OfficeMax 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Contract Initiatives

We have has also identified several programs for improving growth and efficiency in our

Contract operations. These include continuing to focus on the middle-market and other

high-growth, high-return customers; pursuing product extension opportunities; driving Retail sales

through Contract customers; completing an evaluation of our Canadian operations; and

implementing system-wide cost efficiencies.

Other

As part of our Turnaround Plan for Higher Performance, we are also ceasing operations at the

Company’s wood-polymer building materials facility near Elma, Washington which is reflected as a

discontinued operation in the Consolidated Financial Statements. The estimated pretax costs and

expenses to exit this business total approximately $41 million, including $24 million of asset

write-offs and impairment, $11 million of lease and contract termination costs and $6 million of

other closure and exit costs, including severance. In connection with the decision to cease

operations at the facility, we completed an assessment of the recoverability of the related long-lived

assets and recorded a $28.2 million pretax charge in 2005 that included asset write-off and

impairment and other closure costs.

On September 29, 2005, we announced that Naperville, Illinois was selected as the location for

our new consolidated corporate headquarters. We also announced that our retail headquarters in

Shaker Heights, Ohio and our existing corporate headquarters in Itasca, Illinois would move into the

new corporate headquarters. The relocation and consolidation process is expected to be completed

during the latter half of 2006. We expect that this headquarters consolidation will improve

operational efficiencies, enhance collaboration among departments, and reduce costs over time.

Management expects the total cost of the relocation and consolidation will be $40 to $50 million on

a pre-tax basis. The Company recorded charges of $25 million during the third and fourth quarters

of 2005 related to the headquarters relocation and consolidation.

Sale of Paper, Forest Products and Timberland Assets

On October 29, 2004, we completed the sale of our paper, forest products and timberland

assets to affiliates of Boise Cascade, L.L.C., a new company formed by Madison Dearborn Partners

LLC (the ‘‘Sale’’). The Sale did not include our facility near Elma, Washington. The Sale completes

the company’s transition, begun in the mid-1990s, from a predominantly manufacturing-based

company to an independent office products distribution company. Some assets of the segments

whose assets we sold, such as the facility near Elma, Washington and Company-owned life

insurance, were retained by OfficeMax, as were some liabilities of the segments whose assets we

sold such as liabilities associated with retiree pension and benefits, litigation, environmental

remediation at selected sites and facilities previously closed. The assets that we sold were included

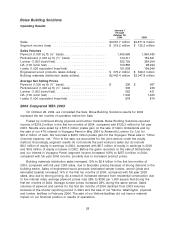

in our Boise Building Solutions and Boise Paper Solutions segments.

In connection with the Sale, we recorded a $280.6 million gain in our Corporate and Other

segment in our Consolidated Statement of Income (Loss). On October 29, 2004, we invested

$175 million in securities of affiliates of Boise Cascade, L.L.C. This investment represents continuing

involvement as defined in Financial Accounting Standards Board (‘‘FASB’’) Statement 144,

‘‘Accounting for the Impairment or Disposal of Long-Lived Assets.’’ Accordingly, we do not show

the historical results of the paper, forest products and timberland assets as discontinued operations.

An additional $180 million of gain on the Sale was deferred as a result of our continuing

involvement with Boise Cascade, L.L.C. We will recognize this gain as we reduce our investment in

affiliates of Boise Cascade, L.L.C. We realized note and cash proceeds of approximately $3.5 billion

18