OfficeMax 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

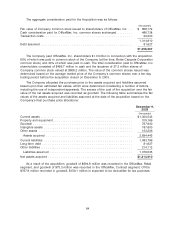

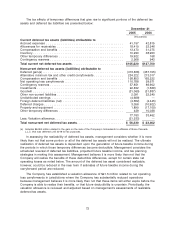

The aggregate consideration paid for the Acquisition was as follows:

(thousands)

Fair value of Company common stock issued to shareholders of OfficeMax, Inc. . . $ 808,172

Cash consideration paid for OfficeMax, Inc. common shares exchanged ........ 486,738

Transaction costs ................................................ 20,000

1,314,910

Debt assumed .................................................. 81,627

$1,396,537

The Company paid OfficeMax, Inc. shareholders $1.3 billion in connection with the acquisition,

60% of which was paid in common stock of the Company (at the time, Boise Cascade Corporation

common stock) and 40% of which was paid in cash. The total consideration paid to OfficeMax, Inc.

shareholders consisted of $486.7 million in cash and the issuance of 27.3 million shares of

Company common stock valued at $808.2 million. The value of the common shares issued was

determined based on the average market price of the Company’s common shares over a ten-day

trading period before the acquisition closed on December 9, 2003.

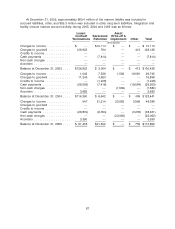

The Company allocated the purchase price to the assets acquired and liabilities assumed

based upon their estimated fair values, which were determined considering a number of factors,

including the use of independent appraisals. The excess of the cost of the acquisition over the fair

value of the net assets acquired was recorded as goodwill. The following table summarizes the fair

values of the assets acquired and liabilities assumed at the date of the acquisition based on the

Company’s final purchase price allocations:

December 9,

2003

(thousands)

Current assets .................................................. $1,300,543

Property and equipment ........................................... 315,166

Goodwill ...................................................... 767,930

Intangible assets ................................................ 187,600

Other assets ................................................... 123,206

Assets acquired ............................................... 2,694,445

Current liabilities ................................................ 1,083,796

Long-term debt ................................................. 81,627

Other liabilities .................................................. 214,112

Liabilities assumed ............................................. 1,379,535

Net assets acquired .............................................. $1,314,910

As a result of the acquisition, goodwill of $694.6 million was recorded in the OfficeMax, Retail

segment, and goodwill of $73.3 million was recorded in the OfficeMax, Contract segment. Of the

$767.9 million recorded in goodwill, $159.1 million is expected to be deductible for tax purposes.

64