OfficeMax 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

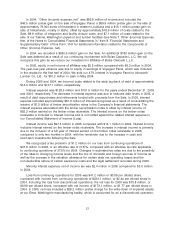

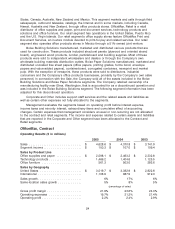

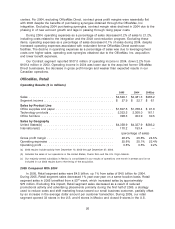

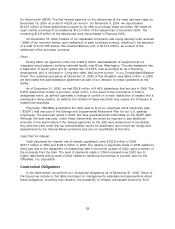

Boise Building Solutions

Operating Results

January 1

through

October 28,

2004 2003

Sales .......................................... $3,257.7 million $2,871.9 million

Segment income (loss) ............................. $ 319.2 million $ 125.3 million

Sales Volumes

Plywood (1,000 sq ft) (3⁄8’’ basis) ....................... 1,465,965 1,890,480

Particleboard (1,000 sq ft) (3⁄4’’ basis) ................... 134,411 152,621

Lumber (1,000 board feet) ........................... 302,725 364,054

LVL (100 cubic feet) ................................ 100,855 98,294

I-joists (1,000 equivalent lineal feet) ..................... 191,938 199,949

Engineered wood products (sales dollars) ................ $ 375.2 million $ 329.3 million

Building materials distribution (sales dollars) .............. $2,442.4 million $2,047.8 million

Average Net Selling Prices

Plywood (1,000 sq ft) (3⁄8’’ basis) ....................... $ 336 $ 267

Particleboard (1,000 sq ft) (3⁄4’’ basis) ................... 305 236

Lumber (1,000 board feet) ........................... 552 431

LVL (100 cubic feet) ................................ 1,640 1,463

I-joists (1,000 equivalent lineal feet) ..................... 978 874

2004 Compared With 2003

On October 29, 2004, we completed the Sale. Boise Building Solutions results for 2004

represent the ten months of operation before the Sale.

Fueled by continued strong plywood and lumber markets, Boise Building Solutions reported

income of $319.2 million in the first ten months of 2004, compared with $125.3 million for full year

2003. Results were aided by a $15.3 million pretax gain on the sale of Idaho timberlands and by

the sale of our 47% interest in Voyageur Panel in May 2004 to Ainsworth Lumber Co. Ltd. for

$91.2 million of cash. We recorded a $46.5 million pretax gain for the Voyageur Panel sale in ‘‘Other

(income) expense, net.’’ Prior to the sale, we accounted for the joint venture under the equity

method. Accordingly, segment results do not include the joint venture’s sales but do include

$6.3 million of equity in earnings in 2004, compared with $8.7 million of equity in earnings in 2003

and $0.6 million of equity in losses in 2002. Before the gains recorded on the sale of timberlands

and our interest in Voyageur Panel, segment income increased 105% to $257.4 million in 2004,

compared with full year 2003 income, primarily due to increased product prices.

Building materials distribution sales increased 19% to $2.4 billion in the first ten months of

2004, compared with full year 2003 sales, due to favorable pricing because of strong demand in the

building sector. Sales of engineered wood products (laminated veneer lumber, wood I-joists and

laminated beams) increased 14% in the first ten months of 2004, compared with full year 2003

sales, also due to strong pricing. As a result of increased demand from residential construction due

to low interest rates, average plywood prices rose 26% to $336 per 1,000 square feet during the

first ten months of 2004. Average lumber prices increased 28% during the same period. Sales

volumes of plywood and lumber for the first ten months of 2004 declined from 2003 volumes

because of the shorter reporting period in 2004 and the sale of our Yakima, Washington, plywood

and lumber facilities in February 2004. The sale of our Yakima facilities did not have a material

impact on our financial position or results of operations.

28