OfficeMax 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

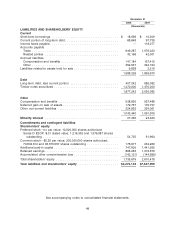

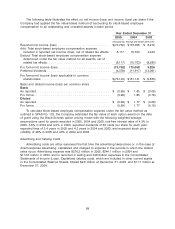

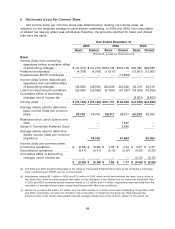

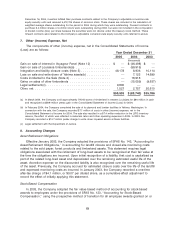

The following table illustrates the effect on net income (loss) and income (loss) per share if the

Company had applied the fair value-based method of accounting for stock-based employee

compensation to all outstanding and unvested awards in each period.

Year Ended December 31

2005 2004 2003

(thousands, except per-share amounts)

Reported net income (loss) ............................ $(73,762) $173,058 $ 8,272

Add: Total stock-based employee compensation expense

included in reported net income (loss), net of related tax effects 6,117 15,703 4,234

Deduct: Total stock-based employee compensation expense

determined under the fair value method for all awards, net of

related tax effects .................................. (6,117) (15,703) (9,280)

Pro forma net income (loss) ............................ (73,762) 173,058 3,226

Preferred dividends .................................. (4,378) (11,917) (13,061)

Pro forma net income (loss) applicable to common

shareholders ..................................... $(78,140) $161,141 $ (9,835)

Basic and diluted income (loss) per common share

Basic

As reported ........................................ $ (0.99) $ 1.85 $ (0.08)

Pro forma ......................................... (0.99) 1.85 (0.16)

Diluted

As reported ........................................ $ (0.99) $ 1.77 $ (0.08)

Pro forma ......................................... (0.99) 1.77 (0.16)

To calculate stock-based employee compensation expense under the fair value method as

outlined in SFAS No. 123, the Company estimated the fair value of each option award on the date

of grant using the Black-Scholes option pricing model with the following weighted-average

assumptions used for grants awarded in 2005, 2004 and 2003: risk-free interest rates of 4.3% in

2005, 3.6% in 2004 and 4.0% in 2003; expected dividends of 60 cents per share for each year;

expected lives of 3.4 years in 2005 and 4.3 years in 2004 and 2003; and expected stock price

volatility of 28% in 2005 and 40% in 2004 and 2003.

Advertising and Catalog Costs

Advertising costs are either expensed the first time the advertising takes place or, in the case of

direct-response advertising, capitalized and charged to expense in the periods in which the related

sales occur. Advertising expense was $276.2 million in 2005, $344.1 million in 2004 and

$113.6 million in 2003, and is recorded in selling and distribution expenses in the Consolidated

Statements of Income (Loss). Capitalized catalog costs, which are included in other current assets

in the Consolidated Balance Sheets, totaled $9.9 million at December 31, 2005, and $11.7 million at

December 31, 2004.

59