OfficeMax 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and administration methods; and unanticipated costs of terminating or relocating facilities and

operations. There may also be negative effects associated with employee morale and performance

because of job changes and reassignments.

We retained responsibility for certain liabilities of the paper, forest products and

timberland businesses we sold. These obligations include liabilities related to environmental, tax,

litigation and employee benefit matters. Some of these retained liabilities could turn out to be

significant, which could have a material adverse effect on our results of operations. Our exposure to

these liabilities could harm our ability to compete with other office products distributors, who would

not typically be subject to similar liabilities.

Our continued equity interest in Boise Cascade, L.L.C. subjects us to the risks associated

with the paper and forest products industry. When we sold our forest products businesses, we

purchased a continuing equity interest in affiliates of Boise Cascade, L.L.C. In addition, we have an

ongoing obligation to purchase paper from an affiliate of Boise Cascade, L.L.C. These continuing

interests subject us to market risks associated with the paper and forest products industry. These

industries are subject to cyclical market pressures. Historical prices for products have been volatile,

and industry participants have limited influence over the timing and extent of price changes. The

relationship between supply and demand in these industries significantly affects product pricing.

Demand for building products is driven mainly by factors such as new construction and remodeling

rates, interest rates and weather. The supply of paper and building products fluctuates based on

manufacturing capacity, and excess capacity, both domestically and abroad, can result in significant

variations in product prices. The level of supply and demand for forest products will affect the price

we pay for paper. Our ability to realize the carrying value of our equity interest in affiliates of Boise

Cascade L.L.C. is dependent upon many factors, including the operating performance of Boise

Cascade L.L.C. and other market factors that may not be specific to Boise Cascade L.L.C., due in

part to the fact that there is not a liquid market for our equity interest. Our exposure to these risks

could decrease our ability to compete effectively with our competitors, who typically are not subject

to such exposures.

Compromises of customer debit and credit card data, regardless of the source of the

breach, may damage OfficeMax reputation. There is an ongoing federal investigation relating to

ATM fraud involving legitimate debit card use at various retailers that was later tied to fraudulent

transactions outside the U.S. While we have no knowledge of a security breach at OfficeMax, it is

possible that information security compromises involving OfficeMax customer data, including

breaches that occur at third party processors, may damage our reputation. Such damage to our

reputation could adversely affect our operating results.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

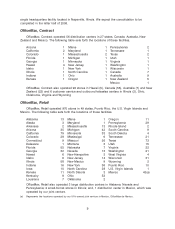

ITEM 2. PROPERTIES

The majority of OfficeMax facilities are rented under operating leases. (For more information

about our operating leases, see Note 10, Leases, of the Notes to Consolidated Financial Statements

in ‘‘Item 8. Financial Statements and Supplementary Data’’ of this Form 10-K.) Our properties are in

good operating condition and are suitable and adequate for the operations for which they are used.

Presented below is a list of our facilities by segment as of February 25, 2006. In addition, our

corporate headquarters is in Itasca, Illinois, and our retail operations are headquartered in Shaker

Heights, Ohio. We are currently in the process of consolidating these headquarters locations into a

8