OfficeMax 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our effective tax rate for continuing operations for the year ended December 31, 2004, was

37.5%, compared with an effective tax rate for continuing operations of 28.1% for 2003. The year

ended December 31, 2003 included a one-time tax benefit related to a favorable tax ruling of

approximately $2.9 million, net of changes in other tax items.

Minority interest in 2004 is related to our majority-owned subsidiary in Mexico. We purchased

our ownership interest in this subsidiary as part of the OfficeMax, Inc. acquisition in

December 2003. The subsidiary is consolidated in our results of operations. There is no amount

associated with 2003 as the results of operations of this business are reported one month in

arrears.

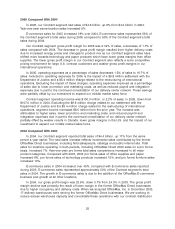

Income from continuing operations increased significantly in 2004, compared with the same

period a year earlier. The increase resulted from the gain on the Sale, increased income in our

office products business due primarily to the OfficeMax, Inc. acquisition, increased income from

operations in Boise Building Solutions due to strong product prices and increased income in Boise

Paper Solutions. Boise Paper Solutions reported an operating loss before the gains on the

timberlands sales during 2004 due to higher year-over-year manufacturing costs and operating

difficulties experienced during the first quarter of 2004.

In 2003, the $8.8 million recorded in ‘‘Cumulative effect of accounting changes, net of income

tax’’ consisted of an after-tax charge of $4.1 million, or $0.07 per share, from the adoption of FASB

Statement 143, ‘‘Accounting for Asset Retirement Obligations’’, which affects the way we account

for landfill closure costs. This statement requires us to record an asset and a liability (discounted)

for estimated closure and closed-site monitoring costs and to depreciate the asset over the landfill’s

expected useful life. Previously, we accrued for the closure costs over the life of the landfill and

expensed monitoring costs as incurred. We also recorded an after-tax charge of $4.7 million, or

$0.08 per share, related to the adoption of EITF 02-16. EITF 02-16 requires that vendor allowances

reside in inventory with the product and be recognized when the product is sold, changing the

timing of our recognition of these items and creating a one-time, noncash, cumulative-effect

adjustment.

Net income for 2004 was $173.1 million, or $1.77 per diluted share, compared with net income

of $8.3 million, or a loss of $0.08 per diluted share, for 2003. Income increased in 2004, compared

with 2003, because of the gain on the Sale, increased income in the office products business

primarily due to the OfficeMax, Inc. acquisition, increased income from operations in Boise Building

Solutions due to strong product prices and the positive impact of a $36.6 million after-tax gain on

the sale of Louisiana timberland and a $28.4 million after-tax gain on the sale of our 47% interest in

Voyageur Panel.

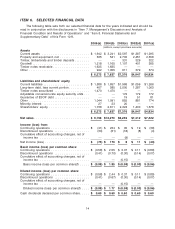

Segment Discussion

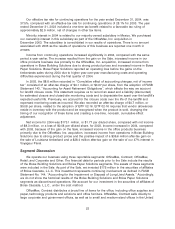

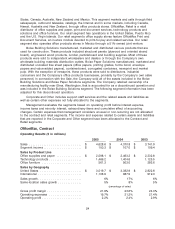

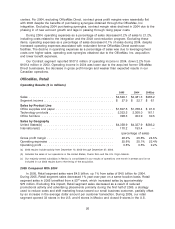

We operate our business using three reportable segments: OfficeMax, Contract; OfficeMax,

Retail; and Corporate and Other. The financial data for periods prior to the Sale include the results

of the Boise Building Solutions and Boise Paper Solutions segments. The assets of these segments

were included in the Sale. As part of the Sale, we invested $175 million in the securities of affiliates

of Boise Cascade, L.L.C. This investment represents continuing involvement as defined in FASB

Statement No. 144, ‘‘Accounting for the Impairment or Disposal of Long-Lived Assets.’’ Accordingly,

we do not show the historical results of the Boise Building Solutions and Boise Paper Solutions

segments as discontinued operations. We account for our investment in the securities of affiliates of

Boise Cascade, L.L.C., under the cost method.

OfficeMax, Contract distributes a broad line of items for the office, including office supplies and

paper, technology products and solutions and office furniture. OfficeMax, Contract sells directly to

large corporate and government offices, as well as to small and medium-sized offices in the United

23