OfficeMax 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.liquidation preference of $45 per share. This preferred stock, a portion of which was redeemed in

2004 with proceeds from the Sale, was originally issued to the trustee of the Company’s ESOP for

salaried employees in 1989, and was allocated to eligible participants through 2005. All shares

outstanding have been allocated to participants in the plan. Each ESOP preferred share is entitled

to one vote, bears an annual cumulative dividend of $3.31875 and is convertible at any time by the

trustee to 0.80357 share of common stock. The ESOP preferred shares may not be redeemed for

less than the liquidation preference.

During 2004, the Company announced plans to return between $800 million and $1 billion of

the Sale proceeds to shareholders via common or preferred stock buybacks, cash dividends or a

combination of these alternatives. As part of this commitment to return cash to equity-holders, the

Company redeemed $110 million of its Series D preferred stock on November 1, 2004, and paid

related accrued dividends of $3 million. In May 2005, the Company repurchased 23.5 million shares

of its common stock and the associated common stock purchase rights through a modified Dutch

auction tender offer at a purchase price of $775.5 million, or $33.00 per share, plus transaction

costs.

Common Stock

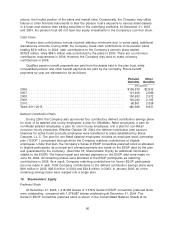

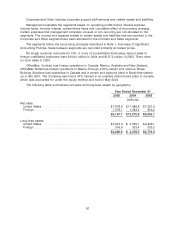

The Company is authorized to issue 200,000,000 shares of common stock, of which 70,804,612

shares were issued and outstanding at December 31, 2005. Of these, 13,680 shares were restricted

stock which is discussed below. Of the unissued shares, 12,286,914 shares were reserved for the

following purposes:

Conversion or redemption of Series D ESOP preferred stock .................... 977,410

Issuance under OfficeMax Incentive and Performance Plan ..................... 5,726,239

Issuance under Key Executive Stock Option Plan ............................ 5,248,612

Issuance under Director Stock Compensation Plan ........................... 42,678

Issuance under Director Stock Option Plan ................................. 108,500

Issuance under Key Executive Deferred Compensation Plan ..................... 110,429

Issuance under 2003 Director Stock Compensation Plan ....................... 73,046

The Company has a shareholder rights plan that was adopted in December 1988. The current

rights plan, as amended and restated, took effect in December 1998 and expires in

December 2008. On January 18, 2006, the Company announced that the board of directors voted

not to seek an extension of the shareholder rights plan when it expires in 2008.

91