OfficeMax 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

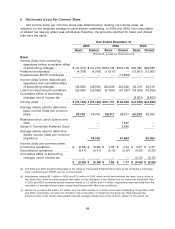

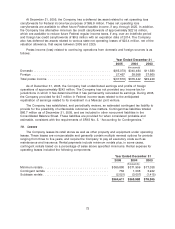

December 16, 2004, investors fulfilled their purchase contracts related to the Company’s adjustable conversion-rate

equity security units and received 5,412,705 shares of common stock. These shares are included in the calculation of

weighted average shares outstanding for the period in 2004 during which they were outstanding. Forward contracts to

purchase 5.4 million shares of common stock were outstanding during 2003, but were not included in the computation

of diluted income (loss) per share because the securities were not dilutive under the treasury stock method. These

forward contracts were related to the Company’s adjustable conversion-rate equity security units referred to above.

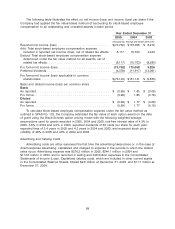

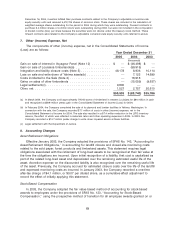

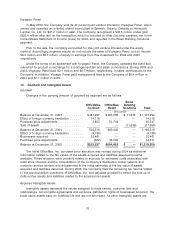

7. Other (Income) Expense, Net

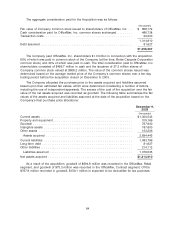

The components of other (income) expense, net in the Consolidated Statements of Income

(Loss) are as follows:

Year Ended December 31

2005 2004 2003

(thousands)

Gain on sale of interest in Voyageur Panel (Note 12) .......... $ — $(46,498) $ —

Gain on sale of Louisiana timberlands(a) ................... — (59,915) —

Integration and facility closure costs (Note 5) ................ 48,178 8,936 10,114

Loss on sale and write-down of Yakima assets(b) ............. — 7,123 14,699

Costs incidental to the Sale (Note 2) ...................... — 18,916 —

Gains on sales of other timberlands ...................... — (15,059) (9,637)

Legal settlement(c) ................................... 9,800 — —

Other, net ......................................... 1,527 2,757 20,610

$59,505 $ (83,740) $35,786

(a) In March 2004, the Company sold approximately 79,000 acres of timberland in western Louisiana for $84 million in cash

and recognized a $59.9 million pretax gain in the Consolidated Statement of Income (Loss) for 2004.

(b) In February 2004, the Company completed the sale of its plywood and lumber facilities in Yakima, Washington. In

connection with the sale, the Company recorded $7.1 million of costs in other (income) expense, net in the

Consolidated Statement of Income for 2004. The sale also resulted in a $7.4 million reduction in the LIFO inventory

reserve, the effect of which was reflected in materials, labor and other operating expenses in 2004. In 2003, the

Company recorded a $14.7 million pretax charge to write down impaired assets at these facilities.

(c) Legal settlement with the Department of Justice.

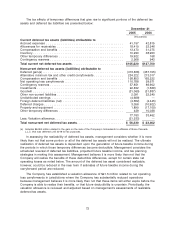

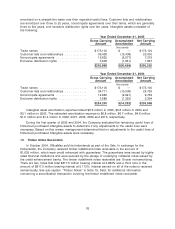

8. Accounting Changes

Asset Retirement Obligations

Effective January 2003, the Company adopted the provisions of SFAS No. 143, ‘‘Accounting for

Asset Retirement Obligations,’’ in accounting for landfill closure and closed-site monitoring costs

related to the sold paper, forest products and timberland assets. This statement requires legal

obligations associated with the retirement of long-lived assets to be recognized at their fair value at

the time the obligations are incurred. Upon initial recognition of a liability, that cost is capitalized as

part of the related long-lived asset and depreciated over the remaining estimated useful life of the

asset. Accretion expense on the discounted liability is also recognized over the remaining useful life

of the asset. Previously, the Company accrued for estimated closure costs over the life of the landfill

and expensed monitoring costs as incurred. In January 2003, the Company recorded a one-time

after-tax charge of $4.1 million, or $0.07 per diluted share, as a cumulative-effect adjustment to

record the effect of initially applying this statement.

Stock-Based Compensation

In 2003, the Company adopted the fair value-based method of accounting for stock-based

awards to employees under the provisions of SFAS No. 123, ‘‘Accounting for Stock-Based

Compensation,’’ using the prospective method of transition for all employee awards granted on or

69