OfficeMax 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

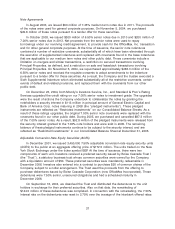

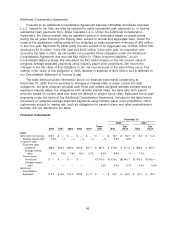

Additional Consideration Agreement

Pursuant to an Additional Consideration Agreement between OfficeMax and Boise Cascade,

L.L.C. related to the Sale, we may be required to make substantial cash payments to, or receive

substantial cash payments from, Boise Cascade, L.L.C. Under the Additional Consideration

Agreement, the Sale proceeds may be adjusted upward or downward based on paper prices

during the six years following the closing date, subject to annual and aggregate caps. Under the

terms of the agreement, neither party will be obligated to make a payment in excess of $45 million

in any one year. Payments by either party are also subject to an aggregate cap of $125 million that

declines to $115 million in the fifth year and $105 million in the sixth year. In connection with

recording the Sale in 2004, we calculated our projected future obligation under the Additional

Consideration Agreement and accrued $42 million in ‘‘Other long-term liabilities’’ on our

Consolidated Balance Sheet. We calculated the $42 million based on the net present value of

weighted average expected payments using industry paper price projections. We record the

changes in the fair value of this obligation in our net income (loss) in the period they occur. The

change in fair value of this obligation in 2005 resulted in expense of $2.9 million and is reflected in

our Consolidated Statement of Income (Loss).

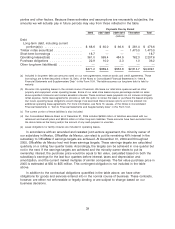

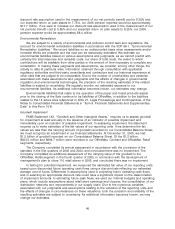

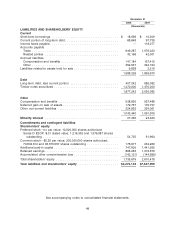

The table below provides information about our financial instruments outstanding at

December 31, 2005 that are sensitive to changes in interest rates or paper prices. For debt

obligations, the table presents principal cash flows and related weighted average interest rates by

expected maturity dates. For obligations with variable interest rates, the table sets forth payout

amounts based on current rates and does not attempt to project future rates. Estimated future cash

payments under the terms of the Additional Consideration Agreement, included in the table below,

are based on weighted average expected payments using industry paper price projections. Other

instruments subject to market risk, such as obligations for pension plans and other postretirement

benefits, are not reflected in the table.

Financial Instruments

December 31

2005 2004

There- Fair Fair

2006 2007 2008 2009 2010 after Total Value Total Value

Debt

Short-term borrowings $18.7 $ — $ — $ — $ — $ — $ 18.7 $ 18.7 $ 10.3 $ 10.3

Average interest rates 6.6% —% —% —% —% —% 6.6% 6.6% — —

Long-term debt

Fixed-rate debt

payments ...... $68.6 $25.4 $34.6 $50.9 $15.7 $ 281.4 $ 476.6 $ 471.3 $ 683.6 $ 697.7

Average interest

rates ....... 6.3% 7.9% 7.6% 8.9% 5.7% 6.6% 6.9% —% 7.0% —

Timber notes

securitized ..... $ — $ — $ — $ — $1,470.0 $1,470.0 $$1,440.7 $1,470.0 $1,452.4

Average interest

rates ....... ———— 5.5% 5.5% 5.7% 5.5% 5.6%

Additional

Consideration

Agreement ...... $9.2 $8.5 $12.4 $19.9 $ 4.7 $ — $ 54.7 $ 44.9 $ 54.7 $ 42.0

42