OfficeMax 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the model used to calculate stock-based compensation expense in the future, model assumptions,

actual participant forfeitures and certain other requirements of SFAS No. 123(R), the Company’s

historical level of stock-based compensation expense may not be indicative of the stock-based

compensation expense that will be recognized in future financial statements.

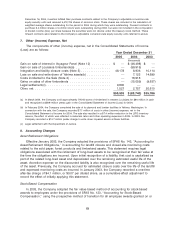

In November 2003, the Emerging Issues Task Force (the ‘‘EITF’’) reached a consensus on EITF

Issue No. 03-10, ‘‘Application of Issue No. 02-16 by Resellers to Sales Incentives Offered to

Consumers by Manufacturers.’’ The consensus required that consideration received by a reseller

from a vendor that is a reimbursement by the vendor for honoring the vendor’s sales incentives

offered directly to consumers be recorded as revenue, rather than as a reduction of cost of goods

sold. The Company adopted EITF Issue No. 03-10 on January 1, 2004, and it did not have a

material impact on the Company’s consolidated financial position or results of operations.

In January 2003, the FASB issued FASB Interpretation No. 46, ‘‘Consolidation of Variable

Interest Entities, an interpretation of ARB 51.’’ In December 2003, the FASB issued a revised version

of this interpretation, FASB Interpretation No. 46 (revised December 2003), ‘‘Consolidation of

Variable Interest Entities, and interpretation of ARB 51,’’ to clarify some of the provisions of the

original interpretation and to exempt certain entities from its requirements. Interpretation No. 46, as

revised, required the Company to reclassify its outstanding adjustable conversion-rate equity

securities from minority interest to debt in the Consolidated Balance Sheets and to recognize

distributions on these securities as interest expense rather than as minority interest, net of income

tax in the Consolidated Statements of Income (Loss). As allowed by the revised FASB Interpretation

No. 46, prior years’ financial statements were reclassified. In all periods presented, there was no net

effect on earnings, and the reclassification of these securities to debt did not affect the Company’s

financial covenants.

In October 2004, OfficeMax sold its timberlands as part of the Sale. In exchange for the

timberlands, the Company received timber installment notes receivable that were credit enhanced

with guarantees. In December 2004, the Company completed a securitization transaction and

transferred its interest in the timber installment notes receivable to wholly owned bankruptcy remote

subsidiaries. Recourse on the securitization notes is limited to the pledged timber installment notes

receivable.

The original entities issuing the credit enhanced timber installment notes to OfficeMax are

variable-interest entities (the ‘‘VIE’s’’) under the revised Interpretation No. 46R. The holders of the

timber installment notes (the bankruptcy remote subsidiaries to which the Company transferred the

notes in the securitization) are considered to be the primary beneficiaries, and therefore, the VIE’s

are required to be consolidated with the wholly owned bankruptcy remote subsidiaries, which are

also the issuers of the securitization notes. As a result, the accounts of the bankruptcy remote

subsidiaries have been consolidated into those of OfficeMax. The effect of consolidation of these

entities is that the securitization transaction is treated as a financing, and both the timber installment

notes receivable and the securitization notes payable are reflected in the Company’s Consolidated

Balance Sheet.

See Note 8, Accounting Changes, for additional information related to the adoption of SFAS

No. 143, ‘‘Accounting for Asset Retirement Obligations,’’ SFAS No. 148, ‘‘Accounting for Stock-

Based Compensation—Transition and Disclosure,’’ and EITF Issue No. 02-16, ‘‘Accounting by a

Customer (Including a Reseller) for Certain Consideration Received From a Vendor,’’ and their effect

on the Company’s consolidated financial statements and disclosures.

61