OfficeMax 2005 Annual Report Download - page 67

Download and view the complete annual report

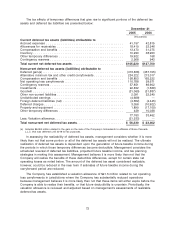

Please find page 67 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recorded the facility’s assets as held for sale on the Consolidated Balance Sheets and the results of

its operations and planned divestiture as discontinued operations.

In connection with the adoption of the plan to divest the facility, management completed an

assessment of the recoverability of the related long-lived assets in accordance with SFAS No. 144,

and recorded a pretax charge of $67.8 million ($41.4 million after recognition of an income tax

benefit of $26.4 million) to reduce the carrying amount of these assets to their fair value based

upon estimated discounted future cash flows. This charge was reflected as loss from write-down of

assets within discontinued operations in the Consolidated Statement of Income (Loss) for 2004.

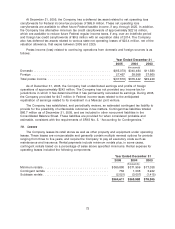

During 2005, the Company experienced unexpected difficulties in achieving anticipated levels

of production at the facility. These issues delayed the process of identifying and qualifying a buyer

for the business. While management made substantial progress in addressing the manufacturing

issues that caused production to fall below plan, during the fourth quarter of 2005, management

concluded that the Company is unable to attract a strategic buyer in the near term and elected to

cease operations of the facility during the first quarter of 2006. In connection with this decision,

management completed an assessment of the recoverability of the related long-lived assets in

accordance with SFAS No. 144, and recorded a pretax charge of $28.2 million ($17.2 million after

recognition of an income tax benefit of $11.0 million) that included an impairment charge to reduce

the carrying amount of these assets to their estimated fair value based upon estimated discounted

future cash flows as well as other closure costs. This charge was reflected as loss from write-down

of assets within discontinued operations in the Consolidated Statement of Income (Loss) for 2005.

The estimated pretax costs to exit this business total approximately $41 million, including

$24 million of non-cash asset write-off and impairment charges, $11 million of lease and contract

termination costs and $6 million of other closure and exit costs, including severance.

The assets and liabilities of the wood-polymer building materials facility near Elma, Washington,

are included in current assets ($0.3 million and $24.1 million at December 31, 2005 and 2004,

respectively) and current liabilities ($9.8 million and $3.2 million at December 31, 2005 and 2004,

respectively) in the Consolidated Balance Sheets. The assets are reported at their estimated fair

value less costs to sell and are no longer depreciated.

4. OfficeMax, Inc. Acquisition

On December 9, 2003, the Company completed the acquisition of OfficeMax, Inc. (the

‘‘Acquisition’’), primarily a retail office products distributor, by acquiring 100% of its voting securities

in exchange for a combination of cash, Company common stock and the assumption of certain

debt. The acquisition was a major step in the Company’s transition to an independent office

products distribution company. The acquisition was accounted for under the purchase method, and

accordingly, the results of operations of OfficeMax, Inc. are included in the Company’s consolidated

financial statements from the date of the acquisition. The Company changed its name from Boise

Cascade Corporation to OfficeMax Incorporated in connection with the sale of the paper, forest

products and timberland assets. References to the OfficeMax, Inc. Acquisition and OfficeMax, Inc.

Integration herein refer to Boise Cascade Corporation’s acquisition of OfficeMax, Inc., and the

related integration activities.

63