OfficeMax 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Reclassifications

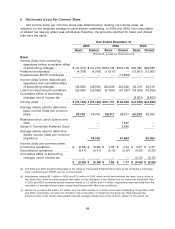

Certain amounts included in the prior years’ financial statements have been reclassified to

conform with the current year’s presentation. These reclassifications did not affect the reported

amounts of net income (loss) or earnings (loss) per share.

2. Sale of Paper, Forest Products and Timberland Assets

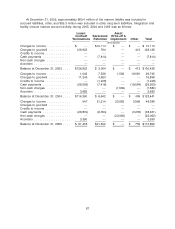

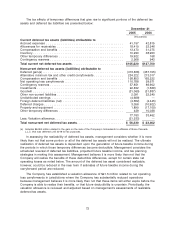

On October 29, 2004, the Company completed the Sale, which included substantially all of the

assets of the Boise Building Solutions and Boise Paper Solutions segments. In connection with the

Sale, the Company recognized a $280.6 million gain in the Consolidated Statement of Income

(Loss). For segment reporting purposes, the gain was included in the Corporate and Other

segment.

The Sale did not include the wood-polymer building materials facility near Elma, Washington.

(See Note 3, Discontinued Operations for additional information relating to the Elma Washington

facility.) The Company also retained certain other assets and liabilities of the sold paper, forest

products and timberland business, including Company-owned life insurance policies, and liabilities

such as those associated with retiree pension and other benefits, litigation, and environmental

remediation at selected active sites and facilities previously closed.

In connection with the sale, the Company invested $175 million in securities of affiliates of

Boise Cascade, L.L.C. This investment represents continuing involvement as defined in SFAS

No. 144, ‘‘Accounting for the Impairment or Disposal of Long-Lived Assets,’’ and accordingly, the

historical results of the sold paper, forest products and timberland assets are not reported as

discontinued operations. An additional $180 million of gain realized from the Sale was deferred as a

result of the Company’s continuing involvement with Boise Cascade, L.L.C. This deferred gain will

be recognized in earnings as the Company’s investment in affiliates of Boise Cascade, L.L.C. is

reduced.

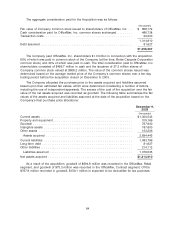

The Company received cash and other consideration of approximately $3.7 billion from the

Sale. Total proceeds to the Company after allowing for the $175 million investment in the securities

of affiliates of Boise Cascade, L.L.C and transaction related expenses, were approximately

$3.5 billion. The consideration for the timberlands portion of the Sale included $1.6 billion of timber

installment notes receivable. In December 2004, the Company completed a securitization

transaction and transferred its interest in the timber installment notes receivable to wholly owned

bankruptcy remote subsidiaries in exchange for cash proceeds of $1.5 billion. Including the cash

received at the closing of the Sale and the proceeds from the securitization of the timber installment

notes, and deducting the cash used to pay for the $175 million investment and transaction-related

expenses, the Company received a net total of $3.3 billion in cash from the Sale and related

transactions. In 2004, the Company used a portion of these proceeds to repurchase and retire

outstanding debt, to redeem outstanding Series D preferred stock and to make contributions to the

pension plans for active employees who became employees of Boise Cascade, L.L.C. in

connection with the Sale. In the second quarter of 2005, the Company used substantially all of the

remaining proceeds to repurchase 23.5 million shares of its common stock and the associated

common stock purchase rights through a modified Dutch auction tender offer.

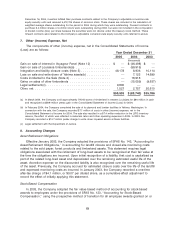

3. Discontinued Operations

In December 2004, the Company’s board of directors authorized management to pursue the

divestiture of the facility near Elma, Washington that manufactures integrated wood-polymer

building materials. The board of directors and management concluded that the operations of the

facility were no longer consistent with the Company’s strategic direction. The Company has

62