OfficeMax 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pre-Opening Expenses

The Company incurs certain non-capital expenses prior to the opening of a store. These

pre-opening expenses consist primarily of straight-line rent from the date of possession, store

payroll, supplies and grand opening advertising costs and are expensed as incurred and reflected

in selling and distribution expenses. In 2005 and 2004, the Company recorded approximately

$4.5 million and $1.5 million in pre-opening costs, respectively. Pre-opening costs in 2003 were

insignificant.

Leasing Arrangements

The Company conducts a substantial portion of its business in leased properties. Some of the

Company’s leases contain escalation clauses and renewal options. In accordance with SFAS

No. 13, ‘‘Accounting for Leases,’’ as amended by SFAS No. 29, ‘‘Determining Contingent Rentals,’’

and FASB Technical Bulletin 85-3, ‘‘Accounting for Operating Leases with Scheduled Rent

Increases,’’ the Company recognizes rental expense for the leases that contain predetermined fixed

escalation clauses on a straight-line basis over the expected term of the lease. The difference

between the amounts charged to expense and the contractual minimum lease payment is recorded

to other long-term liabilities in the Consolidated Balance Sheets. At December 31, 2005 and 2004,

other long-term liabilities included approximately $27.8 million and $14.0 million related to these

future escalation clauses.

The expected term of a lease is calculated from the date the Company first takes possession of

the facility, including any periods of free rent and any option or renewal periods management

believes are probable of exercise. This expected term is used in the determination of whether a

lease is capital or operating and in the calculation of straight-line rent expense. Rent abatements

and escalations are considered in the calculation of minimum lease payments in the Company’s

capital lease tests and in determining straight-line rent expense for operating leases. Straight-line

rent expense is also adjusted to reflect any allowances or reimbursements provided by the lessor.

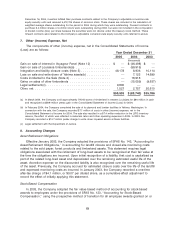

Recently Issued or Newly Adopted Accounting Standards

In December 2004, the FASB issued SFAS No. 123 (revised 2004), ‘‘Share-Based Payment,’’

(SFAS No. 123(R)) which addresses the accounting for transactions in which an entity exchanges

its equity instruments for goods or services, with a primary focus on exchanges of employee

services in share-based payment transactions. This statement is a revision to SFAS No. 123 and

supersedes Accounting Principles Board (‘‘APB’’) Opinion 25 and its related implementation

guidance. It eliminates an entity’s ability to account for share-based compensation transactions

using the intrinsic-value method of accounting prescribed in APB Opinion No. 25, which was

permitted under SFAS No. 123, as originally issued. The statement requires entities to recognize

compensation expense for awards of equity instruments to employees based on the grant-date fair

value of those awards. SFAS No. 123(R) will also require the benefits of tax deductions in excess of

recognized compensation cost to be reported as a financing cash flow, rather than as an operating

cash flow, as required under current guidance. The new requirement will reduce net operating cash

flows and increase net financing cash flows in periods after adoption, however total cash flow will

remain unchanged from that which would have been reported under prior accounting rules.

SFAS No. 123(R) is effective for fiscal years beginning after June 15, 2005, with early adoption

permitted. The Company will implement the new standard beginning with the first quarter of fiscal

2006, using the statement’s modified prospective application method. While management is still in

the process of determining the impact of applying SFAS No. 123(R), the Company does not expect

that the adoption of SFAS No. 123(R) will affect the Company’s financial position or have a

significant impact on reported income, earnings per share or cash flows. However, depending on

60