OfficeMax 2005 Annual Report Download - page 36

Download and view the complete annual report

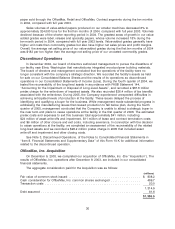

Please find page 36 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In September 2005, the board of directors approved a plan to relocate and consolidate the

Company’s retail headquarters in Shaker Heights, Ohio and its existing corporate headquarters in

Itasca, Illinois into a new facility in Naperville, Illinois. Approximately 650 associates are located at

the retail headquarters and 950 associates are located at the corporate headquarters. The

relocation and consolidation process is expected to be completed during the second half of 2006.

Management expects the total cost of the relocation and consolidation will be approximately

$40 to $50 million on a pre-tax basis, and will be recognized in operations during 2005 and 2006.

Such charges are expected to require cash outlays of $15 to $20 million for severance, retention

and other employee costs, and approximately $10 to $15 million for contract termination and other

closure costs. Non-cash charges for accelerated depreciation of facilities and leasehold

improvements are expected to total $10 to $15 million during 2005 and 2006. These estimated

costs do not include expected future expenses for personnel training, recruiting and relocation or

the potential savings from these actions due to expected efficiencies and tax incentives.

The Company recorded charges totaling $25.0 million during the third and fourth quarters of

2005 related to the headquarters relocation and consolidation in the Corporate and Other segment.

Also in 2005, the Company recorded charges to income of $23.2 million for the write-down of

impaired assets related to underperforming retail stores and the restructuring of our Canadian

operations.

See Note 5., Integration and Facility Closures, of the Notes to Consolidated Financial

Statements in ‘‘Item 8, Financial Statements and Supplementary Data’’ of this Form 10-K for

additional information related to our integration and consolidation efforts and the related charges

and reserves.

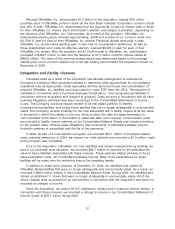

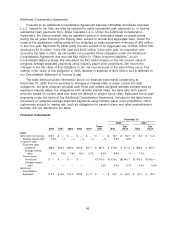

Liquidity and Capital Resources

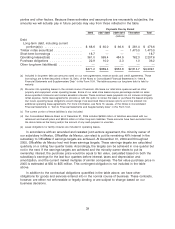

As of December 31, 2005, we had $72.2 million of cash and cash equivalents and

$494.6 million of short-term and long-term debt, excluding the $1.5 billion of timber securitization

notes. We also had $22.4 million of restricted investments on deposit which are pledged to secure

a portion of the outstanding debt, bringing our net debt (total debt less restricted investments) to

$472.2 million. We expensed $14.4 million of costs related to the early retirement of debt and

reduced our total debt by approximately $199 million during 2005. During 2004, we paid down

$1.6 billion of our debt, primarily with the proceeds of the Sale, and expensed $137.1 million of

costs related to the early retirement of debt. A significant portion of the premiums paid with respect

to the debt we repaid was the result of the low interest rate environment in the market at the time of

repayment.

During 2004, we announced plans to return between $800 million and $1 billion of the Sale

proceeds to shareholders via common or preferred stock buybacks, cash dividends or a

combination of these alternatives. As part of this return of cash to equity-holders, we redeemed

$110 million of our Series D preferred stock on November 1, 2004, and paid related accrued

dividends of $3 million. Additionally, during the second quarter 2005, we repurchased 23.5 million

shares of our common stock and the associated common stock purchase rights through a modified

Dutch auction tender offer at a purchase price of $775.5 million, or $33.00 per share, plus

transaction costs.

Our primary ongoing cash requirements relate to working capital, expenditures for property and

equipment, lease obligations and debt service. We expect to fund these requirements through a

combination of cash flow from operations and seasonal borrowings under our revolving credit

facility. The sections that follow discuss in more detail our operating, investing, and financing

activities, as well as our financing arrangements.

32