shareholders in April 2003.

The 2003 DSCP replaces the previous Director Stock Compensation Plan, which was approved

by shareholders in 1992 and expired on January 1, 2003. A total of 73,046 shares of common stock

is reserved for issuance under the 2003 DSCP. The provisions of the 2003 DSCP are substantially

similar to the previous plan. The 2003 DSCP permits nonemployee directors to elect to receive

grants of options to purchase shares of the Company’s common stock in lieu of cash

compensation. The difference between the $2.50-per-share exercise price of 2003 DSCP options

and the market value of the common stock subject to the options is intended to offset the cash

compensation that participating directors elect not to receive. Options expire three years after the

holder ceases to be a director.

The 2003 Plan was effective January 1, 2003, and replaces the Key Executive Performance

Plan for Executive Officers, Key Executive Performance Plan for Key Executives/Key Managers, 1984

Key Executive Stock Option Plan (‘‘KESOP’’), Key Executive Performance Unit Plan (‘‘KEPUP’’) and

Director Stock Option Plan (‘‘DSOP’’), which are discussed below. No further grants or awards have

been made under the Key Executive Performance Plans, KESOP, KEPUP, or DSOP since 2003. A

total of 5,726,239 shares of common stock is reserved for issuance under the 2003 Plan. The

Company’s executive officers, key employees and nonemployee directors are eligible to receive

awards under the 2003 Plan at the discretion of the Executive Compensation Committee of the

Board of Directors. Eight types of awards may be granted under the 2003 Plan, including stock

options, stock appreciation rights, restricted stock, restricted stock units, performance units,

performance shares, annual incentive awards and stock bonus awards.

92