OfficeMax 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

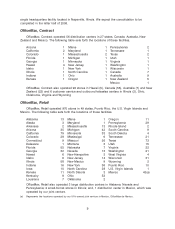

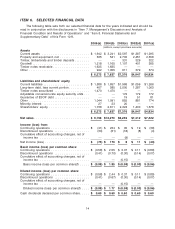

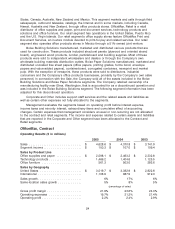

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth our selected financial data for the years indicated and should be

read in conjunction with the disclosures in ‘‘Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations’’ and ‘‘Item 8. Financial Statements and

Supplementary Data’’ of this Form 10-K.

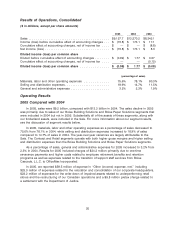

2005(a) 2004(b) 2003(c) 2002(d) 2001(e)

(millions, except per-share amounts)

Assets

Current assets .......................... $ 1,942 $ 3,241 $2,597 $1,387 $1,295

Property and equipment, net ................ 535 541 2,730 2,451 2,558

Timber, timberlands and timber deposits ........ — — 331 329 322

Goodwill ............................... 1,218 1,165 1,107 401 385

Timber notes receivable .................... 1,635 1,635 — — —

Other ................................. 942 1,055 611 379 374

$ 6,272 $ 7,637 $7,376 $4,947 $4,934

Liabilities and shareholders’ equity

Current liabilities ......................... $ 1,588 $ 1,857 $1,986 $1,056 $1,266

Long-term debt, less current portion ........... 407 585 2,000 1,387 1,063

Timber notes securitized ................... 1,470 1,470 — — —

Adjustable conversion-rate equity security units . . . — — 172 172 172

Guarantee of ESOP debt ................... — — 19 51 81

Other ................................. 1,044 1,091 855 881 774

Minority interest ......................... 27 23 20 — —

Shareholders’ equity ...................... 1,736 2,611 2,324 1,400 1,578

$ 6,272 $ 7,637 $7,376 $4,947 $4,934

Net sales .............................. $ 9,158 $13,270 $8,245 $7,412 $7,422

Income (loss) from:

Continuing operations ..................... $ (41)$ 234 $ 35 $ 19 $ (39)

Discontinued operations ................... (33) (61) (18) (8) (4)

Cumulative effect of accounting changes, net of

income tax ........................... — — (9) — —

Net income (loss) ........................ $ (74) $ 173 $ 8 $ 11 $ (43)

Basic income (loss) per common share:

Continuing operations ..................... $ (0.58) $ 2.55 $ 0.37 $ 0.11 $ (0.89)

Discontinued operations ................... (0.41) (0.70) (0.30) (0.14) (0.07)

Cumulative effect of accounting changes, net of

income tax ........................... — — (0.15) — —

Basic income (loss) per common share(f) ..... $ (0.99) $ 1.85 $ (0.08) $ (0.03) $ (0.96)

Diluted income (loss) per common share:

Continuing operations ..................... $ (0.58) $ 2.44 $ 0.37 $ 0.11 $ (0.89)

Discontinued operations ................... (0.41) (0.67) (0.30) (0.14) (0.07)

Cumulative effect of accounting changes, net of

income tax ........................... — — (0.15) — —

Diluted income (loss) per common share(f) .... $ (0.99) $ 1.77 $ (0.08) $ (0.03) $ (0.96)

Cash dividends declared per common share ..... $ 0.60 $ 0.60 $ 0.60 $ 0.60 $ 0.60

14