OfficeMax 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

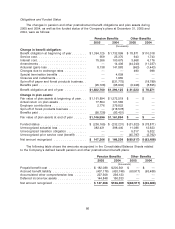

The prepaid benefit cost is included in other long-term assets. The long-term portion of the

accrued benefit liability is included in other long-term liabilities, compensation and benefits. The

current portion of the accrued benefit liability of $9.5 million and $12.7 million at December 31,

2005 and 2004, respectively, is included in accrued liabilities, compensation and benefits.

The projected benefit obligation, accumulated benefit obligation and fair value of plan assets

for the pension plans with accumulated benefit obligations in excess of plan assets were

$1.3 billion, $1.3 billion and $1.1 billion as of December 31, 2005, and $1.3 billion, $1.3 billion and

$1.1 billion as of December 31, 2004.

The amount of additional minimum pension liability is determined based on a comparison of

the value of pension plan assets and the plans’ accumulated benefit obligation, and is reflected in

comprehensive income (loss), net of applicable income taxes.

Pension Benefits

2005 2004 2003

(thousands)

Decrease in minimum liability included in other comprehensive

loss, net of taxes ................................. $ (8,615) $ (19,027) $ (52,929)

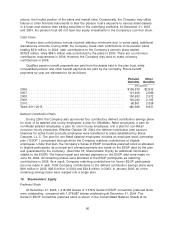

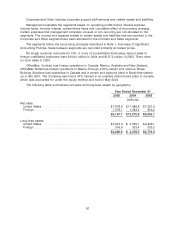

Components of Net Periodic Benefit Cost

The components of net periodic benefit cost are as follows:

Pension Benefits Other Benefits

2005 2004 2003 2005 2004 2003

(thousands)

Service cost .............. $ 959 $ 25,370 $ 41,695 $ 643 $ 1,743 $ 1,686

Interest cost .............. 75,266 100,675 105,534 3,668 6,176 6,926

Expected return on plan assets (84,135) (99,165) (102,430) — — —

Recognized actuarial loss ..... 29,628 38,071 24,845 675 1,075 1,090

Plan settlement/curtailment

expense (benefit) ......... — 94,885 820 — (24,002) —

Amortization of prior service

costs and other .......... — 9,386 6,133 (826) (530) (2,065)

Company-sponsored plans .... 21,718 169,222 76,597 4,160 (15,538) 7,637

Multiemployer pension

plans .................. — 460 526 — — —

Net periodic benefit cost

(income) ............... $ 21,718 $ 169,682 $ 77,123 $4,160 $ (15,538) $ 7,637

87