OfficeMax 2005 Annual Report Download - page 87

Download and view the complete annual report

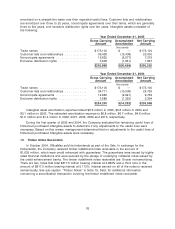

Please find page 87 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Unrealized gains and losses associated with marking the electricity and natural gas swap

contracts to market were recorded as a component of other comprehensive income (loss) and

included in the stockholders’ equity section of the Consolidated Balance Sheets as part of

accumulated other comprehensive income (loss). These amounts were reclassified into operations

in the month in which the related electricity or natural gas was used or in the month a hedge was

determined to be ineffective.

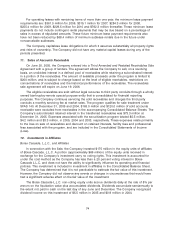

Interest Rate Swaps

On October 27, 2004, the Company and one of its subsidiaries each entered into an interest

rate swap contract with an affiliate of Goldman, Sachs & Co. The contracts were entered into in

order to hedge the interest rate risk associated with the issuance of debt securities in connection

with the securitization of the timber notes received in the Sale. (See Note 15. Debt, for additional

information related to the timber notes and the related securitization transaction.) The Company

paid $19.0 million to settle these swap contracts on December 16, 2004, in conjunction with the

issuance of the securitization notes. The settlement amount reflected the effect of the decrease in

interest rates that occurred during the period the swaps were outstanding.

In April and May 2004, the Company entered into two interest rate swaps with notional

amounts of $50 million each. These swaps converted $100 million of fixed-rate 7.50% debentures to

variable-rate debt based on six-month LIBOR plus approximately 3.9% for the April swap, and

six-month LIBOR plus 3.8% for the May swap. In March 2002, the Company entered into an interest

rate swap with a notional amount of $50 million. This swap converted $50 million of fixed-rate

7.05% debentures to variable-rate debt based on six-month LIBOR plus approximately 2.2%. In

September 2004, the Company settled all of these swaps in anticipation of making a tender offer for

the underlying debt instruments. These swaps were designated as fair value hedges of a

proportionate amount of the fixed-rate debentures. The swaps and debentures were marked to

market, with changes in the fair value of the instruments recorded in income (loss) in the period

they arose. These swaps were effective in hedging the changes in the fair value of the hedged item;

accordingly, changes in the fair values of these instruments had no net effect on reported net

income (loss).

In February 2001, the Company entered into two interest rate swaps with notional amounts of

$50 million each, one that matured in February 2003 and one that matured in February 2004. In

November 2001, the Company entered into a third interest rate swap with a notional amount of

$50 million, which matured in November 2004. The swaps were designated as hedges of the

variable cash flow risk related to the variable interest payments on equivalent amounts of LIBOR-

based revolving credit borrowings outstanding in 2004 and 2003. The effective interest rates on the

borrowings under the LIBOR-based unsecured revolving credit agreement, including the swaps,

were 3.4% at December 31, 2003. Changes in the fair value of these swaps, net of taxes, were

recorded in accumulated other comprehensive income (loss) and reclassified to interest expense as

interest expense was recognized on the LIBOR-based debt. Amounts reclassified to operations in

2004 and 2003 increased interest expense by $1.2 million and $3.0 million, respectively.

Ineffectiveness related to these hedges was not significant.

83