OfficeMax 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

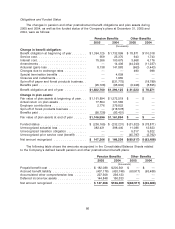

returns, the funded position of the plans and market risks. Occasionally, the Company may utilize

futures or other financial instruments to alter the pension trust’s exposure to various asset classes

in a lower-cost manner than trading securities in the underlying portfolios. At December 31, 2005

and 2004, the pension trust did not have any equity investments in the Company’s common stock.

Cash Flows

Pension plan contributions include required statutory minimums and, in some years, additional

discretionary amounts. During 2005, the Company made cash contributions to its pension plans

totaling $2.8 million. In 2004, cash contributions to the Company’s pension plans totaled

$279.8 million, while $84.5 million was contributed to the plans in 2003. There are no minimum

contribution requirements in 2006. However, the Company may elect to make voluntary

contributions in 2006.

Qualified pension benefit payments are paid from the assets held in the plan trust, while

nonqualified pension and other benefit payments are paid by the Company. Future benefit

payments by year are estimated to be as follows:

Pension Other

Benefits Benefits

(thousands)

2006 ..................................................... $105,570 $2,932

2007 ..................................................... 101,408 2,589

2008 ..................................................... 100,933 2,372

2009 ..................................................... 100,043 2,165

2010 ..................................................... 98,801 2,038

Years 2011-2015 ............................................ 480,368 8,621

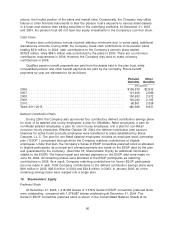

Defined Contribution Plans

During 2004, the Company also sponsored four contributory defined contribution savings plans

for most of its salaried and hourly employees: a plan for OfficeMax, Retail employees, a plan for

non-Retail salaried employees, a plan for union hourly employees, and a plan for non-Retail

nonunion hourly employees. Effective October 29, 2004, the defined contribution plan account

balances for active forest products employees were transferred to plans established by Boise

Cascade, L.L.C. The plan for non-Retail salaried employees includes an employee stock ownership

plan (‘‘ESOP’’) component through which the Company matches contributions of eligible

employees. Under that plan, the Company’s Series D ESOP convertible preferred stock is allocated

to eligible participants, as principal and interest payments are made on the ESOP debt by the plan

and guaranteed by the Company. (See Note 18, Shareholders’ Equity for additional information

related to the ESOP.) The final principal and interest payments on the ESOP debt were made on

June 30, 2004. All remaining shares were allocated to the ESOP participants as matching

contributions in 2005. As a result, Company matching contributions for former ESOP participants

are now made in cash. Total Company contributions to the defined contribution savings plans were

$9.9 million in 2005, $26.6 million in 2004 and $34.8 million in 2003. In January 2005, all of the

remaining savings plans were merged into a single plan.

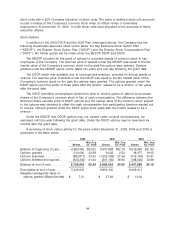

18. Shareholders’ Equity

Preferred Stock

At December 31, 2005, 1,216,335 shares of 7.375% Series D ESOP convertible preferred stock

were outstanding, compared with 1,376,987 shares outstanding at December 31, 2004. The

Series D ESOP convertible preferred stock is shown in the Consolidated Balance Sheets at its

90