OfficeMax 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

paper sold through the OfficeMax, Retail and OfficeMax, Contract segments during the ten months

in 2004, compared with full year 2003.

Sales volumes of value-added papers produced on our smaller machines decreased 6% to

approximately 324,000 tons for the first ten months of 2004, compared with full year 2003. Volumes

declined because of the shorter reporting period in 2004. The greatest areas of growth in our value-

added grades were label, release and specialty papers, whose volume increased 18% during the

ten-month period in 2004, compared with full year 2003 levels. Value-added grades generally have

higher unit costs than commodity grades but also have higher net sales prices and profit margins.

Overall, the average net selling price of our value-added grades during the first ten months of 2004

was $183 per ton higher than the average net selling price of our uncoated commodity grades.

Discontinued Operations

In December 2004, our board of directors authorized management to pursue the divestiture of

our facility near Elma, Washington that manufactures integrated wood-polymer building materials.

The board of directors and management concluded that the operations of the facility were no

longer consistent with the company’s strategic direction. We recorded the facility’s assets as held

for sale on our Consolidated Balance Sheets and the results of its operations as discontinued

operations in our Consolidated Statements of Income (Loss). During the fourth quarter of 2004, we

tested the recoverability of the long-lived assets in accordance with FASB Statement 144,

‘‘Accounting for the Impairment or Disposal of Long-Lived Assets’’, and recorded a $67.8 million

pretax charge for the write-down of impaired assets. We also recorded $26.4 million of tax benefits

associated with the write-down. During 2005, the Company experienced unexpected difficulties in

achieving anticipated levels of production at the facility. These issues delayed the process of

identifying and qualifying a buyer for the business. While management made substantial progress in

addressing the manufacturing issues that caused production to fall below plan, during the fourth

quarter of 2005, management concluded that the Company is unable to attract a strategic buyer in

the near term and plans to cease operations at the facility in the first quarter of 2006. The estimated

pretax costs and expenses to exit this business total approximately $41 million, including

$24 million of asset write-offs and impairment, $11 million of lease and contract termination costs

and $6 million of other closure and exit costs, including severance. In connection with the decision

to cease operations at the facility, we completed an assessment of the recoverability of the related

long-lived assets and we recorded a $28.2 million pretax charge in 2005 that included asset

write-off and impairment and other closing costs.

See Note 3, Discontinued Operations, of the Notes to Consolidated Financial Statements in

‘‘Item 8. Financial Statements and Supplementary Data’’ of this Form 10-K for additional information

related to the discontinued operation.

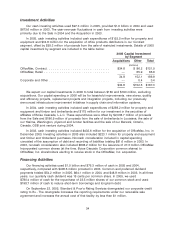

OfficeMax, Inc. Acquisition

On December 9, 2003, we completed our acquisition of OfficeMax, Inc. (the ‘‘Acquisition’’). The

results of OfficeMax, Inc. operations after December 9, 2003, are included in our consolidated

financial statements.

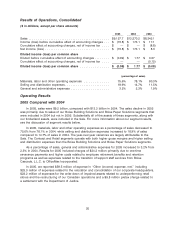

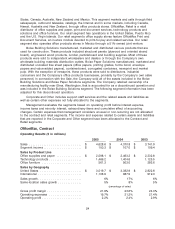

The aggregate consideration paid for the Acquisition was as follows:

(millions)

Fair value of common stock issued ....................................... $ 808.2

Cash consideration for OfficeMax, Inc. common shares exchanged ................ 486.7

Transaction costs .................................................... 20.0

1,314.9

Debt assumed ...................................................... 81.6

$1,396.5

30