OfficeMax 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Utility Swaps

Effective January 2004, the Company entered into two electricity swaps that converted 7 and

36 megawatts of usage per hour to a fixed price. Effective with the date of the Sale, these swaps

were assumed by Boise Cascade, L.L.C. These swaps were designated as cash flow hedges.

Accordingly, changes in the fair value of the swaps, net of taxes, were recorded in accumulated

other comprehensive income (loss) in the Consolidated Balance Sheet and reclassified to

operations in the period the related electricity was used. Ineffectiveness related to these swaps was

not significant.

In November 2003, the Company entered into a natural gas swap to hedge the variable cash

flow risk on 25,000 MMBtu per day of natural gas usage to a fixed price. The swap expired in

March 2004. In April 2004, the Company entered into a natural gas swap to hedge the variable

cash flow risk on 2,520,000 MMBtu of gas allocated on a monthly basis to a fixed price. The swap

expired in October 2004. The swaps were designated as cash flow hedges. Accordingly, changes in

the fair value of the swaps, net of taxes, were recorded in accumulated other comprehensive

income (loss) in the Consolidated Balance Sheet and reclassified to earnings as the gas was used

in operations.

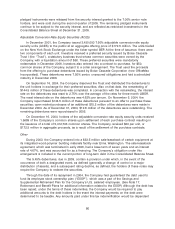

Additional Consideration Agreement

Pursuant to an Additional Consideration Agreement entered into between the Company and

Boise Cascade, L.L.C. in connection with the Sale, the Company may be required to make cash

payments to, or entitled to receive cash payments from, Boise Cascade, L.L.C. Under the Additional

Consideration Agreement, the Sale proceeds may be adjusted upward or downward based on

changes in paper prices during the six years following the closing date, with the amount of any

such adjustments being subject to annual and aggregate caps. Under the terms of the agreement,

neither party will be obligated to make a payment in excess of $45 million in any one year.

Payments by either party are also subject to aggregate caps over the term of the agreement; these

caps are $125 million in the first four years of the agreement, $115 million in the fifth year and

$105 million in the sixth year.

In connection with recording the Sale in 2004, the Company calculated its projected future

obligation under the Additional Consideration Agreement based on the net present value of

weighted average expected future payments using industry paper price projections, and accrued a

liability of $42 million in other long-term liabilities on the Consolidated Balance Sheet. This accrual

was recorded as an adjustment to the gain on sale of assets reflected in the Consolidated

Statement of Income (Loss) for 2004. Changes in the fair value of the Company’s obligation under

the Additional Consideration Agreement following its initial measurement and recognition are

included in operations. Expense of $2.9 million related to the change in fair value of this obligation

was included in the Consolidated Statement of Income (Loss) for 2005.

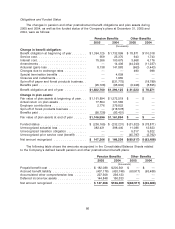

17. Retirement and Benefit Plans

Pension and Other Postretirement Benefit Plans

During the period through October 28, 2004, some of the Company’s employees were covered

by noncontributory defined benefit pension plans. Effective July 31, 2004, the Company established

separate mirror plans for active employees in the paper and forest products businesses, and

transferred associated assets and obligations to the new plans. Effective October 29, 2004, under

the terms of the Asset Purchase Agreement, the Company transferred sponsorship of the plans

covering active employees of the paper and forest products business to Boise Cascade, L.L.C. As a

result, only those terminated vested employees and retirees whose employment with the Company

ended on or before July 31, 2004, and some active OfficeMax, Contract employees continue to be

84