OfficeMax 2005 Annual Report Download - page 74

Download and view the complete annual report

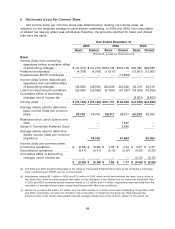

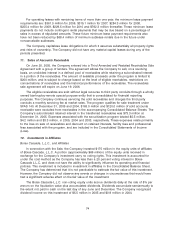

Please find page 74 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.after January 1, 2003, as permitted in SFAS No. 148, ‘‘Accounting for Stock-Based Compensation—

Transition and Disclosure.’’ Prior to 2003, the Company accounted for its stock-based employee

compensation plans under the recognition and measurement provisions of APB Opinion No. 25,

‘‘Accounting for Stock Issued to Employees,’’ and its related interpretations. Under APB Opinion

No. 25, the cost for stock-based awards was measured as the excess of the market value of the

underlying common stock at the time of grant over the amount that the employee was required to

pay upon exercise. Because the Company’s stock option awards were generally granted with

exercise prices that were equal to the market value of the underlying stock as of the date of grant,

no significant compensation expense related to stock options was recognized under the provisions

of APB No. 25. The adoption of SFAS No. 123 did not materially affect the Company’s financial

position or results of operations.

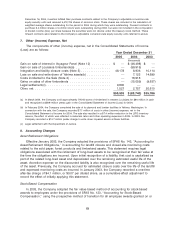

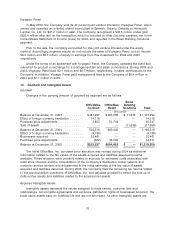

Vendor Rebates and Allowances

The Company participates in various cooperative advertising and other marketing programs

with its vendors. The Company also participates in volume purchase rebate programs, some of

which provide for tiered rebates based on defined levels of purchase volume. These arrangements

enable the Company to receive reimbursement for costs incurred to promote the sale of vendor

products, or to earn rebates that reduce the cost of merchandise purchased. Effective January 1,

2003, the Company adopted the guidelines issued by the FASB’s Emerging Issues Task Force (the

‘‘EITF’’) in Issue No. 02-16, ‘‘Accounting by a Customer (Including a Reseller) for Certain

Consideration Received From a Vendor.’’ Under EITF Issue No. 02-16, consideration received from

a vendor is presumed to be a reduction of the cost of the vendor’s products or services, unless it is

for a specific, incremental and identifiable cost to sell the product. Accordingly, volume-based

rebates and allowances are accrued as earned over the incentive period and are initially recorded

as a reduction in the cost of merchandise inventories, and are included in operations (as a

reduction in materials, labor and other operating expenses) in the period the related product is

sold. Amounts received under other event-based promotional programs are recognized at the time

of the event as a reduction of cost of goods sold or inventory, as appropriate, based on the nature

of the promotion and the terms of the vendor agreement. The adoption of EITF 02-16 resulted in a

non-cash, after-tax charge of $4.7 million, or $0.08 per diluted share, in 2003.

70