OfficeMax 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2005 Compared With 2004

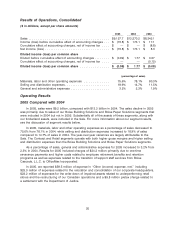

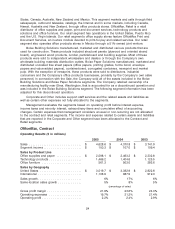

In 2005, our Contract segment had sales of $4.6 billion, up 6% from $4.4 billion in 2004.

Year-over-year same-location sales increased 5%

E-commerce sales for 2005 increased 18% over 2004. E-commerce sales represented 56% of

the Contract segment’s total sales during 2005 compared to 50% of the Contract segment’s total

sales during 2004.

Our Contract segment gross profit margin for 2005 was 21.9% of sales, a decrease of 1.7% of

sales compared with 2004. The decrease in gross profit margin resulted from higher delivery costs

due to increased energy prices and changes to product mix as our Contract segment sales have

shifted more towards technology and paper products which have lower gross margins than office

supplies. The lower gross profit margin in our Contract segment also reflects a more competitive

pricing environment for large U.S. contract customers and weaker gross profit margins in our

international operations.

In 2005, operating expenses as a percentage of sales decreased 1.5% of sales to 19.7% of

sales. Included in operating expenses for 2005 is the impact of a $9.8 million settlement with the

Department of Justice and a $5.4 million charge related to the restructuring of international

operations. Excluding the impact of these charges, operating expenses improved as a percentage

of sales due to lower promotion and marketing costs, as well as reduced payroll and integration

expenses due in part to the continued consolidation of our delivery center network. These savings

were partially offset by our investment to expand our middle market sales force.

Contract segment operating income was $100.3 million, or 2.2% of sales, in 2005, down from

$107.0 million in 2004. Excluding the $9.8 million charge related to our settlement with the

Department of Justice and the $5.4 million charge related to the restructuring of international

operations, segment income increased $8.5 million from the prior year. The increase was

attributable to higher sales, lower promotion and marketing costs, and reduced payroll and

integration expenses due in part to the continued consolidation of our delivery center network,

partially offset by weaker results in Canada, lower gross margins in the U.S. and the impact of our

investment to expand our middle market sales force.

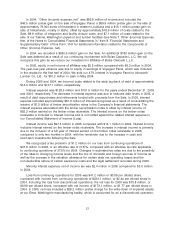

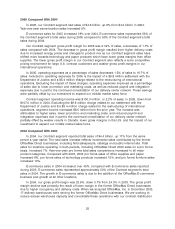

2004 Compared With 2003

In 2004, our Contract segment reported total sales of $4.4 billion, up 17% from the same

period a year earlier. The total sales increase reflects incremental sales contributed by the former

OfficeMax Direct businesses, including field salespeople, catalogs and public Internet site. Total

sales for locations operating in both periods, including OfficeMax Direct 2003 sales on a pro forma

basis, increased 7%. Year-over-year pro forma total sales comparisons increased in all major

product categories. Compared with 2003, 2004 pro forma sales of office supplies and paper

increased 6%, pro forma sales of technology products increased 10%, and pro forma furniture sales

increased 10%.

E-commerce sales in 2004 increased over 40%, compared with E-commerce sales reported

during 2003. E-commerce sales represented approximately 50% of the Contract segment’s total

sales in 2004. The growth in E-commerce sales is due to the addition of the OfficeMax E-commerce

business and growth at all other locations.

In 2004, our gross profit margin was 23.6%, down 0.7% from 24.3% in 2003. The gross profit

margin decline was primarily the result of lower margin in the former OfficeMax Direct businesses

due to higher occupancy and delivery costs. When we acquired OfficeMax, Inc. in December 2003,

17 delivery warehouses were serving the former OfficeMax Direct businesses. We are working to

reduce excess warehouse capacity and consolidate these operations with our contract distribution

25