OfficeMax 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Timber Resources

On October 29, 2004, we sold substantially all of our timberland assets, including

approximately 2.3 million acres of timberland in the United States, 35,000 acres of eucalyptus

plantation land in Brazil and a 16,000-acre cottonwood fiber farm near Wallula, Washington, to

affiliates of Boise Cascade, L.L.C.

Competition

Domestic and international office products markets are highly competitive. Our competitive

position in the office products industry is influenced by many factors, including price, service,

quality, product selection and convenient locations. Some of our competitors are larger than

OfficeMax and have greater financial resources. These resources afford those competitors greater

purchasing power, increased financial flexibility and more capital resources for expansion and

improvement, which may enable them to compete more effectively than we can. We can give no

assurance that increased competition will not have an adverse effect on our business.

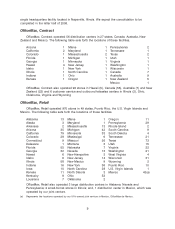

OfficeMax, Contract. The business-to-business office products market is highly competitive.

Purchasers of office products have many options when purchasing office supplies and paper,

technology products and solutions and office furniture. We are among the four largest

business-to-business contract stationers in the United States. We also compete with worldwide

contract stationers, large retail office products suppliers, direct-mail distributors, discount retailers,

drugstores, supermarkets, Internet merchandisers and thousands of local and regional contract

stationers, many of whom have long-standing customer relationships.

Increased competition in the office products industry, together with increased advertising, has

heightened price awareness among end-users. Such heightened price awareness has led to margin

pressure on office products. Besides price, competition is also based on customer service. We

believe our excellent customer service gives us a competitive advantage among

business-to-business office products distributors. Our ability to network our distribution centers into

an integrated system enables us to serve, at a competitive cost, large national accounts that rely on

us to deliver consistent products, prices and service to multiple locations.

OfficeMax, Retail. The retail office products industry, which includes superstore chains,

Internet merchandisers and numerous other competitors, is highly competitive. Businesses in the

office products superstore industry compete on the basis of pricing, product selection, convenient

locations, customer service and ancillary business offerings. We currently have two direct domestic

competitors, Office Depot and Staples, whose stores are similar to OfficeMax stores in terms of

store format, pricing strategy and product selection. In the future, we expect to experience

increased competition from computer and electronics superstore retailers, mass merchandisers,

Internet merchandisers and wholesale clubs. In particular, mass merchandisers, such as Wal-Mart,

and wholesale clubs have increased their assortment of office products to attract home office

customers and individual consumers. Further, various other retailers that have not historically

competed with superstores, such as drugstores and grocery chains, have begun to carry at least a

limited assortment of basic office supplies. We expect this trend toward a proliferation of retailers

offering a limited assortment of office supplies to continue. Many of our competitors have increased

their presence in our markets in recent years. We expect our competitors to continue to expand

their presence in our markets in the future.

We also anticipate increasing competition from our two direct domestic competitors and

various other providers of print-for-pay services, which has historically been a key point of difference

for OfficeMax stores. Such increased competition could adversely affect our results of operations

and profit margins.

4