OfficeMax 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2004, we repaid $1.6 billion of our debt, primarily with the proceeds of the Sale, and we

redeemed $110 million of our Series D preferred stock and paid related accrued dividends of

$3 million. In addition, in 2004, we settled the purchase contracts related to our adjustable

conversion-rate equity units and received $172.5 million.

Additions to long-term debt in 2003 resulted primarily from our acquisition of OfficeMax, Inc.

Additions included $150 million under an unsecured credit agreement, $300 million of 6.50% notes,

$200 million of 7.00% notes, $50.0 million of 7.45% medium-term notes and $33.5 million for the

sale-leaseback of equipment at our integrated wood-polymer building materials facility near Elma,

Washington, that was accounted for as a financing arrangement. Payments of long-term debt in

2003 included $125 million of medium-term notes and $40 million under our revolving credit

agreement.

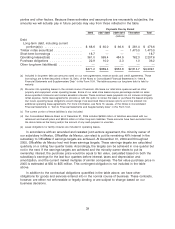

Our debt-to-equity ratio, excluding the securitized timber notes, was .28:1 and .27:1 at

December 31, 2005 and 2004, respectively. Our debt-to-equity ratio remained constant year over

year despite a net debt reduction of $198.7 million due in large part to the stock buyback activity in

2005.

We lease our store space and other property and equipment under operating leases. These

operating leases are not included in debt; however, they represent a significant commitment.

Obligations under operating leases are shown in the ‘‘Contractual Obligations’’ section of this

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Financing Arrangements

Our debt structure consists of credit agreements, note agreements, and other borrowings as

follows. For more information, see ‘‘Contractual Obligations’’ and ‘‘Disclosures of Financial Market

Risks’’ in this Management’s Discussion and Analysis of Financial Condition and Results of

Operations.

Credit Agreements

On June 24, 2005, we entered into a loan and security agreement for a new revolving credit

facility. The new revolver replaced our previous revolving credit facility, which was scheduled to

expire on June 30, 2005. The maximum aggregate borrowing amount under the new facility is equal

to the lesser of (i) a percentage of the value of certain eligible inventory less certain reserves or

(ii) $500 million. Letters of credit may be issued under the revolver up to a maximum limit of

$100 million. The combined sum of outstanding borrowings and letters of credit issued under the

revolver may not exceed the maximum aggregate borrowing amount. The outstanding balance

under the new revolver was $18.7 million at December 31, 2005. Letters of credit issued under the

revolver totaled $89.6 million as of December 31, 2005. As of December 31, 2005, our maximum

aggregate borrowing amount was $500.0 million. The minimum and maximum amounts of

short-term borrowings outstanding were zero and $101.0 million during the year ended

December 31, 2005, and $6.2 million and $493.7 million during the year ended December 31, 2004.

The average amounts of short-term borrowings outstanding during the years ended December 31,

2005 and 2004, were $30.3 million and $82.8 million, respectively. The weighted average annual

interest rates for these borrowings were 6.6% for 2005 and 2.8% for 2004. The activity in 2004

reflects the addition of two $200 million term loan facilities in September 2004 to fund incremental

contributions to our pension plans and to decrease our accounts receivable financing. In addition,

during the second quarter of 2004, we added two $20 million floating rate term loans. On

October 29, 2004, we repaid the two $200 million and two $20 million term loans with the proceeds

from the Sale.

35