OfficeMax 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

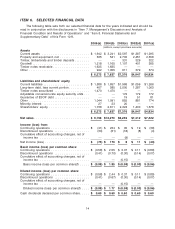

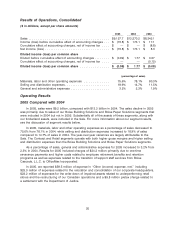

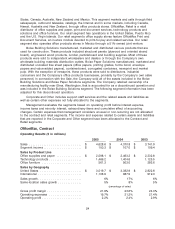

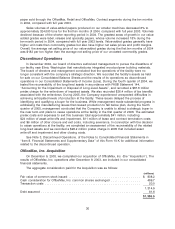

Results of Operations, Consolidated

($ in millions, except per share amounts)

2005 2004 2003

Sales ............................................ $9,157.7 $13,270.2 $8,245.1

Income (loss) before cumulative effect of accounting changes . . . $ (73.8) $ 173.1 $ 17.1

Cumulative effect of accounting changes, net of income tax .... $ — $ — $ (8.8)

Net income (loss) ................................... $ (73.8) $ 173.1 $ 8.3

Diluted income (loss) per common share

Diluted before cumulative effect of accounting changes ........ $ (0.99) $ 1.77 $ 0.07

Cumulative effect of accounting changes, net of income tax .... — — (0.15)

Diluted income (loss) per common share ................ $ (0.99) $ 1.77 $ (0.08)

(percentage of sales)

Materials, labor and other operating expenses .............. 75.6% 78.1% 80.3%

Selling and distribution expenses ........................ 18.9% 14.7% 11.5%

General and administrative expenses ..................... 3.2% 2.3% 1.9%

Operating Results

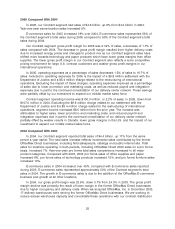

2005 Compared with 2004

In 2005, sales were $9.2 billion, compared with $13.3 billion in 2004. The sales decline in 2005

was primarily due to sales of our Boise Building Solutions and Boise Paper Solutions segments that

were included in 2004 but not in 2005. Substantially all of the assets of these segments, along with

our timberland assets, were included in the Sale. For more information about our segment results,

see the discussion of segment results below.

In 2005, materials, labor and other operating expenses as a percentage of sales decreased to

75.6% from 78.1% in 2004, while selling and distribution expenses increased to 18.9% of sales

compared to 14.7% of sales in 2004. The year-over-year variances are largely attributable to the

Sale. The Contract and Retail segments operate with both higher gross margins and higher selling

and distribution expenses than the Boise Building Solutions and Boise Paper Solutions segments.

As a percentage of sales, general and administrative expenses for 2005 increased to 3.2% from

2.3% in 2004. Results for 2005 included charges of $24.2 million primarily due to one-time

severance payments and higher costs related to employee retirement benefits and retention

programs as well as expenses related to the transition of support staff services from Boise

Cascade, L.L.C. to OfficeMax Incorporated.

In 2005, we reported $59.5 million of expense in ‘‘Other (income) expense, net,’’ including

$25.0 million of expenses related to the relocation and consolidation of our corporate headquarters,

$23.2 million of expenses for the write-down of impaired assets related to underperforming retail

stores and the restructuring of our Canadian operations and a $9.8 million pretax charge related to

a settlement with the Department of Justice.

20