OfficeMax 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discounted to their present value. (See Note 21, Legal Proceedings and Contingencies for

additional information.)

Self-insurance

The Company is self-insured for certain losses related to workers’ compensation and medical

claims as well as general and auto liability. The expected ultimate cost for claims incurred as of the

balance sheet date is recognized as a liability in the Consolidated Balance Sheet. The expected

ultimate cost of claims is estimated based principally on analysis of historical claim data and

actuarial estimates of claims incurred but not reported. Losses are accrued and charged to

operations when it is probable that a loss has been incurred and the amount can be reasonably

estimated. Accrued self-insurance liabilities are based on claims filed and estimates of claims

incurred.

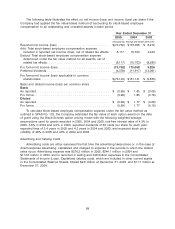

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and

liabilities are recognized for the future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabilities and their respective tax bases

and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities

of a change in tax rates is recognized in income in the period that includes the enactment date.

In determining the quarterly provision for income taxes, the Company uses an estimated annual

effective tax rate based on expected annual income and statutory tax rates. The estimated effective

tax rate also reflects the Company’s assessment of the ultimate outcome of tax audits. Significant or

unusual items are recognized in the quarter in which they occur.

The determination of the Company’s provision for income taxes requires significant judgment,

the use of estimates, and the interpretation and application of complex tax laws. Significant

judgment is also required in assessing the timing and amounts of deductible and taxable items.

Stock-Based Compensation

In 2003, the Company adopted the fair value-based method of accounting for stock-based

awards to employees under the provisions of SFAS No. 123, ‘‘Accounting for Stock-Based

Compensation,’’ using the prospective method of transition for all employee awards granted on or

after January 1, 2003, as permitted in SFAS No.148, ‘‘Accounting for Stock-Based Compensation—

Transition and Disclosure.’’ As a result, cost related to stock-based employee compensation

included in the determination of net income in 2003 is less than the amount that would have been

recognized if the fair value-based method had been applied to all awards granted since the original

effective date of SFAS No. 123. Included in the Company’s Consolidated Statements of Income

(Loss) for 2005, 2004 and 2003, is pretax compensation expense of $10.0 million, $25.7 million and

$6.9 million, respectively, of which $9.2 million, $25.1 million and $6.5 million related to restricted

stock and restricted stock unit awards.

58