OfficeMax 2005 Annual Report Download - page 21

Download and view the complete annual report

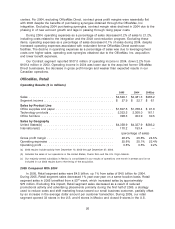

Please find page 21 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additionally, during the second quarter of 2005, we repurchased 23.5 million shares of our common

stock and the associated common stock purchase rights through a modified Dutch auction tender

offer at a purchase price of $775.5 million, or $33.00 per share, plus transaction costs.

Recent Developments and 2006 Outlook

In January 2006, we announced our Turnaround Plan for Higher Performance, which included

some specific details of our 2006 operating plan. Below is a list of the three key areas of focus for

generating higher performance:

• Improve the corporate infrastructure with key initiatives in supply chain and information

systems;

• Drive operating performance improvement in the OfficeMax, Retail and OfficeMax, Contract

businesses; and

• Deliver financial performance through a combination of cost-saving initiatives and the

allocation of capital for growth.

Improving Corporate Infrastructure—Supply Chain and Information Systems

We are developing a single supply chain supporting both the Retail and Contract segments.

The supply chain initiatives that we have underway are designed to achieve several goals in 2006,

including improved SKU management, heightened forecast accuracy, expeditious replenishment,

better product transition, improved inventory accuracy and enhanced supplier performance.

Complementing these supply chain actions are a range of major IT initiatives including

consolidating two core data centers into one; investing in the eCommerce platform; launching a

common platform for in-store kiosks and OfficeMax.com, our public website; and integrating

systems in order to utilize contract distribution centers to augment retail store replenishment.

Underpinning these initiatives will be upgrades to the inventory management system that will

enhance store-level and item-level forecasting and provide better reporting and visibility across the

supply chain.

Retail Initiatives

We have initiated several programs for driving revenue growth and margin improvement in our

Retail segment in 2006 and beyond. These include merchandising strategies intended to expand

our small business customer base, continuing to grow Print and Document Services, driving

incremental sales from the OfficeMax ink refill program, and improving category management. In

Retail, we will also pursue cost savings initiatives from store labor and management programs, as

well as advertising and marketing cost efficiencies.

As we reported on January 10, 2006 we are rebalancing our real estate portfolio in order to exit

underperforming locations and increase our presence in high-growth regions. We intend to close

110 domestic underperforming retail stores during the first quarter of 2006. The estimated pre-tax

cost to close the 110 underperforming retail stores is approximately $141 million. During the fourth

quarter of 2005, we recorded $17.9 million of asset impairment charges in our retail segment,

primarily related to those store closures. We are optimistic about our plans to open up to 70 new

domestic OfficeMax stores in key regions in 2006. In addition to enhancing our presence in these

key regions, these new stores will also utilize our new ‘‘Advantage’’ prototype store format that is

designed to enhance the customer shopping experience. The OfficeMax domestic store count is

expected to be approximately 887 at the end of 2006 compared to 927 at year end 2005, for a net

decrease of approximately 40 stores in 2006.

17